Friday morning S&P futures up 0.4% after Thursday’s tech-led U.S. equity sell-off, with Nasdaq down over 2.5%—its steepest drop since early September. Treasuries are flat to weaker with curve flattening, the dollar index is up 0.2%, gold up 0.3%, Bitcoin futures down 0.3%, and WTI crude up 2% amid geopolitical tensions.

Key Earnings Takeaways:

- Amazon (AMZN): Notable operating income beat with strong margin expansion.

- Apple (AAPL): iPhone sales outperformed but Q4 guidance underwhelmed.

- ExxonMobil (XOM): Beat estimates, raised production, and increased dividend.

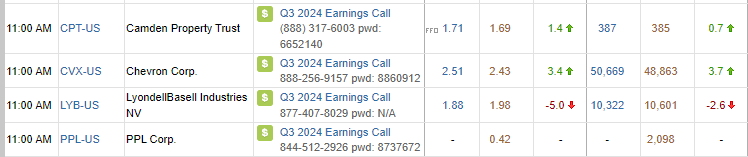

- Chevron (CVX): Strong quarter, aided by U.S. Gulf production and cost cuts.

- Intel (INTC): Data Center & AI beat expectations; Q4 guidance better than feared.

- Atlassian (TEAM): Big post-earnings gainer on beat and raised FY guidance.

- Halozyme (HALO): Beat estimates, raised guidance, citing pipeline strength.

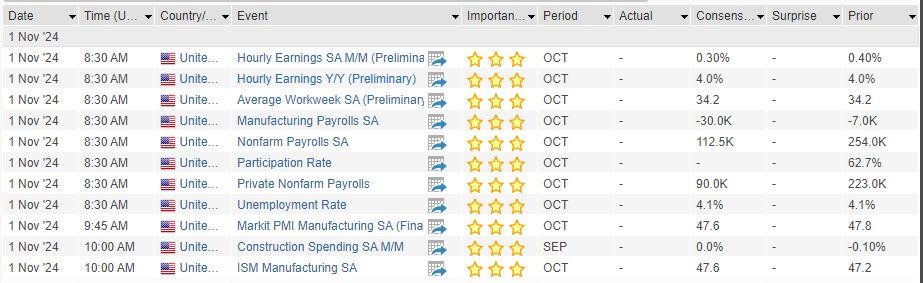

Economic Outlook: October’s employment report, ISM manufacturing, and construction spending are on the agenda, with anticipated noise in employment data due to strikes and weather impacts. Forecasts include NFP growth of 110-120K, a 4.1% unemployment rate, and a 0.3% wage increase.

Market Sentiment: While month-end pressures have eased, appetite remains cautious due to high yields and election uncertainties. The bullish case is supported by disinflation, Fed easing prospects, favorable seasonality, and anticipated corporate buybacks, with a longer-term shift toward 2025 earnings growth expectations.

U.S. equities closed lower on Thursday, with major indices near their lowest points of the day: Dow (-0.90%), S&P 500 (-1.86%), Nasdaq (-2.76%), and Russell 2000 (-1.63%). The Nasdaq experienced its worst session since early September, led downward by significant declines in tech due to mixed earnings from major players, notably Microsoft (MSFT) and Meta Platforms (META). Other underperforming sectors included semiconductors, cosmetics, casinos, auto suppliers, airlines, software, credit cards, online brokers, and industrial metals. Conversely, utilities, energy, managed care, dollar stores, housing-related retail, cruise lines, quick-service restaurants, tobacco, grocers, entertainment, and telecom outperformed.

The risk-off sentiment stemmed from cautious tech earnings, particularly disappointing reports from several “Magnificent 7” companies. However, the overarching narrative of long-term AI growth remains positive. Other headwinds included election uncertainties, which have influenced bond yields, though markets appear comfortable with current yield levels, supported by a soft/no-landing economic outlook. Bulls are also looking forward to potential year-end seasonality, a reduction in election-related hedges, and a resumption of stock buybacks.

In the fixed income market, treasuries were mixed with a flattened curve. The dollar index fell by 0.1%, with particular attention to yen strength following hawkish guidance from the Bank of Japan (BoJ). Gold ended the day down 1.8% but has gained 3.4% in October, marking its seventh rise in the past eight months. Bitcoin futures dropped 2.1%, while WTI crude closed 0.9% higher amid potential geopolitical tensions in the Middle East.

Company News by GICS Sector:

Information Technology

- Microsoft (MSFT): Fiscal Q1 results were positive, with Azure growth at 34% y/y CC, though Q2 guidance anticipates a slowdown to 31-32%, attributing this to supply constraints.

- Twilio (TWLO): Q3 beat expectations, with Q4 guidance above. The company highlighted growth in Communications, driven by political campaigns, and strategic traction.

- Paycom Software (PAYC): Surged 21.4% following a Q3 revenue and EBITDA beat, as well as a positive outlook on execution and automation.

- Roblox (RBLX): Rose 19.9% on strong Q3 bookings, DAUs, and average bookings per DAU, with a positive Q4 bookings outlook.

- Etsy (ETSY): Posted gains with Q3 earnings/revenue beat; board approved $1B stock buyback, but lower Q4 GMS expected due to macro factors.

Consumer Discretionary

- Peloton (PTON): Gained 27.8% after a positive FQ1 earnings report, raised FY guidance, and CEO announcement.

- Norwegian Cruise Line (NCLH): Rose 6.3% on Q3 results and raised FY EBITDA guidance due to strong demand.

- MGM Resorts (MGM): Fell 11% due to weaker-than-expected Q3 earnings; softness in Las Vegas and China weighed on results.

- Carvana (CVNA): Increased 19.2% after a strong Q3 showing in revenue, EBITDA, and net income, with an improved FY24 EBITDA outlook.

Health Care

- Merck (MRK): Q3 earnings and revenue exceeded expectations; however, Gardasil sales declined in China, leading to FY EPS guidance cuts.

- Bristol-Myers Squibb (BMY): Rose 5.9% on strong Q3 EPS and revenue, with legacy products driving top-line performance and improved margins.

- Madrigal Pharmaceuticals (MDGL): Shares jumped 20.1% due to strong Q3 results and successful Rezdiffra launch.

Financials

- Intercontinental Exchange (ICE): Dropped 6.4%, with Q3 results below expectations for Mortgage Tech and FIDS divisions, along with elevated expenses.

- Robinhood (HOOD): Fell 16.7% following a Q3 earnings miss, with lower-than-expected transaction-based and net interest revenues.

Industrials

- Huntington Ingalls Industries (HII): Declined 26.2% as Q3 earnings missed due to project delays and labor inefficiencies.

- Xylem (XYL): Fell 6.5% on mixed Q3 results, with weaker Water Infrastructure revenue and a lower FY revenue guide.

- C.H. Robinson Worldwide (CHRW): Declined 6%, citing a soft transport environment and slow recovery expectations.

Communication Services

- Meta Platforms (META): Fell 4.1%, with solid Q3 results but concerns around its investment cycle and 2025 capex guidance.

- Roku (ROKU): Dropped 17.3%, despite Q3 revenue and GM growth, with concerns around future revenue deceleration and reporting changes.

- Coinbase (COIN): Lost 15.3% as Q3 revenue missed, with analysts raising concerns about diversification challenges and transaction revenue.

Energy

- ConocoPhillips (COP): Gained 6.4% on a Q3 beat and raised FY production guidance, along with a 34% dividend hike and share buyback expansion.

Real Estate

- Eaton Corp. (ETN): Fell 3.3% with a Q3 revenue miss but strong margins, leading to a slight FY guidance raise.

Consumer Staples

- Estée Lauder (EL): Dropped 20.9% following a disappointing FQ1, with a 47% dividend cut and cautious guidance due to China headwinds.

- Sprouts Farmers Market (SFM): Rose 8.1% on strong Q3 earnings and revenue, with robust Q4 guidance and raised FY24 outlook.

Materials

- International Paper (IP): Up 13.3% on better-than-expected Q3 EPS, with benefits from strategic packaging and higher pricing

Eco Data Releases | Friday November 1st, 2024

S&P 500 Constituent Earnings Announcements | Friday November 1st, 2024

Data sourced from FactSet Research Systems Inc.