S&P futures are down 0.2% Wednesday morning following Tuesday’s gains, which were supported by big tech. European markets are slightly lower, following a mixed Asian session. Treasuries are firmer with curve steepening, the Dollar index is weaker (yen strength notable), gold is up 0.9%, Bitcoin futures rebounded 3.1%, and WTI crude rose 0.4%.

Tariffs remain in focus as Trump named Kevin Hassett for the National Economic Council and Jamieson Greer as U.S. Trade Representative, bolstering plans to reshape global trade. Meanwhile, a 60-day ceasefire between Israel and Hezbollah begins today. Market sentiment is supported by systematic fund flows, seasonality, and resilient macro trends, though there’s increased discussion of hedging against downside risks.

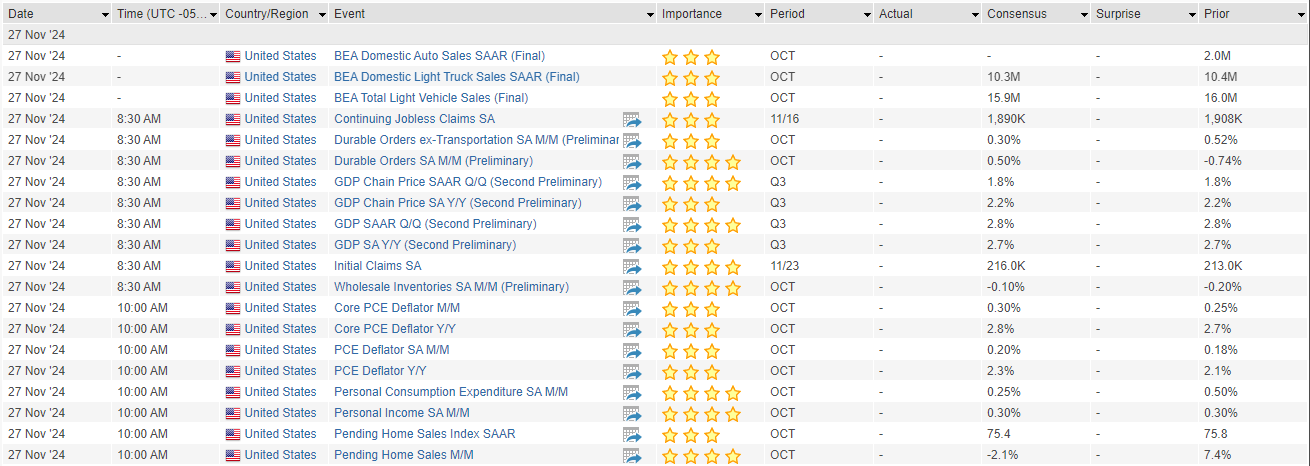

Key economic releases today include October PCE, durable goods, pending home sales, weekly jobless claims, and the second read of Q3 GDP. Treasury auctions conclude with $44B in 7Y notes after strong demand for 2Y and 5Y notes earlier this week. Overseas, German and French consumer confidence weakened, and China reported a faster decline in October industrial profits. U.S. markets are closed Thursday for Thanksgiving, with early closure on Friday.

Key Corporate Highlights

Information Technology

- Dell Technologies (DELL-US): Fell on a sales miss driven by weaker consumer PC demand, though AI server orders hit record levels, and margins beat expectations.

- CrowdStrike (CRWD-US): Posted strong Q3 metrics but flagged slight disappointment with Q4 EPS guidance and an unchanged FY25 outlook.

- Workday (WDAY-US): Q3 results beat expectations, but Q4 subscription revenue and margin guidance were slightly weaker.

- Autodesk (ADSK-US): Guidance was in line but noted headwinds in new business growth.

Healthcare

- Nutanix (NTNX-US): Rose on strong ARR and FCF, with analysts positive on large-deal momentum and demand commentary.

- Ambarella (AMBA-US): Beat earnings, raised guidance, and highlighted normalizing inventories and automotive wins.

Consumer Discretionary

- Nordstrom (JWN-US): Beat expectations, with Nordstrom and Nordstrom Rack both performing well; FY guidance was unchanged.

- Urban Outfitters (URBN-US): Posted a big margin-driven earnings beat, led by strength in its Anthropologie brand.

- Guess (GES-US): Missed earnings and cut guidance, citing weaker North American customer traffic.

U.S. equities ended mostly higher on Tuesday, with the Dow up 0.28%, the S&P 500 up 0.57%, and the Nasdaq gaining 0.63%, while the Russell 2000 fell 0.73%. The S&P 500 set a fresh record high, driven by continued cyclical rotation and strength in big tech. Sectors such as GLP-1 drug makers, software, hospitals, streaming, video games, and cruise lines outperformed, while retail, building materials, industrial metals, autos, and drug stores lagged. Treasuries weakened, with a bit of curve steepening following Monday’s rally. The Dollar index rose 0.2%, while gold was up 0.1%, Bitcoin futures fell 3.6%, and WTI crude dipped 0.2%.

Tariff concerns were a key focus after Trump announced plans for 10% tariffs on Chinese goods and 25% on imports from Mexico and Canada, citing crime and drug concerns. Analysts see the announcement more as a negotiating tactic than a reshaping of global trade. Meanwhile, macro data showed mixed trends: November consumer confidence improved while inflation expectations hit their lowest since March 2020, but October new home sales fell 17.3% m/m. Economists downplayed the November FOMC minutes, which reflected broad support for gradual rate reductions amid uncertainty over fiscal and economic policy.

Key economic reports, including GDP, durable goods, and PCE inflation, are set for Wednesday, while Friday’s calendar remains quiet with markets closing early.

Company News by GICS Sector

Health Care

- Eli Lilly (LLY-US) & Novo Nordisk (NVO-US): Gained after the White House proposed Medicare and Medicaid coverage for obesity drugs.

- Amgen (AMGN-US): Fell on underwhelming data for its experimental obesity drug.

- Poseida Therapeutics (PSTX-US): To be acquired by Roche.

Information Technology

- Analog Devices (ADI-US): Beat earnings but flagged weakness in its U.S. automotive segment.

- Semtech (SMTC-US): Rose on earnings beat and raised guidance, with data center demand noted as a bright spot.

- Zoom Video Communications (ZM-US): Declined after an underwhelming guidance raise.

Consumer Discretionary

- Best Buy (BBY-US): Missed earnings and cut guidance, citing weaker demand and macro pressures.

- Burlington Stores (BURL-US): Reported lighter comps, partly due to weather, but noted improved November trends.

- Dick’s Sporting Goods (DKS-US): Beat earnings and raised guidance.

- Abercrombie & Fitch (ANF-US): Beat and raised guidance, though faced a high bar of expectations.

- Kohl’s (KSS-US): Dropped on an earnings miss, guidance cut, and announcement of CEO Tom Kingsbury’s transition.

- Dana Inc (DAN-US): Announced CEO transition, plans to sell its Off-Highway business, and cost cuts of ~$200M.

- Leslie’s (LESL-US): Fell sharply after missing Q4 estimates and issuing disappointing guidance.

Industrials

- Woodward (WWD-US): Jumped on earnings beat, with strong aerospace margins highlighted.

Financials

- Wells Fargo (WFC-US): Rose on reports that the Federal Reserve may lift its asset cap in the first half of 2025.

Consumer Staples

- Smucker’s (SJM-US): Gained following positive sentiment around portfolio restructuring and strategic moves

Eco Data Releases | Wednesday November 27th, 2024

S&P 500 Constituent Earnings Announcements | Wednesday November 27th, 2024

No Constituents Report Today

Data sourced from FactSet Research Systems Inc.