S&P futures are down 0.1% in Wednesday morning trading, following Tuesday’s close in which U.S. equities fell, reflecting a loss of momentum in certain segments of the “Trump trade.” Higher rates have also increased scrutiny on some cyclical stocks, while stocks connected to China underperformed. Asian markets mostly declined overnight, with South Korea down more than 2.5% and Japan down over 1.5%, though Chinese indices saw gains. In contrast, European markets opened higher, up about 0.3%. Treasuries firmed slightly after selling off on Tuesday, and the Dollar index remained mostly flat. Among commodities, WTI crude oil rose 0.9%, gold increased 0.3%, and Bitcoin futures fell 1.2%.

Today’s economic focus is the Consumer Price Index (CPI), which is expected to provide insights into the December Federal Open Market Committee (FOMC) meeting. Current odds for a rate cut are around 65%. Though there is concern about a higher-than-expected CPI print, the market may be somewhat cushioned due to the recent recalibration of rate cut expectations. Analysts forecast a 0.2% month-over-month increase in headline CPI, bringing the year-over-year rate to 2.6% from 2.4%. Core CPI is expected to rise by 0.3% month-over-month, keeping the year-over-year rate steady at 3.3%. Producer Price Index (PPI) data is due on Thursday, with retail sales numbers following on Friday. Federal Reserve officials Logan, Musalem, and Schmid are scheduled to speak today, and Fed Chair Powell will speak on Thursday.

Company News by GICS Sector

Health Care

- Amgen (AMGN-US): Announced that its experimental obesity drug does not raise any bone safety concerns.

- Progyny (PGNY-US): Stock dropped significantly after missing earnings expectations and guiding lower, citing persistent consumption issues.

- ModivCare (MODG-US): Beat earnings expectations due to product pull-forward, though provided a lower outlook for FY24.

Communication Services

- Spotify (SPOT-US): Reported positive earnings takeaways, with improvements in gross margins and subscriber trends.

- ZoomInfo Technologies (ZI-US): Reported slightly better-than-expected Q3 results with in-line Q4 guidance, though SMB challenges remain a headwind.

Consumer Discretionary

- Foot Locker (FL-US): Q3 earnings beat expectations; noted early signs of market share gains in the U.S. for Q4.

- Cava Group (CAVA-US): Stock surged following strong earnings and raised guidance.

Technology

- Skyworks Solutions (SWKS-US): Issued weaker guidance, affected by broad market weakness.

- Cardlytics (CART-US): Q3 showed growth in gross transaction value and orders, though Q4 EBITDA guidance was lower due to high reinvestments and high expectations.

Consumer Staples

- Inter Parfums (IPAR-US): Issued lighter-than-expected guidance for 2025.

Financials

- Rocket Companies (RKT-US): Under pressure after issuing a softer Q4 outlook due to lower origination volume.

Industrials

- Spirit Airlines (SAVE-US): Reportedly preparing to file for bankruptcy.

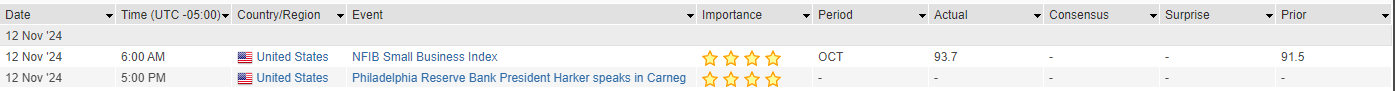

Eco Data Releases | Wednesday November 13th, 2024

S&P 500 Constituent Earnings Announcements | Wednesday November 13th, 2024

Data sourced from FactSet Research Systems Inc.