S&P futures rose 0.1% in Wednesday’s pre-market after a mixed Tuesday session driven by big tech gains, especially in the S&P 500 and Nasdaq, while nearly 70% of S&P components closed down. Key laggards included homebuilders, autos, energy, and defensive sectors. Treasury yields stabilized with support from a strong 7-year note auction. The Dollar Index dipped 0.1%, Gold rose 0.4%, Bitcoin futures were up 0.1%, and WTI crude increased 0.8%.

The market is now focused on a heavy round of earnings, with Google (GOOGL-US) delivering strong results from Cloud and AI. Additionally, upcoming economic data, including ADP private payrolls, Q3 GDP, and the Treasury’s refunding announcement, are in the spotlight. The Fed remains anticipated to deliver a 25 basis point rate cut next week. The election has brought a slight risk-off sentiment, with hedges reducing exposure, though bulls are optimistic about seasonal trends, mutual fund year-end selling cessation, and a resumption of buybacks.

Earnings Highlights

- Technology: Google (GOOGL) beat on Cloud; AMD guided light but had positive takeaways; SNAP saw strong EBITDA and announced a $500M buyback.

- Healthcare: Eli Lilly (LLY) missed and cut guidance on inventory issues for Mounjaro/Zepbound; DaVita (DVA) affected by lower treatment growth.

- Industrials: Caterpillar (CAT) missed on sales and EPS; Werner (WERN) cited freight challenges; Owens-Illinois (OI) lowered FY guidance.

- Consumer Discretionary: Chipotle (CMG) comps were light; Electronic Arts (EA) raised bookings guidance.

- Financials: Visa (V) beat with a FY25 guidance seen as cautiously optimistic.

Economic Calendar for the Week

- Wednesday: ADP private payrolls (+108K expected), Q3 GDP (+2.6% expected), pending home sales, and Treasury’s quarterly refunding announcement.

- Thursday: Personal income/spending, PCE inflation, Chicago PMI.

- Friday: Employment report, ISM manufacturing, and construction spending.

US equities ended mixed on Tuesday, closing slightly below peak levels. The Nasdaq gained +0.78%, hitting its first record closing high since July 10, while the S&P 500 rose +0.16% and the Dow Jones Industrial Average slipped -0.36%. The Russell 2000 lagged with a -0.27% drop. Support came largely from big tech, while the equal-weighted S&P underperformed. Outperformers included hospitals, apparel, semiconductors, software, airlines, cruise lines, exchanges, waste management, and precious-metals miners. Laggards included homebuilders, home improvement, autos, utilities, beverages, energy, and paper/packaging sectors.

Treasuries were somewhat firmer across the curve, while the Dollar Index remained flat. Gold increased by 0.9%, and Bitcoin futures rose 4.5%. WTI crude declined 0.3%, continuing its downward trend amid easing Middle East tensions.

Looking ahead, the market anticipates earnings reports from the “Mag 7,” a potentially volatile October employment report, upcoming elections, and the November FOMC meeting. Yields face upward pressure due to deficit concerns, though they’ve moderated since the release of a softer JOLTS report. Key upcoming economic data includes ADP private payrolls, Q3 GDP, and pending home sales on Wednesday; personal income/spending, PCE inflation, ECI, Chicago PMI on Thursday; and the employment report, ISM manufacturing, and construction spending on Friday.

GICS Sector Updates

Consumer Discretionary

- VFC Corp (VFC-US): +27.0%, beat Q2 expectations, resumed guidance, positive on Vans brand stabilization and cost control.

- Boot Barn Holdings (BOOT-US): -19.8%, in-line Q2 results but Q3 guidance below consensus; announced CEO departure.

- Crocs (CROX-US): -19.2%, Q3 beat but downgraded HEYDUDE growth outlook; reiterated lower revenue growth guidance.

Information Technology

- CommVault Systems (CVLT-US): +24.0%, beat Q2 earnings and guidance for Q3; noted increased demand.

- Cadence Design Systems (CDNS-US): +12.5%, exceeded Q3 expectations; upbeat pipeline commentary with China recovery.

- Zebra Technologies (ZBRA-US): +5.8%, Q3 beat with robust sales growth; Q4 guidance exceeded consensus.

- Check Point Software (CHKP-US): -14.5%, in-line Q3 with weak subscription growth; billings missed.

Healthcare

- Tenet Healthcare (THC-US): +16.7%, significant Q3 EBITDA beat with higher FY guidance due to increased hospital admissions.

- TransMedics Group (TMDX-US): -29.9%, Q3 miss with lower-than-expected transplant market volume; analysts concerned about growth.

Industrials

- Camping World Holdings (CWH-US): +6.9%, beat on Q3 earnings and revenue; anticipated recovery in used unit volume in 2025.

- H&E Equipment Services (HEES-US): -6.3%, missed on Q3 revenue; noted fleet utilization declines due to demand reduction.

Financials

- F5, Inc. (FFIV-US): +10.1%, Q4 beat with strong billings and buyback boost; FY25 guidance above consensus.

- PayPal (PYPL-US): -4.0%, Q3 EPS beat but revenue missed; soft guidance for Q4 and lower customer account growth.

Materials

- Graphic Packaging (GPK-US): -5.6%, Q3 revenue and EBITDA missed; impacted by customer destocking and inflationary pressures.

- Corning (GLW-US): +4.7%, Q3 beat with strong optical communications growth; Q4 guidance above consensus.

Consumer Staples

- Keurig Dr Pepper (KDP-US): -2.9%, largest shareholder JAB Holding sold 60M shares at $32.85 each.

Communication Services

- Leidos Holdings (LDOS-US): +9.5%, beat Q3 earnings; raised guidance with improved performance across all segments.

Energy

- Ford Motor (F-US): -8.4%, missed Q3 EBIT guidance; forecast for FY fell to low end due to EV headwinds and warranty costs.

Eco Data Releases | Wednesday October 30th, 2024

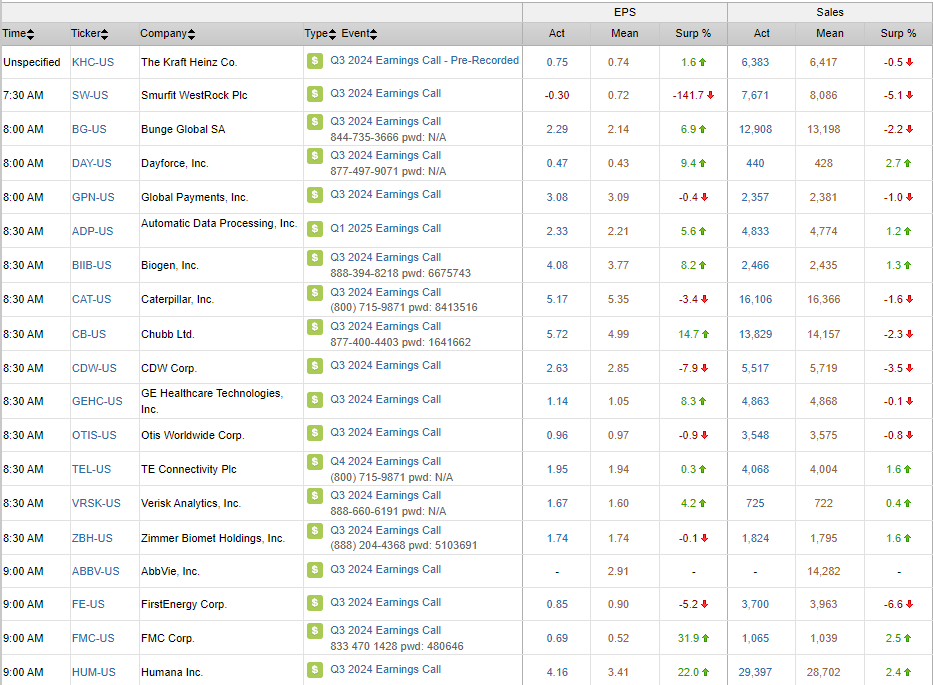

S&P 500 Constituent Earnings Announcements | Wednesday October 30th, 2024

Data sourced from FactSet Research Systems Inc.