S&P futures are up 0.5% Monday morning following last week’s gains, where all major U.S. indexes rose over 1.5%. Standouts included small caps, crypto, regional banks, and cyclicals, while big tech, A&D, China ADRs, and airlines lagged. Asian markets were mostly higher overnight, though Hong Kong and China were weaker. European markets are up over 0.5%. Treasuries are firmer with curve bull flattening, the Dollar index is down 0.4%, gold fell 1.3%, Bitcoin futures rose 1%, and WTI crude is down 0.8%.

The nomination of Scott Bessent as Treasury Secretary is the major story, with markets viewing him as a safe, market-friendly choice. Bessent outlined his “3-3-3” policy focusing on cutting the deficit to 3% of GDP, achieving 3% GDP growth through deregulation, and producing 3M barrels of oil equivalent daily. A quiet holiday-shortened week is expected, with ISMs, NFP, CPI, and the FOMC meeting looming in December.

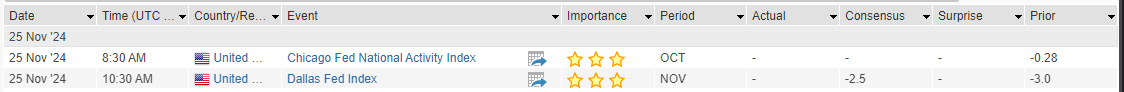

Economic Calendar

- Monday: No major data scheduled.

- Tuesday: S&P Case-Shiller and FHFA home price indexes, new home sales, consumer confidence, and November FOMC minutes.

- Wednesday: Q2 GDP second release, durable goods, initial claims, Chicago PMI, pending home sales, personal income/spending, and PCE inflation.

- Friday: Tokyo CPI and early stock market closure at 13:00 ET.

Corporate News

- Comcast (CMCSA-US): “Wicked” is projected to generate $114M in its domestic debut, marking the largest opening for a Broadway adaptation.

- Lattice Semiconductor (LSCC-US): Reportedly considering a bid for Intel’s (INTC-US) Altera unit.

- ONEOK (OKE-US): To acquire the remainder of EnLink Midstream (ENLC-US) for $4.3B in stock.

- CoreWeave: Reuters reported the AI cloud platform is targeting a $35B valuation for its expected Q2 2025 IPO.

Upcoming Earnings

- Tuesday Morning: ADI-US, ANF-US, BBY-US, DKS-US, KSS-US, M-US, SJM-US.

- Tuesday After Close: ADSK-US, CRWD-US, DELL-US, GES-US, HPQ-US, JWN-US, URBN-US, WDAY-US.

U.S. equities ended higher on Friday, with the Dow gaining 0.97%, the S&P 500 up 0.35%, the Nasdaq rising 0.16%, and the Russell 2000 jumping 1.80%. The S&P 500 secured a solid weekly gain, with retail, banks, small caps, autos, and oil services leading the charge, while semiconductors, China tech, hospitals, and managed care lagged. Treasuries were mixed with some curve flattening, while the Dollar index climbed 0.5%, gold gained 1.4%, Bitcoin futures rose 0.8%, and WTI crude settled 1.6% higher.

Rotation into Trump themes, cyclicals, and small caps continued as big tech faced regulatory headwinds. Flash U.S. November PMI reached its highest level since April 2022, driven by services strength, contrasting with weaker overseas data. The Michigan consumer sentiment index was revised down, while inflation expectations remained stable. Investors are preparing for next week’s holiday-shortened calendar, which includes new home sales, GDP, and durable goods data, along with the release of FOMC minutes. Key macro catalysts in December include ISMs (2-Dec, 4-Dec), NFP (6-Dec), CPI (11-Dec), and the FOMC decision (18-Dec).

Company News by GICS Sector

Consumer Discretionary

- Gap (GPS-US): Rose 12.9% on Q3 earnings and guidance beat, citing Gap brand momentum, strong merchandise margins, and share gains across brands. Athleta returned to growth, while Old Navy faced weather-related headwinds.

- Ross Stores (ROST-US): Gained 2.2% after Q3 earnings beat driven by strong margins; FY guidance was raised despite a Q4 outlook below expectations.

- Tapestry (TPR-US): Increased 4.4% after announcing a $2B accelerated share repurchase program under its expanded $2.8B authorization.

Information Technology

- Elastic (ESTC-US): Surged 14.7% on an outsized Q2 earnings beat and raised FY25 guidance. Positive takeaways included GenAI adoption momentum and a strong pipeline of $100K+ customer adds.

- NetApp (NTAP-US): Gained after earnings beat, raised guidance, and noted market share gains in the cloud space.

Energy

- Texas Pacific Land (TPL-US): Jumped 14.5% on news it will join the S&P 500 before trading on 26-Nov, replacing Marathon Oil (MRO-US), which is being acquired by ConocoPhillips (COP-US).

Health Care

- Viking Therapeutics (VKTX-US): Increased 1.9% after B. Riley initiated coverage with a “Buy” rating, citing potential for its GLP-1/GIP agonist VK2735 as a differentiated therapy.

- TransMedics Group (TMDX-US): Fell 4.2% after being downgraded to “Hold” by Needham, which flagged rising competition as a potential risk.

- Tenet Healthcare (THC-US): Declined 2.9% after being downgraded to “Outperform” by Raymond James, which flagged potential challenges tied to sunsetting ACA subsidies.

Industrials

- EchoStar (SATS-US): Declined 2.8% after confirming that DIRECTV has terminated a purchase agreement with no termination fee.

- Copart (CPRT-US): Gained 10.2% on FQ1 revenue beat, supported by resilient U.S. ASPs and growth in specialty equipment sales.

Consumer Staples

- Intuit (INTU-US): Fell 5.7% despite a Q1 earnings beat, as Q2 guidance was light due to the pull-forward of marketing expenses for its Consumer Tax business.

Communication Services

- Reddit (RDDT-US): Dropped 7.2% following a report that Advance Magazine Publishers plans to establish a credit facility using its Reddit equity stake. The decline followed a strong weekly rally (+26% before Friday’s session).

Eco Data Releases | Monday November 25th, 2024

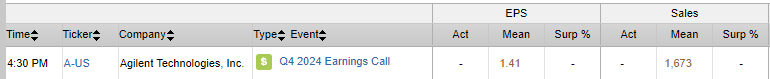

S&P 500 Constituent Earnings Announcements | Monday November 25th, 2024

Data sourced from FactSet Research Systems Inc.