Equities closed last week to the downside as the Nasdaq led shares lower off -2.55% while the S&P 500 gave up 1.73% and the Dow lost 1.01% on the day.

Wrapping up the week from a sector perspective, XLP and XLRE finished the week as the only positive gainers. XLK and XLE were the source of the most intense selling both down >5% on the week while XLB and XLI were down >4% in a “risk-off” tape.

S&P 500 futures rose 0.7% in Monday pre-market trading, attempting to rebound after last week’s sharp selloff, which marked the worst week for the S&P 500 since March 2023 and for the Nasdaq since January 2022. The declines were largely driven by a broad selloff across big tech and semiconductor stocks. In the bond market, Treasuries weakened across the curve, with the 2-year yield closing at its lowest level since September 2022, and the 10-year yield reaching its lowest since June 2023. The 2/10 spread remains slightly positive at +5 basis points. The dollar index is up 0.4%, with the yen showing the most weakness, while gold remained flat. Copper rebounded 1.8% after last week’s 3.3% decline, and Bitcoin futures rose 3.5%, recovering some losses after dropping 8.6% last week. WTI crude also saw a modest recovery, up 0.9% after last week’s 8% drop, which pushed prices to their lowest levels since June 2023.

In the tech sector, all eyes are on Apple (AAPL) as it hosts its iPhone event today, with a focus on potential AI features and the timing of its Apple Intelligence platform. Reports over the weekend also suggested that the new iPhone will be powered by the ARM-based A9 chip architecture. Meanwhile, Tesla (TSLA) CEO Elon Musk denied reports that his AI company, xAI, held talks to take a share of Tesla’s electric vehicle revenues in exchange for access to its technology.

Semiconductor stocks, along with big tech, were hit hard last week, contributing to broader market losses. However, demand for AI-related technology remains strong, even as investor expectations remain high.

In the energy market, WTI crude saw a modest recovery on Monday, up 0.9% after last week’s 8% selloff brought prices to their lowest point since June 2023. The energy sector continues to face volatility, with demand concerns persisting.

In automotive news, August’s Manheim used car index is set to be released today, offering a glimpse into the health of the auto market. Additionally, Boeing (BA) reached a new labor agreement with a union representing 33,000 of its workers, averting a potential strike.

The consumer sector continues to face concerns over weakening trends, particularly among lower-income consumers. However, during last week’s Goldman Sachs conference, several retailers expressed optimism about consumer demand heading into the latter part of the year.

On the corporate front, Big Lots (BIG) filed for bankruptcy and agreed to a sale to private equity firm Nexus Capital Management. The news comes amid increasing pressure on retailers facing headwinds from shifting consumer spending patterns.

From a macroeconomic perspective, last week’s August payrolls report raised concerns about slowing growth, with markets reacting negatively to the data. The report indicated a “bad-news-is-bad-news” dynamic, reinforcing fears that the Federal Reserve may be falling behind the curve. However, the data wasn’t weak enough to push the Fed toward a 50-basis point rate cut. Key Fed officials, including New York Fed President Williams and Governor Waller, expressed support for a 25-basis point cut, noting that while the labor market is cooling, it is not deteriorating.

Looking ahead, this week’s key data release is Wednesday’s August core CPI report, with expectations for headline inflation to hold steady at 0.2% month-over-month and 3.2% year-over-year. However, the market appears to be placing less emphasis on the CPI data, as the Fed’s focus has shifted more toward employment conditions. China also reported weaker-than-expected inflation figures for August, with CPI growth falling short of expectations and PPI deflation worsening, further fueling concerns about China’s slowing economic growth.

In the political arena, attention is focused on the upcoming debate between former President Trump and Vice President Harris, with recent polling showing an extremely close race. This debate could be pivotal as the political landscape heats up ahead of the 2024 election

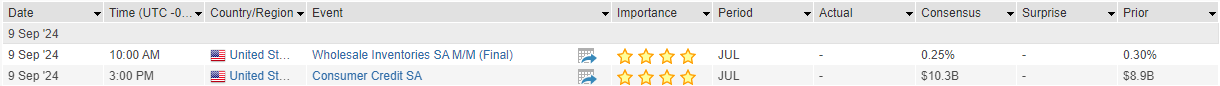

Eco Data Releases | Monday September 9th, 2024

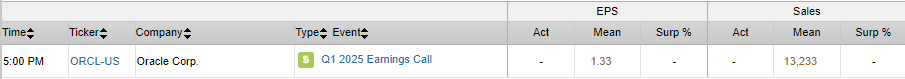

S&P 500 Constituent Earnings Announcements by GICS Sector | Monday September 9th, 2024

Data sourced from FactSet Data Systems