S&P futures up 0.2% Monday morning after two consecutive weeks of declines. Asian markets mostly higher, with South Korea leading on favorable tax news and China’s Shanghai Composite up over 1%. Japan was closed for a holiday. European markets are up ~0.3%. Treasuries strengthened, the dollar index fell 0.5%, gold is up 0.1%, Bitcoin futures rose 0.3%, and WTI crude surged 2.9% on geopolitical concerns and potential OPEC+ production delays.

Key Events This Week:

- U.S. election, expected 25 bp Fed rate cut, China’s NPC meeting, and 103 S&P 500 earnings reports.

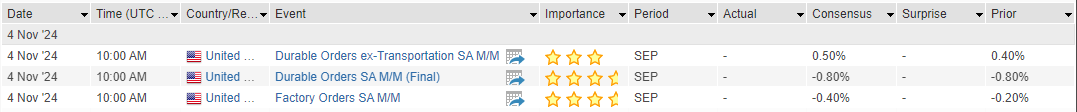

- Economic data includes September factory orders today, ISM services and 10-year Treasury auction on Tuesday, 30-year Treasury auction Wednesday, Q3 productivity and FOMC announcement on Thursday, and University of Michigan sentiment on Friday.

Notable Headlines:

- Nvidia (NVDA): Reportedly in investment talks with xAI.

- Tesla (TSLA): China-made EV sales down over 5% y/y in October.

- Berkshire Hathaway (BRK.B): Operating earnings light due to insurance, cash pile exceeds $325B.

- Comcast (CMCSA): Exploring Reverse Morris Trust for cable networks.

- Yum China (YUMC): Comps down, but EPS beat on stronger sales/margins.

- Viking Therapeutics (VKTX): Strong rise on positive obesity drug results.

- Air Transport Services Group (ATSG): Near $3.1B acquisition by Stonepeak.

- Blackstone (BX): In talks to acquire ROIC

U.S. equities closed higher on Friday, partially recovering Thursday’s sell-off. Major indices gained: Dow (+0.69%), S&P 500 (+0.41%), Nasdaq (+0.80%), and Russell 2000 (+0.61%), led by big tech, particularly Amazon (AMZN), which offset Apple (AAPL) weakness. Strength was seen across semis, airlines, life sciences, media, restaurants, software, and credit cards. Underperformers included utilities, exchanges, tobacco, beverages, drug stores, apparel, and telecom. Treasury yields rose, the dollar strengthened, and the dollar index was up 0.3%. Gold edged down slightly, Bitcoin futures declined by 1.4%, and WTI crude rose 0.3%, though off session highs.

The October employment report showed a sharp slowdown, with nonfarm payrolls increasing by only 12K (well below ~110-120K consensus), unemployment unchanged at 4.1%, and average hourly earnings up 0.4% (above expectations). The ISM manufacturing index missed estimates, reaching its lowest level since June 2023, with declining production but slight improvements in new orders and employment indexes. Market sentiment remains cautious amid high yields and election uncertainties, but bulls focus on positive seasonality, potential Fed easing, and projected 2025 earnings growth.

Company News by GICS Sector:

Information Technology

- Apple (AAPL): Outperformed on iPhone sales but Services revenue was light and Q4 guidance fell short.

- Intel (INTC): Surprised with a Q3 beat on earnings and revenue, bolstered by Data Center & AI growth and encouraging Q4 guidance.

- Atlassian (TEAM): Posted strong earnings with revenue and margins above expectations, aided by Cloud and Data Center segments; raised FY guidance and announced a new $1.5B buyback.

- Onto Innovation (ONTO): Lost 11.2% despite strong AI packaging revenue, as delays in JetStep lithography orders weighed on the Q4 guidance range.

Communication Services

- Charter Communications (CHTR): Gained 11.9% after an adjusted EBITDA, revenue, and FCF beat, with solid Residential results and capex reduction guidance.

- Telephone & Data Systems (TDS): Declined 7.6% on a Q3 earnings miss, driven by lower service revenues and lowered U.S. cellular guidance.

Consumer Discretionary

- Amazon (AMZN): Delivered a strong Q3 operating income beat with margin expansion across segments; AWS growth was modest, affected by supply constraints, but AWS margins were strong, with optimistic AI commentary.

- Wayfair (W): Dropped 6.3% despite a Q3 beat, with active customers and orders below consensus, although average order value improved.

- Church & Dwight (CHD): Rose 4.8% on a Q3 EPS beat with organic sales growth; guidance was slightly lowered due to macro headwinds but positioned for consumer trade-down benefits.

Health Care

- Halozyme Therapeutics (HALO): Jumped 13% on Q3 results, with strong Enhanze technology adoption driving royalty revenue; raised FY guidance.

- Cardinal Health (CAH): Increased 7% after a Q1 EPS and revenue beat, boosted by Specialty Solutions; raised FY25 EPS guidance on pharmaceutical segment strength.

- Abbott Laboratories (ABT): Gained 4.6% after a favorable court ruling in its baby formula division; analysts noted the company may benefit from reduced liability concerns moving forward.

Energy

- ExxonMobil (XOM): Reported a Q3 beat, with higher production and an increased dividend, citing strength from U.S. Gulf production and cost reductions.

- Chevron (CVX): Posted solid Q3 results, including record U.S. and Permian Basin production, and outlined structural cost reduction goals by 2026.

Industrials

- MasTec (MTZ): Rose 5.8% on Q3 EBITDA beat, driven by strong Clean Energy bookings and record backlog, with an EPS guidance increase.

- Waters (WAT): Increased 19.8% on Q3 EPS and revenue beat, with raised FY24 guidance and strong customer spending trends across all end markets.

Financials

- Essent Group (ESNT): Fell 10.4% following a Q3 EPS miss and rising delinquency rates, with new insurance largely in line with prior quarters.

Eco Data Releases | Monday November 4th, 2024

S&P 500 Constituent Earnings Announcements | Monday November 4th, 2024

Data sourced from FactSet Research Systems Inc.