Equities started the new week mixed with the Dow giving back 0.08% while the Nasdaq added 0.28% and the S&P 500 0.10%, both new all-time highs. Crude settled lower on fears that hurricane Beryl could crimp US demand finishing at $82.24 while the US 10yr Yield dipped 1 bp to 4.28%.

At the stock level GLW, SMCI, INTC and ENPH were all up >5% on the day while PARA, ETSY and CMG were > -5% decliners, belying the index level movements.

At the sector level, Tech. shares led the advance adding 0.60%, while Comm. Services names gave back some of Friday’s gains off 0.90%. Energy was a laggard while Materials and Industrials made small gains.

A light economic calendar for Tuesday with NFIB Small Business Optimism the lone release. Earnings calendar is quiet until the big banks kick off the Q3 season on Friday.

Eco Data Releases | Tuesday July 9th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 07/09/2024 06:00 | NFIB Small Business Optimism | Jun | 90.2 | — | 90.5 | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Tuesday July, 9th 2024

No S&P 500 constituents report today

Tactical Tuesday

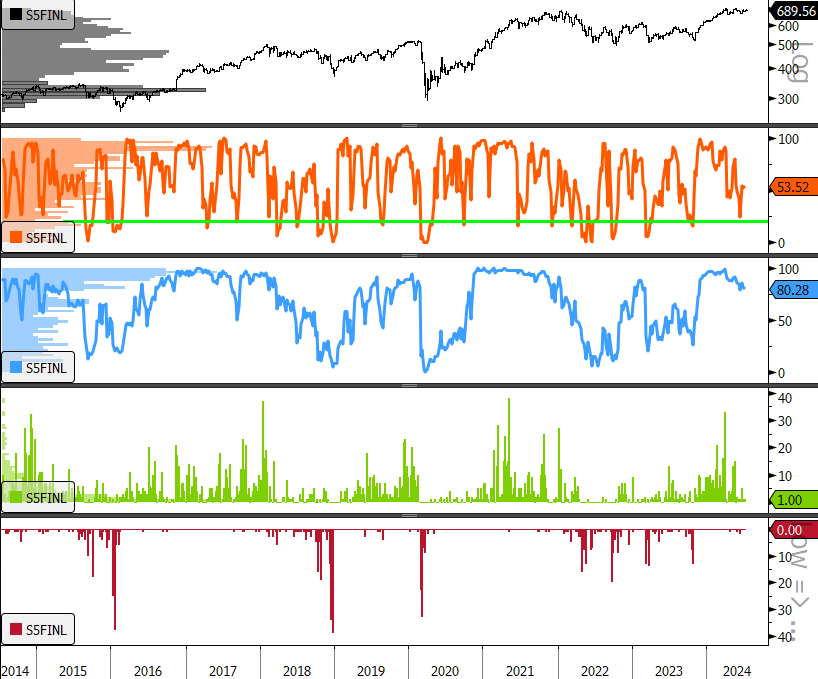

While the Mag7 dominate the momentum conversation (with occasional interlopers like LLY and SMCI), economically sensitive cyclical sectors have been consolidating sideways since April awaiting some spur of rotation. We have been watching Financial Sector internals for a a wash out reading of <20% of sector constituents above their 50-day moving averages. That <20% level has been a strong tactical buy signal when equities are in an uptrend price structure at the index level as they are now.

The Financial Sector came very close to our tactical buy signal in April with a 21.03% reading and again in June with a reading of 23.94%. We read extensively about the bank run last year and were told that higher rates exacerbated the problem for many bank balance sheets. Now that rates have consolidated and are forecast to move lower rather than higher the stage may be set for Financials to gain some traction. We will be interested to see if “close” is close enough for our signal. We are long XLF in our Elev8 Sector Model Portfolio on the timeliness of some of our tactical inputs, most notably the aforementioned %above50day reading and the current MACD reading for the chart.

- XLF 10yr, weekly

- % of stocks above 50-day m.a. Green Line is our 20% “tactical buy” threshold

- % of stocks above 200-day m.a.

- New 52-wk highs

- New 52-wk lows

Sources: Bloomberg