S&P futures lower:

S&P futures are down 0.2% in Wednesday morning trading, following a weaker Tuesday session where US equities declined. Laggards included crowded shorts, lower quality stocks, semis, and regional banks, while energy and defensives outperformed. Asian markets were mostly down overnight, with Japan falling over 2% and South Korea down more than 1%, though Hong Kong surged more than 6%. European markets are up about 0.5%. Treasuries are weaker with some curve steepening, while the dollar index is up 0.1%. Gold is down 0.8%, Bitcoin futures down 0.5%, and WTI crude is up 3.5%.

Key themes:

Middle East tensions remain an overhang after Israel vowed retaliation following an Iranian missile strike. The strike at US East/Gulf Coast ports poses potential risks to growth and supply chains. Tuesday night’s vice-presidential debate is not expected to impact broader election uncertainty. NKE-US mixed Q1 results and softer guidance are in focus amid a slow corporate news cycle, with concerns surrounding turnaround sentiment for the company.

Economic data:

The ADP private payrolls report is today’s highlight, with the Street expecting a 125K increase in September, following a weaker-than-expected 99K gain in August. Fedspeak remains light, with Hammack, Musalem, Bowman, and Barkin scheduled to speak, though only Barkin will discuss the economic outlook. The market awaits clarity on the 25 vs. 50 bp rate cut debate ahead of Friday’s September employment report, where expectations are for a ~140K increase in nonfarm payrolls, the unemployment rate to hold at 3.8%, and average hourly earnings growth to decelerate to 0.3% m/m.

Israel vows retaliation following Iranian missile barrage:

Israeli Prime Minister Netanyahu vowed to retaliate after Iran launched ballistic missiles targeting military and intelligence sites near Tel Aviv. The White House warned Tehran of severe consequences. While Iran claimed its attack was over, it also threatened a stronger response if Israel retaliates. The attack has raised concerns about a wider Middle East conflict, contributing to a spike in oil prices amid fears of damage to Iranian energy facilities.

East Coast port strike begins:

Around 45K dockworkers at 36 East and Gulf Coast ports went on strike, the largest since 1977. Wages and automation concerns are the key issues. Analysts warn even a short strike could cause significant disruption, with JPMorgan estimating costs between $3.8-4.5B per day. The White House has been encouraging negotiations but is hesitant to impose a cooling-off period.

September ISM Manufacturing unchanged:

The ISM Manufacturing Index for September remained at 47.2, slightly below expectations, marking six consecutive months of contraction. The Prices Index fell into contraction territory for the first time this year, while the Employment Index continued to decline. Weak demand, low order rates, and election uncertainty were cited as concerns by respondents.

August JOLTS job openings surprise increase:

August JOLTS job openings rose 4.3% month-over-month to 8.04M, beating expectations. The layoffs rate decreased, but hires and quits rates both ticked down. This report kicks off a week of labor market data, with September nonfarm payrolls expected to show little change from July’s 142K figure. A soft print could bolster the case for a 50 bp rate cut, but analysts caution that Powell’s recent comments suggest two 25 bp cuts are more likely.

Fed Chair Powell comments on November decision:

In a speech at the NABE conference, Powell reiterated that if the economy evolves as expected, policy will shift toward a more neutral stance, with two 25 bp cuts likely this year. He emphasized that the Fed is not rushing into decisions and pushed back against expectations of a 50 bp cut. Powell’s remarks follow other Fedspeak, with Chicago’s Goolsbee supporting a gradual rate reduction and Atlanta’s Bostic open to a larger cut if labor data weakens.

Chicago PMI and Dallas Fed Index show improvements:

September Chicago PMI slightly rose to 46.6, driven by improvements in order backlogs and employment. The Texas manufacturing index also saw a rise in employment, although overall activity remained weak. Upcoming employment data, including the ISM Manufacturing Index and the September nonfarm payrolls report, will be crucial in shaping the Fed’s decisions

Corporate news by Sector:

Consumer Discretionary:

- NKE-US: Shares are down after mixed fiscal Q1 results, with sales slightly missing expectations, though better gross margins and SG&A led to an EPS beat. The company guided below for fiscal Q2 and withdrew its FY25 guidance.

Financials:

- LPLA-US: Stock dropped significantly following the termination of its CEO.

- OZRK-US: Announced a 2.5% increase in its quarterly dividend.

Real Estate:

- KIM-US: The company announced a $322M acquisition and raised its 2024 guidance assumptions.

Consumer Staples:

- LW-US: Shares are down as the company’s FY25 EPS guidance cut overshadowed a strong Q1 earnings beat.

Industrials:

- RGP-US: The company flagged a challenging operating environment and noted it does not expect a significant uplift in Q2 revenue run rate from Q1.

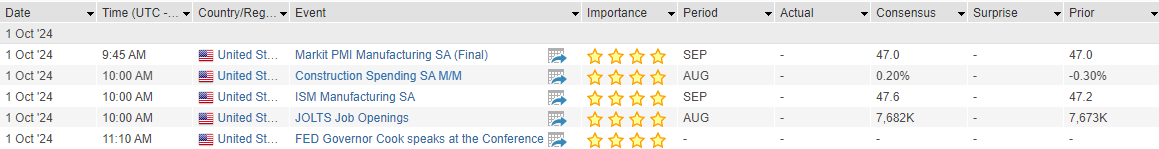

Eco Data Releases | Wednesday October 2nd, 2024

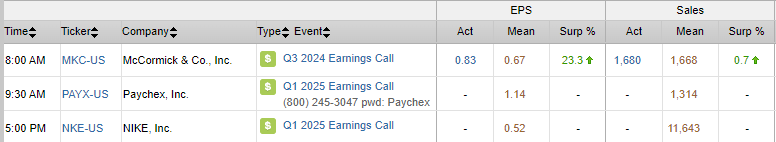

S&P 500 Constituent Earnings Announcements | Wednesday October 2nd, 2024

Data sourced from FactSet Data Systems