Another record day for the Nasdaq (+1.53%) and the S&P 500 (+0.85%) as CPI came in at 3.3% and Powell’s comments were indicative of a more dovish policy over the next 12 months. CVX and NKE off 2.6% and 2.3% respectively were catalysts for the Dow’s negative close (-0.09) as economically sensitive cyclicals continue to lag Growth and Tech. shares.

The yield on the 10yr Treasury dipped to 4.30% and is now below its 200-day moving average for the 2nd day in a row. Homebuilders and Bank stocks were up on lower rates as housing affordability and bank balance sheet stability are on the upswing as rates move lower.

Initial and continuing jobless claims are on the docket for Thursday as well as producer price index monthly reports. A light earnings day as ADBE is the lone S&P 500 constituent to report.

Eco Data Releases | Thursday June 13th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 06/13/2024 08:30 | Initial Jobless Claims | 8-Jun | 225k | — | 229k | — |

| 06/13/2024 08:30 | Continuing Claims | 1-Jun | 1795k | — | 1792k | — |

| 06/13/2024 08:30 | PPI Final Demand MoM | May | 0.10% | — | 0.50% | — |

| 06/13/2024 08:30 | PPI Ex Food and Energy MoM | May | 0.30% | — | 0.50% | — |

| 06/13/2024 08:30 | PPI Ex Food, Energy, Trade MoM | May | 0.30% | — | 0.40% | — |

| 06/13/2024 08:30 | PPI Final Demand YoY | May | 2.50% | — | 2.20% | — |

| 06/13/2024 08:30 | PPI Ex Food and Energy YoY | May | 2.50% | — | 2.40% | — |

| 06/13/2024 08:30 | PPI Ex Food, Energy, Trade YoY | May | — | — | 3.10% | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday June 13th, 2024

Markets have tailwinds of lower rates and lower crude (-0.23% WTI) in June and the bull trend is clearly established. XLK and XLC are beneficiaries, and with rates sinking lower, homebuilders have potential to join the party. Banks also have a tailwind. The bull market needs varying coalitions of sectors and industries to support the uptrend. Breadth was looking a bit weak heading into June, but lower rates are finally having a salubrious effect on several laggard areas in the near-term.

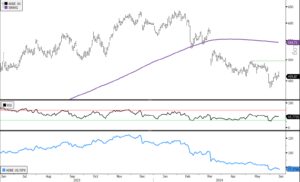

ADBE is up on Thursday looking to change around some rough fortunes over the YTD time frame. A move above $496 would be a bullish “green chute” on the chart. With some life from ORCL and ADSK we wouldn’t rule out some relief for ADBE.

- ADBE (200-day m.a. | Relative to S&P 500)

- A move above $496 is needed to give some indication of material buyer interest

Sources: Bloomberg