S&P futures are down 0.2% in Monday morning trading, following last week’s gains where the Dow, S&P, and Nasdaq all extended their winning streak to six weeks, the longest in 2024. Big tech, banks, airlines, builders, retail, and utilities were standouts, while managed care, energy, machinery, chemicals, and China tech lagged.

Asian markets were mixed overnight, with Hong Kong down over 1.5%, while Shenzhen jumped 1.5% and Japan remained flat. European markets are down 0.2%. Treasuries are weaker, the Dollar Index is up 0.1%, Gold rose 0.7%, Bitcoin futures edged up 0.2%, and WTI crude is up 1.4% after last week’s sharp decline.

No major drivers today, but a busy week ahead with 112 S&P 500 companies reporting earnings. Optimism remains around the soft-/no-landing narrative, Fed easing cycle, AI growth, and China stimulus. Attention also on post-election seasonality and unwinding of downside hedges.

On the economic front, Fed officials Logan, Kashkari, Schmid, and Daly are scheduled to speak today, but it’s a slow data week with key reports on Richmond Fed manufacturing, existing home sales, and Beige Book mid-week.

Corporate news includes:

- Boeing (BA): New proposal to machinists’ union, vote set for Wednesday.

- Pfizer (PFE): CEO has strong board support amid activist push.

- Cigna (CI) and Humana (HUM): Reportedly in refreshed deal talks.

- MetLife (MET): In talks to acquire PineBridge assets outside China.

- Starboard builds stake in Kenvue (KVUE).

- Southwest Airlines (LUV) in settlement talks with Elliott to avoid a proxy fight.

- Levi Strauss (LEVI) receiving interest in its Dockers brand.

- Spirit Airlines (SAVE) rose on debt refinancing extension.

US equities closed mostly higher on Friday, with the Dow up 0.09%, S&P 500 rising 0.40% to a fresh all-time high, and the Nasdaq gaining 0.63%, while the Russell 2000 slipped 0.21%. The S&P 500 notched its sixth consecutive week of gains, led by big tech, with Apple (AAPL) as a standout. Strength was also seen in China tech and auto parts stocks, while industrial metals benefited from renewed optimism around China’s stimulus measures. On the downside, energy was the worst-performing sector due to weak oil prices, while banks and staples also underperformed.

Treasuries were unchanged to firmer at the short end, while the Dollar Index fell 0.3%. Gold was up 0.8%, Bitcoin futures rose 2.7%, and WTI crude settled 2% lower, capping a weekly decline of over 9%.

Positive developments included Netflix (NFLX)’s strong Q3 results and guidance, and Apple (AAPL)‘s better-than-expected iPhone sales in China. However, other key earnings reports were mixed, with American Express (AXP), Schlumberger (SLB), Procter & Gamble (PG), and CVS Health (CVS) delivering underwhelming results. Market sentiment continues to focus on the soft-/no-landing economic narrative, supported by solid earnings, favorable seasonality, and buyback resumptions. Housing data showed September housing starts slightly ahead of expectations, though permits came in below consensus.

Looking ahead, markets will focus on a busy earnings calendar, with 143 S&P 500 companies set to report next week. Fed’s Bostic indicated that the central bank is not in a rush to raise rates further, pegging the neutral rate between 3% and 3.5%.

Notable Stock Movements by GICS Sector

Information Technology

- Intuitive Surgical (ISRG) +10.0%: Q3 results exceeded expectations, with worldwide da Vinci procedures growing 18% year-over-year. Analysts noted strength in DV5 system placements, with FY24 procedure growth guidance raised.

- Datadog (DDOG) +1.5%: Upgraded to buy by UBS, citing positive signs in the H2 spending environment for cloud infrastructure and optimism around AWS/Azure prospects.

- Coherent (COHR) -3.8%: Downgraded to neutral by B Riley Securities, with concerns that NVIDIA may have shifted some business to another supplier for its 1.6T products.

Financials

- Comerica (CMA) +3.7%: Q3 earnings beat estimates, driven by better-than-expected NII, expense control, and a 25% increase in tangible book value (TBV). The company plans to resume buybacks in Q4.

- American Express (AXP) -3.2%: Q3 earnings beat expectations, but revenue slightly missed due to lower discount revenues. While expenses were a bright spot, analysts noted uncertainty around future revenue growth.

- Western Alliance Bancorp (WAL) -8.9%: Shares dropped after an EPS and net interest margin (NIM) miss. Higher expenses and light guidance also weighed on sentiment.

- Ally Financial (ALLY) -2.3%: Q3 results beat expectations, supported by solid consumer auto originations and tax benefits from electric vehicle leases. However, analysts remained cautious about credit issues and margin compression.

- Fifth Third (FITB) -1.5%: Q3 earnings missed expectations, with NII/NIM in line but higher expenses and nonperforming loans surpassing forecasts.

Consumer Discretionary

- Apple (AAPL) +1.2%: China iPhone sales were reported to be up 20% year-over-year in the first three weeks since the iPhone 16 launch, with top-end models seeing particularly strong demand.

- Autoliv (ALV) +6.0%: Q3 revenue and EBIT were better than expected, with strong global outperformance in Europe and Asia ex-China. FY guidance was reaffirmed, with a strong Q4 expected.

- United States Cellular (USM) +7.1%: Announced plans to sell select spectrum assets to Verizon (VZ) for $1 billion, as part of its ongoing efforts to monetize assets.

Industrials

- Crown Holdings (CCK) +4.2%: Q3 earnings beat expectations, driven by improved results in global beverage operations. The company raised its FY24 adjusted EPS guidance.

- Schlumberger (SLB) -4.7%: Q3 results were mixed, with cautious management commentary on slowing international growth and more cautious customer behavior. However, the company is accelerating buybacks and expects to return more than $3B to shareholders this year.

Consumer Staples

- CVS Health (CVS) -5.2%: Guided Q3 EPS 36% below consensus, citing higher medical costs and a $1.2 billion restructuring charge. The announcement of a CEO change was received positively by analysts.

- Procter & Gamble (PG): Organic growth was in line with expectations, though FY guidance remained unchanged.

- Lamb Weston (LW) +10.2%: Reportedly received a 5% stake investment from Jana Partners, which may push the company to explore a sale or make strategic changes.

Materials

- MGP Ingredients (MGPI) -24.2%: Shares plunged after the company cut its FY guidance, citing pressures from weak alcohol spirits trends and elevated whiskey inventories.

- WD-40 (WDFC) -4.8%: Fiscal Q4 revenue was slightly better, but operating income was light, and EPS missed expectations. The company also guided FY25 earnings below consensus, though it highlighted progress in GM expansion and operational efficiencies.

Comm. Services

- Netflix (NFLX) +11.1%: Q3 revenue was 1% ahead of estimates, and operating income beat by 7%. Strong net additions and positive Q4 guidance were well received, with analysts optimistic about a US price increase, ad ramp, and margin expansion in 2025.

Health Care

- Intuitive Surgical (ISRG) +10.0%: Q3 results exceeded expectations, with worldwide da Vinci procedures growing 18% year-over-year. Analysts noted strength in DV5 system placements, with FY24 procedure growth guidance raised.

Eco Data Releases | Monday October 21st, 2024

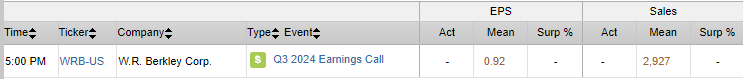

S&P 500 Constituent Earnings Announcements | Monday October 21st, 2024

Data sourced from FactSet Research Systems Inc.