S&P futures are up 0.2% Tuesday morning after U.S. equities rose on Monday, driven by cyclical rotation and retail strength. Most-shorted names and rate-sensitive sectors like housing outperformed, while energy and select big tech lagged. Treasuries are weaker across the curve after Monday’s rally. The Dollar index is little changed, while the Canadian dollar and Mexican peso are under pressure. Gold is up 0.5%, Bitcoin futures fell 3.4%, and WTI crude rebounded 1% after dropping over 3% on Middle East ceasefire news.

At the sector level, year-to-date laggards Healthcare and Materials made some headway at the expense of Technology shares. In the near-term cyclical momentum has cooled after an initial surge immediately after the election. Increased potential for inflation due to tariffs and stimulus has caused interest rates to move higher which complicates the “soft landing” narrative.

Tariff tensions are in focus after Trump announced plans for new tariffs: 10% on Chinese goods and 25% on Mexican and Canadian goods, citing issues related to drugs and crime. The move has reignited concerns about growth and inflation risks tied to Trump’s agenda, though some view this as a short-term negotiating strategy.

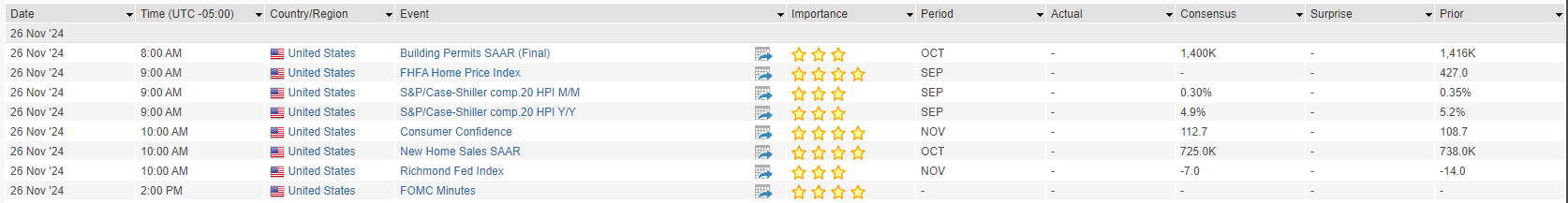

On the economic calendar today: S&P Case-Shiller and FHFA house price indexes, new home sales, and consumer confidence. November FOMC minutes are due this afternoon. Wednesday brings GDP, durable goods, Chicago PMI, and personal income/spending data, while Friday is quiet with an early market close.

Company News by GICS Sector

Information Technology

- Semtech (SMTC-US): Surged on Q3 earnings beat, driven by strong ramps in its Active Copper Cable product lines.

- Zoom Video Communications (ZM-US): Declined after earnings as guidance raise fell short of expectations.

Industrials

- Woodward (WWD-US): Gained significantly on Q4 earnings beat and better FY25 guidance, highlighting strong aerospace margins.

- Dana Inc (DAN-US): Announced immediate CEO transition, plans to sell its Off-Highway business, and cost-cutting measures targeting $200M in savings.

Consumer Discretionary

- Kohl’s (KSS-US): Announced CEO Tom Kingsbury will step down early next year, with Michaels CEO Ashley Buchanan set to take over.

- Blue Bird (BLBD-US): Posted a Q4 beat with FY25 guidance in line to above expectations. EV-related growth was noted, though guidance is weighted toward the second half of FY25.

Financials

- Wells Fargo (WFC-US): Reports indicate its asset cap is expected to be lifted next year, which would allow the bank to expand operations and improve profitability.

Energy

- Leslie’s (LESL-US): Dropped sharply after a Q4 miss and disappointing guidance, citing macroeconomic headwinds impacting the pool supply market.

Eco Data Releases | Monday November 26th, 2024

S&P 500 Constituent Earnings Announcements | Monday November 26th, 2024

Data sourced from FactSet Research Systems Inc.