S&P futures are up 0.4% in Tuesday premarket trading, bouncing back after a weaker Monday session driven by rising Treasury yields. Big tech was mostly down yesterday, except for NVDA, which outperformed. European markets are weaker today, following a mixed session in Asia where China returned from its Golden Week holiday. Treasuries are mixed, with yields pausing after recent increases, while the 10-year yield remains above 4%. The dollar index is down 0.1%, gold is flat, and Bitcoin futures are off 1.2%. WTI crude is down 1.8% after five straight days of gains.

The market narrative hasn’t changed much: rising yields reflect a more hawkish Fed outlook, while optimism remains about a soft-landing scenario. However, concerns persist about Middle East tensions, US presidential election uncertainties, and stretched sentiment indicators. The market is also cautious ahead of Q3 earnings season.

Notable Fedspeak today includes St. Louis’s Musalem advocating patience on easing, while NY’s Williams emphasized that cuts should come “over time.” Governor Kugler focused on inflation control, supporting the Fed’s 50bp cut. Several other Fed officials, including Bostic and Collins, are speaking later today.

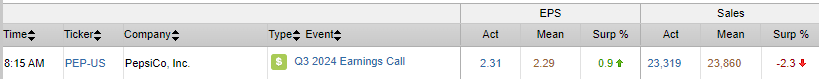

In corporate news, NVDA continues to rise as Foxconn expands in Mexico to meet demand for its Blackwell chips. PEP missed on revenue and lowered guidance due to declines at Frito-Lay and Quaker. HON announced plans to spin off its advanced-materials unit. BA is continuing labor negotiations, while STLA filed more lawsuits against UAW units.

US equities closed lower Monday, with the Dow down 0.94%, S&P 500 off 0.96%, Nasdaq losing 1.18%, and Russell 2000 falling 0.89%. The decline followed Friday’s rally, spurred by stronger-than-expected September nonfarm payrolls. Big tech was mostly weaker, with downgrades hitting AMZN and AAPL, while NVDA outperformed. Other sectors under pressure included autos, insurance (due to hurricanes), utilities, and semiconductors. Outperformers were energy (supported by crude oil prices), pharma, China tech, defense stocks, and industrial metals. The 10-year Treasury yield continued to rise, up 28 bps in the last four sessions, while the dollar index was flat. Gold fell 0.1%, Bitcoin futures gained 1.3%, and WTI crude surged 3.7% to close above $75/barrel.

The broader market is reacting to elevated Treasury yields, Fed repricing after last week’s strong jobs report, and some concerns about rising inflation and “no landing” scenarios. The VIX hit its highest level since early August, amid increased geopolitical risks, elevated oil prices, and election uncertainty. Looking ahead, focus remains on Q3 earnings season, which starts later this week with big banks reporting Friday, along with Thursday’s September CPI.

Information Technology:

- NVDA (+3.3%): Outperformed after CEO Huang commented on CNBC about “insane” demand for the Blackwell product and a new AI partnership with Accenture.

- SMCI (+15.8%): Announced it is shipping over 100K GPUs per quarter and has delivered 2K liquid-cooled racks since June.

Consumer Discretionary:

- AMZN (-3%): Downgraded to equal weight at Wells Fargo, citing limited margin expansion through 1H-25, despite longer-term AI tailwinds.

- NAPA (+102.8%): To be acquired by Butterfly Equity for ~$1.95B, representing a 106% premium to Friday’s closing price.

- DECK (-4.8%): Downgraded to neutral at Seaport Research Partners, citing weaker momentum for Hoka and Ugg brands.

Consumer Staples:

- HSY (-2.3%): Downgraded to neutral at UBS, highlighting input cost pressures and challenging demand.

- COTY (+4.1%): Upgraded to buy at Jefferies, citing valuation and strength in the premium fragrance market.

Health Care:

- PFE (+2.2%): Starboard Value has reportedly taken a $1B stake in Pfizer and is pushing for a turnaround, according to CNBC.

- HIMS (+10.1%): To join S&P SmallCap 600 on Oct. 6.

- DNLI (-7.1%): Downgraded to neutral at Cantor Fitzgerald, citing valuation challenges and margin pressures.

Financials:

- B (+2.7%): Announced a definitive agreement to be acquired by Apollo for $47.50 per share in cash, confirming last week’s reports.

- VSTO (+10.5%): Announced sale of Revelyst for $1.13B, with Kinetic Group sale price raised to $2.23B.

Industrials:

- BA: Restarting negotiations with striking unions after being summoned by a federal mediator.

Energy:

- CVX: Selling Alberta assets to Canadian Natural Resources for $6.5B.

- ALTM: Confirmed it was approached by Rio Tinto for a potential acquisition.

Materials:

- DD (-1.8%): Downgraded to underweight at Barclays after recent stock rally, citing potential underperformance ahead due to uncertainty and limited buyback support.

- APD (+9.5%): Gained on reports that Mantle Ridge has built a $1B stake and plans to push for changes.

Communication Services:

- GOOGL (-2.4%): Slipped after a federal judge ordered Google to open its app store to competition.

- NFLX (-2.5%): Downgraded to underweight by Barclays over concerns about regional revenue trends; however, Piper Sandler upgraded the stock due to multiple business drivers.

- VZ (+1.0%): Announced strategic initiative to accelerate 5G infrastructure deployment in key urban markets.

Eco Data Releases | Monday October 8th, 2024

S&P 500 Constituent Earnings Announcements | Monday October 8th, 2024

Data sourced from FactSet Research Systems Inc.