Two more record closes today as the Nasdaq added 0.88% while the S&P 500 added 0.27% to yesterday’s record close. The Dow fell 0.31% on weakness from AXP and BA. ORCL reported after-hours with shares trading +8% in the after-hours session. AVGO reports tomorrow.

Wednesday is the big day of the month with CPI data releasing before the bell and the FOMC meeting ahead of their 2pm press conference. An in-line to lighter print will very likely be seen as bullish and may even ignite the FOMO crowd. Bifurcation in the market remains a concern as evidenced by the negative divergence in the Dow components today, but the Consumer would be invigorated by lower rates regardless of the cause and the AI theme is not showing any cracks at present. Record highs are typically bullish.

Eco Data Releases | Wednesday June 12th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 06/12/2024 07:00 | MBA Mortgage Applications | 7-Jun | — | — | -5.20% | — |

| 06/12/2024 08:30 | CPI MoM | May | 0.10% | — | 0.30% | — |

| 06/12/2024 08:30 | CPI Ex Food and Energy MoM | May | 0.30% | — | 0.30% | — |

| 06/12/2024 08:30 | CPI YoY | May | 3.40% | — | 3.40% | — |

| 06/12/2024 08:30 | CPI Ex Food and Energy YoY | May | 3.50% | — | 3.60% | — |

| 06/12/2024 08:30 | CPI Index NSA | May | 314.365 | — | 313.548 | — |

| 06/12/2024 08:30 | CPI Core Index SA | May | 318.532 | — | 317.622 | — |

| 06/12/2024 08:30 | Real Avg Hourly Earning YoY | May | — | — | 0.50% | — |

| 06/12/2024 08:30 | Real Avg Weekly Earnings YoY | May | — | — | 0.50% | 0.60% |

| 06/12/2024 14:00 | Monthly Budget Statement | May | -$276.5b | — | -$240.3b | — |

| 06/12/2024 14:00 | FOMC Rate Decision (Upper Bound) | 12-Jun | 5.50% | — | 5.50% | — |

| 06/12/2024 14:00 | FOMC Rate Decision (Lower Bound) | 12-Jun | 5.25% | — | 5.25% | — |

| 06/12/2024 14:00 | Fed Interest on Reserve Balances Rate | 13-Jun | 5.40% | — | 5.40% | — |

| 06/12/2024 14:00 | FOMC Median Rate Forecast: Current Yr | 12-Jun | 4.88% | — | 4.63% | — |

| 06/12/2024 14:00 | FOMC Median Rate Forecast: Next Yr | 12-Jun | 4.13% | — | 3.88% | — |

| 06/12/2024 14:00 | FOMC Median Rate Forecast: +2 Yrs | 12-Jun | 3.13% | — | 3.13% | — |

| 06/12/2024 14:00 | FOMC Median Rate Forecast: Long-Run | 12-Jun | 2.75% | — | 2.56% | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Wednesday June 12th, 2024

A 3-handle on the CPI is table-stakes, but a print materially lower than the 3.3-3.4 type we’ve been seeing is probably needed to move the needle. Those who believe a hot print is on the way, likely have taken some Growth exposure off the table. We are not in that camp, but the Elev8 model has us positioned in favor of the dominant trend and if our stops are triggered, you will read about it tomorrow morning!

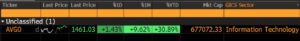

In the meantime, AVGO reports. It has been a strong stock throughout this bull cycle that started in 2023.

- AVGO (200-day m.a. | Relative to S&P 500)

- Stock chart looks like it’s headed to $1600 over the intermediate term with pattern support at $1200. Our process would be long this stock

Sources: Bloomberg