July 2, 2025

At Etfsector.com our goal is to help sector investors come up with strategies that are capable of outperforming the US equity market in any number of circumstances. Our elevate model is an example of an actively managed trend following sector rotation strategy. That strategy seeks to overweight sectors exhibiting strong stock-level momentum over the short-to-intermediate term, and have historically outperformed during the current set of macro conditions relative to equities, interest rates, commodities and currencies.

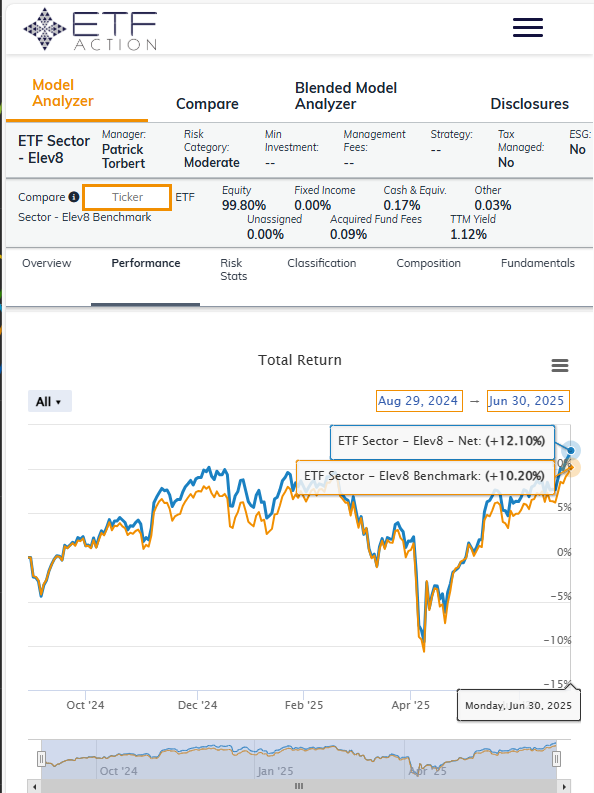

We’ve run the elevate strategy for 10 months now. Results have generally been positive (chart below), but we’ve noticed that the strategy has trouble when top line market conditions change quickly as they did in August 2024 and February of 2025 when sectors went into rotation quickly. When we look at the elevate model’s performance from the end of August 2024 through the end of June 2025, we can see that the model outperformed when equity is moving higher over multi month timeframes.

What’s important to keep in mind is the limitations of the trend following strategy we use for Elev8 are also the characteristics that help it add alpha when exogenous events aren’t moving the tape and the market is trending. This sets the strategist up with a dilemma, how do we keep the best parts of our trend following strategy AND address some of the weaknesses it encounters when sudden changes in conditions hit the tape.

One idea we are keen on is the idea of getting our Elev8 strategy a wingman. A wingman (or wing person) is someone who will accompany you, keep you safe and helps you reach your goals. Often the best wing person is someone who brings something slightly different to the table than you do yourself and can offer characteristics that give you a more complete set of tools to use to complete your mission.

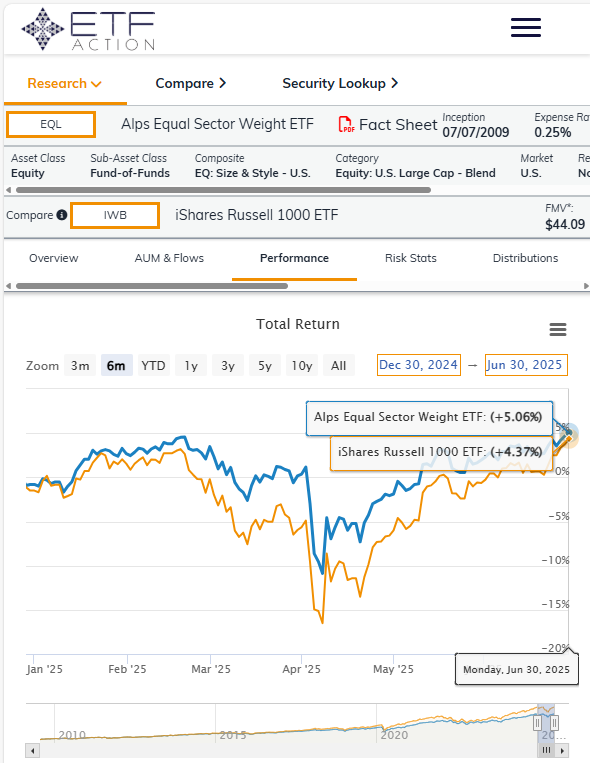

If we were to consider a wingman strategy for the elevate model we’d want something that performed in a counter cyclical manner to complement the trend following nature of the original model, something that was simple that we could rotate to Having full confidence that we know what’s inside of it and how it behaves. An ETF like EQL fits the bill as a wingman portfolio for our elevate model.

EQL ALPS equal sector weight ETF maintains equal weighted positions of each of the eleven GICS sectors on a quarterly basis. Relative to the S&P 500, this means the fund carries a structural OW vs. the S&P 500 in the smallest sectors by Mkt. Cap., Materials, Real Estate, Utilities, Energy and Staples. This imbues EQL with a counter-trend performance dynamic. See the EQL vs. the iShares Russell 1000 ETF (IWB) YTD performance (below). Where Elev8 gave benefit of the doubt to the prevailing bull trend entering February 2025, EQL entered the month with its structural underweight to the Mega-Cap. Growth trade and the AI trade due to its 20+% underweight in Info Tech. Sector shares. The result was EQL was able to outperform from February through the early April lows Where elevate struggled with its inputs during that period. EQL also offers steady passive exposure, so in theory it is cheaper to trade into one fund than to buy and sell several sector ETF positions to replicate its exposure.

Based on historical sector performance profiles, the strategy, in theory, would provide downside alpha capture on S&P 500 corrections given its high exposure to lower volatility sectors. It’s also likely to outperform when commodities prices move higher and interest rates move higher because of structural overweights to the Materials and Energy sector. These characteristics make it an excellent foil for the Elev8 trend following model.

After identifying potential complementary strategies we’re looking for signal to switch between the two exposures. This requires testing. We’re looking for signal that has the potential to get us into a new position before significant drawdown has occurred.

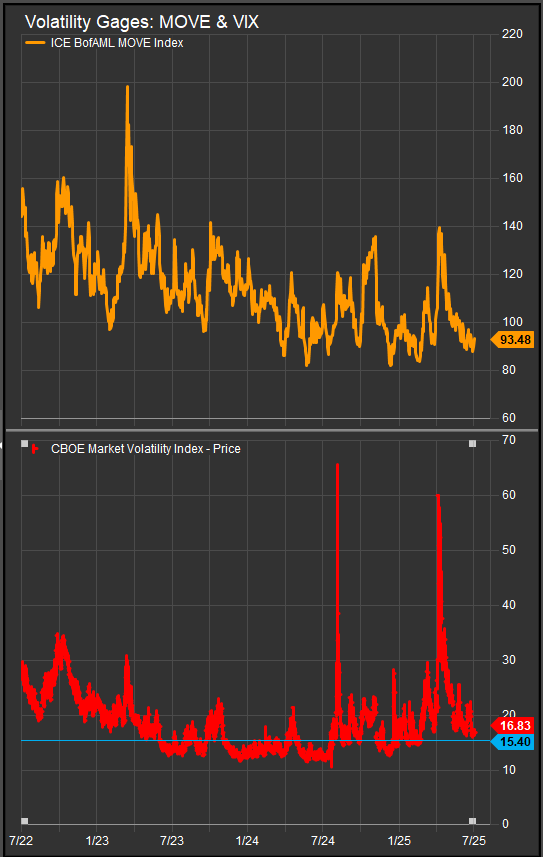

One of our first test cases will be to look at a measure of volatility like the VIX and use it as a contrarian signal. The VIX index has very clearly shown volatility and complacency signals over the last two years (chart below). We can observe on the chart that when the VIX trades above the 30 level it’s typically getting close to a contrarian buy signal, and when VIX levels are between the 10 and 15 range they have typically coincided with complacency and potential for equity correction. The challenge here is that complacency can often last a long time and equities are often outperforming other assets while low volatility prevails, so we want a method that will start scaling in lower vol. positions as a hedge.

For example, if we added 1% of EQL to our portfolio for each handle under 15 on the VIX we could operate in a way that keeps high beta exposure while managing positions so that we’re incrementally adding safety as complacency grows.

Moving forward we would look to implement a strategy of rotating into the EQL ETF fund from our elevated rotation model positions when Equities get overbought and the VIX is at low levels between 10-15. Overbought conditions can be determined using a standard RSI study for the S&P 500 and looking for a value over the 70 level. A favorable setup for this strategy is if spreads between growth and value style performance are widening out in favor of Growth. EQL would be a suitable vehicle to get counter trend exposure and to pick up rotation and profit taking motives under those conditions. Our Elev8 trend following inputs would theoretically have us long upside exposures and growth exposures in those cases making a rotation strategy using EQL an effective way to change sector factor and style exposures quickly.

If we consider the prevailing narratives affecting financial markets 2025, present softness and economic data series is opening the door for the Federal Reserve to consider dovish policy initiatives. If a continued move lower in rates pushes Growth stocks into a near term overbought condition, we would consider adding exposure to EQL in our portfolio as a way to get broad counter-trend hedges in a single position we can put on and take off tactically.

In a future article we will discuss developing tactical overlays and signals for offensive and defensive allocations.

Performance analysis and attribution provided by ETFAction

Other data sourced from Factset Research Systems Incorporated