Stocks closed higher on Friday, marking the fourth consecutive month of gains. The S&P 500 rose 1%, with 76% of its stocks gaining, and finished August with a 2.3% increase, bringing its year-to-date gain to 18.4%. The Dow Jones Industrial Average rose 0.6%, hitting its fourth all-time high this week, while the Nasdaq composite gained 1.1%.

As of this writing Futures for the major US indices are off slightly, but above the worst levels of the session. Please take a look at our monthly outlook pieces for the S&P 500 and each of the 11 large cap. sector SPDR ETFs!

Investors reacted positively to encouraging economic reports. The Commerce Department’s personal consumption expenditures (PCE) report showed prices rose 0.2% from June to July, slightly up from the previous month’s 0.1% increase. Inflation remained steady at 2.5% year-over-year, below economists’ expectations of 2.6%. This suggests that inflation is cooling, which could prompt the Federal Reserve to cut interest rates at its upcoming meeting.

Bond yields were mixed, with the 10-year Treasury yield rising to 3.92% from 3.86%. Crude and Commodities were softer as well with the Bloomberg Commodities Index retreating to the 96 level and WTI Crude settling below $74.

Technology stocks led the market, with Marvell Technology surging 9.2% following strong quarterly results. Broadcom and Nvidia also saw gains, while Dell rose 4.3% after beating analysts’ forecasts due to strong server and networking revenue. Conversely, Ulta Beauty fell 4% after missing sales and profit expectations and lowering its guidance.

The S&P 500 ended the day up 56.44 points to 5,648.40, the Dow rose 228.03 points to 41,563.08, and the Nasdaq increased by 197.19 points to 17,713.62. Solid earnings and economic growth updates have boosted confidence in the broader economy, with reports indicating strong retail sales, employment, and consumer confidence.

Despite these positive trends, September is historically a challenging month for stocks, with the S&P 500 finishing higher only 43% of the time since 1950. Investors are now looking ahead to the latest jobs report, due next Friday, which will provide further clues on the Federal Reserve’s next move. Economists expect the economy to have added 155,000 jobs in August, up from 114,000 in July.

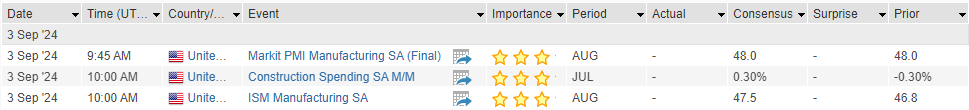

Eco Data Releases | Tuesday September 3rd, 2024

S&P 500 Constituent Earnings Announcements by GICS Sector | Tuesday September 3rd, 2024

No S&P 500 Constituents Report on Monday

Data sourced from FactSet Data Systems