Tech shares came under renewed pressure on Tuesday ahead of MSFT and other Mag7 earnings reports. MSFT posted a mixed earnings release after the bell with shares off 4% in extended trading after the bell. The negative catalyst was a miss in Azzure cloud revenue vs. very high expectations along with higher costs from ongoing data center build outs. Overall equities finished mixed with the Dow adding 0.50% and the S&P 500 and Nasdaq off 0.50% and 1.28% respectively.

At the sector level Energy and Financials led while Tech. Discretionary and Staples lagged. Small and Mid-cap. stocks were positive on the day while international stocks were also positive. Crude and Commodities prices firmed slightly with the Bloomberg Commodities Index still at intermediate term support at the 95 level. The VIX remained elevated, and the S&P 500 is closing in on a near-term oversold condition.

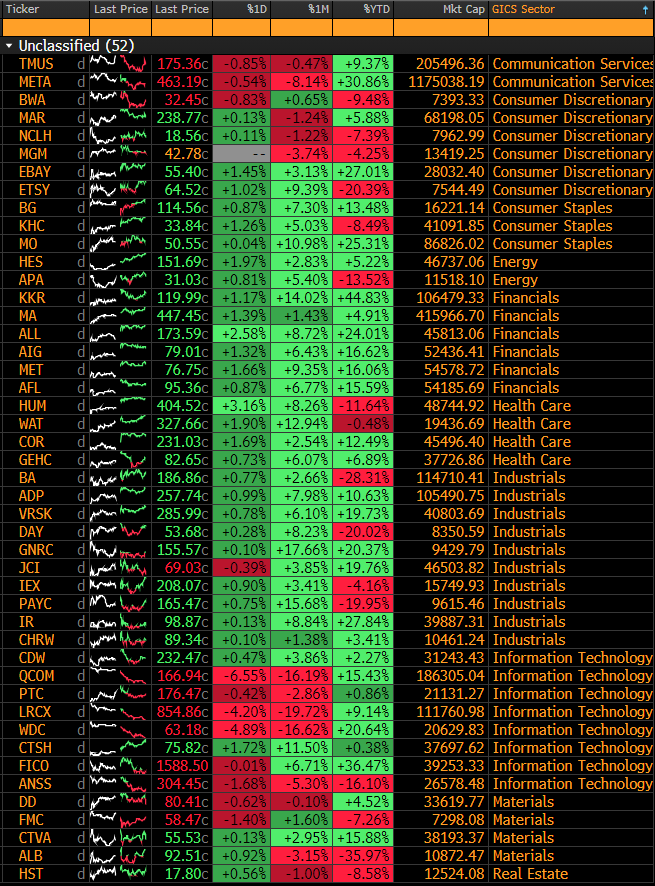

MBA Mortgage Applications and Pending Home Sales highlight the economic releases for Wednesday while META, MA, QCOM and LRCX highlight a large spate of earnings releases.

Eco Data Releases | Wednesday July 31st, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/31/2024 07:00 | MBA Mortgage Applications | 26-Jul | — | — | -2.20% | — |

| 07/31/2024 08:15 | ADP Employment Change | Jul | 150k | — | 150k | — |

| 07/31/2024 08:30 | Employment Cost Index | 2Q | 1.00% | — | 1.20% | — |

| 07/31/2024 09:45 | MNI Chicago PMI | Jul | 45 | — | 47.4 | — |

| 07/31/2024 10:00 | Pending Home Sales MoM | Jun | 1.40% | — | -2.10% | — |

| 07/31/2024 10:00 | Pending Home Sales NSA YoY | Jun | -7.40% | — | -6.60% | — |

| 07/31/2024 14:00 | FOMC Rate Decision (Upper Bound) | 31-Jul | 5.50% | — | 5.50% | — |

| 07/31/2024 14:00 | FOMC Rate Decision (Lower Bound) | 31-Jul | 5.25% | — | 5.25% | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Wednesday July 31st, 2024

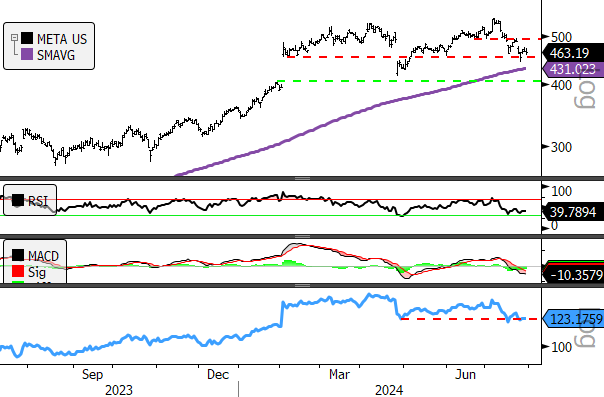

META headlines earnings. The chart below shows META at near-term support. There is potential for the price gap between $400 and $460 to get filled on the downside. At oversold in an uptrend we are constructive on the stock over the intermediate and longer term, but the short-term is a difficult setup to predict.

- META (200-day m.a. | Relative to S&P 500)

- Price and relative curves are at near-term support. A downside breach likely means more pain for Growth Sectors over the near-term.

Worldwide Wednesday

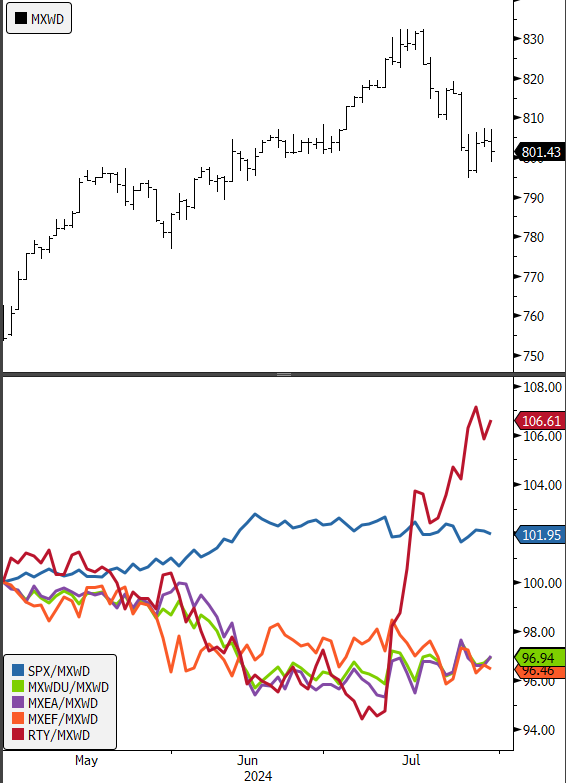

A roughly 5% correction in the MSCI All Country World Index (MXWD) has coincided with the S&P 500 correction stateside. We are looking for trend change away from US equities to generate a “sell” signal, but we haven’t seen that. The Russell 2000 Index has dominated performance over the past 3 weeks while the S&P 500 has been unable to move higher since mid-June. We still favor domestic equities over international.

- Panel 1: MSCI All Country World Index (MXWD)

- Panel 2: S&P 500 Relative to MXWD, MSCI ACWI ex-US Relative to MXWD, MSCI EM Index Relative MXWD, MSCI EAFE Index Relative to MXWD, Russell 2000 Relative to MXWD

Sources: Bloomberg