S&P Futures Higher:

S&P futures are up 0.8% in Thursday morning trading, following a mostly lower session for US equities on Wednesday. Homebuilders, energy, autos, and China tech stocks were among the laggards, while big tech had a mixed performance with Nvidia (NVDA-US) and Meta (META-US) standing out, and semiconductors performing well. Asian markets rallied overnight, with Hong Kong up over 4%, China up 3.5%, and Japan up nearly 3%. European markets are also higher, rising over 1.5%. Treasuries were unchanged to slightly firmer, the Dollar Index remained stable, Gold rose 0.3%, Bitcoin futures gained 1.2%, and WTI crude fell 2.1%.

Risk sentiment is being driven by much better-than-expected earnings results and guidance from Micron (MU-US), supporting the broader AI growth narrative. There’s also renewed focus on China’s policy support, with the Politburo pledging more fiscal stimulus and reports that Beijing could inject nearly $150B into the largest state banks to support the economy. Globally, the easing cycle continues to make headlines, with Switzerland’s SNB delivering its third consecutive rate cut and signaling more potential easing. Meanwhile, expectations for an ECB rate cut in October are also rising. Next week’s September Non-Farm Payrolls (NFP) is still seen as a key driver for market direction, along with the Q3 earnings season starting the following week with major banks reporting.

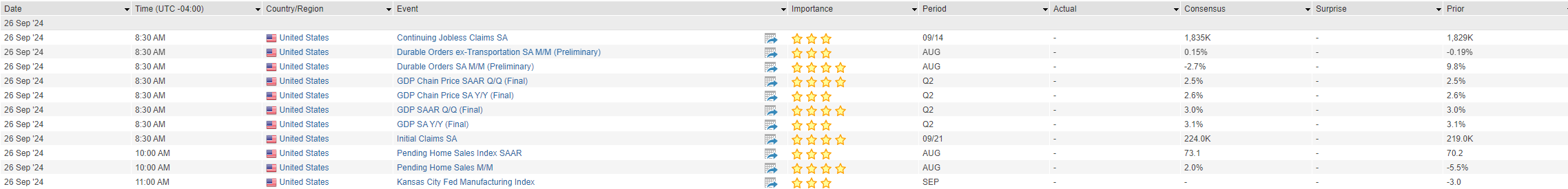

Today’s economic calendar includes initial claims, durable goods orders, and the final revision of Q2 GDP. Initial claims will attract significant attention due to the Fed’s focus on the labor market. Last week’s claims were the lowest since May, and the 4-week average hit its lowest level since early June. There is also a heavy schedule of Fedspeak, including pre-recorded remarks from Powell, along with speeches from Collins, Bowman, Williams, Barr, Kashkari, and Cook. Core PCE inflation is due on Friday, with the Street expecting a 0.2% month-over-month increase, pushing the year-over-year rate up to 2.7%.

GICS Sector Breakdown

Information Technology

- Micron (MU-US) surged after beating fiscal Q4 expectations and providing much stronger-than-expected Q1 guidance. The company highlighted strong demand for AI-related products, noting that high-bandwidth memory (HBM) chips are sold out for 2024 and 2025.

- OpenAI is restructuring into a for-profit company, marking a shift from its previous non-profit model.

Utilities

- NRG Energy (NRG-US) was a significant gainer after raising its full-year guidance, reflecting improved operational performance.

Financials

- Jefferies Financial Group (JEF-US) fell after missing on Q3 revenue and EPS. The firm’s Asset Management division was a drag, though it pointed to a strong pipeline in its Investment Banking segment.

Materials

- H.B. Fuller (FUL-US) missed earnings expectations and cut its full-year guidance, citing volume growth challenges due to slowing demand in certain durable goods markets.

Consumer Discretionary

- Bath & Body Works (BBWI-US) announced that Julie Rosen, president of retail, is stepping down from her role.

Energy

- CNX Resources (CNX-US) missed Q3 EPS estimates and provided weaker-than-expected Q4 guidance, flagging significant challenges in the current operating environment.

Looking Ahead…

Q3 Earnings Growth Expected at +4.6%:

With one week left in Q3, FactSet reports S&P 500 earnings growth is projected at +4.6%, down from +7.8% at the quarter’s start and +11.3% in Q2. Tech, Healthcare, and Communications Services lead the expected growth, while Energy is forecasted to show a double-digit earnings decline. Earnings themes include AI, Fed easing, labor market trends, disinflation, and geopolitical tensions.

Potential East Coast Port Strike:

Attention is growing on a potential East Coast/Gulf Coast port strike starting October 1, as talks between the International Longshoremen’s Association and the US Maritime Alliance remain deadlocked. Ports affected handle 40% of US shipping volume. There are concerns about disruptions to shipping and potential political impacts ahead of the US presidential election. Some importers have already rerouted shipments to West Coast ports. Jefferies warns a strike could weigh on GDP and prompt swift government intervention.

Consumer Confidence Drops, Richmond Fed Weakens:

September’s consumer confidence index fell to 98.7, its largest decline since August 2021, below consensus of 104.0. Labor market data weakened, and inflation expectations rose. The Richmond Fed Manufacturing Survey also declined to -21.0, with new orders, shipments, and employment all falling. House price indexes showed slight growth, with the FHFA up and Case-Shiller’s 20-city index rising 0.27% m/m.

August New Home Sales Beat Consensus:

New home sales fell 4.7% m/m to 716K in August but beat expectations of 696K. Median sales prices stood at $420,600. Mortgage rates dropped to 6.13%, the lowest in two years, with mortgage applications rising 11%. Key economic data tomorrow includes durable goods, GDP, jobless claims, and Jerome Powell’s speech.

September Flash PMIs Show Manufacturing Weakness:

September’s flash S&P Composite PMI came in at 54.4, below expectations. Services rose slightly, but manufacturing fell to 47.0, marking two consecutive months of output declines. Employment in manufacturing saw its steepest decline since June 2020, with input cost growth in services at a six-month high.

Rate Cutting Cycle Positive for Stocks:

Historical data shows that stock performance is typically positive after the start of a Fed rate cut cycle. JPMorgan noted that the S&P 500 has risen 2.5% in the first month and 6.1% over six months following the start of the last five easing cycles. In cycles where the economy avoided a recession, returns were even stronger, with the S&P up 17% over 12 months. Defensive sectors, particularly Utilities, tend to outperform during these periods

Eco Data Releases | Thursday September 26th, 2024

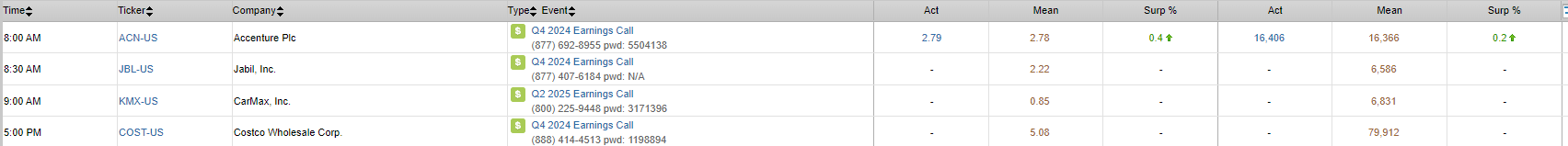

S&P 500 Constituent Earnings Announcements | Thursday September 26th, 2024

Data sourced from FactSet Data Systems