The past several weeks of data and headlines have meaningfully improved investor sentiment, not because risks have disappeared, but because the distribution of outcomes has shifted away from the most adverse scenarios. Inflation is cooling faster than expected, the labor market is softening without cracking, earnings expectations remain intact, and the Federal Reserve is increasingly comfortable acknowledging that policy is still restrictive. Together, these developments have stabilized risk appetite and encouraged investors to re-engage with equities—albeit in a more selective and style-conscious way than earlier in the cycle.

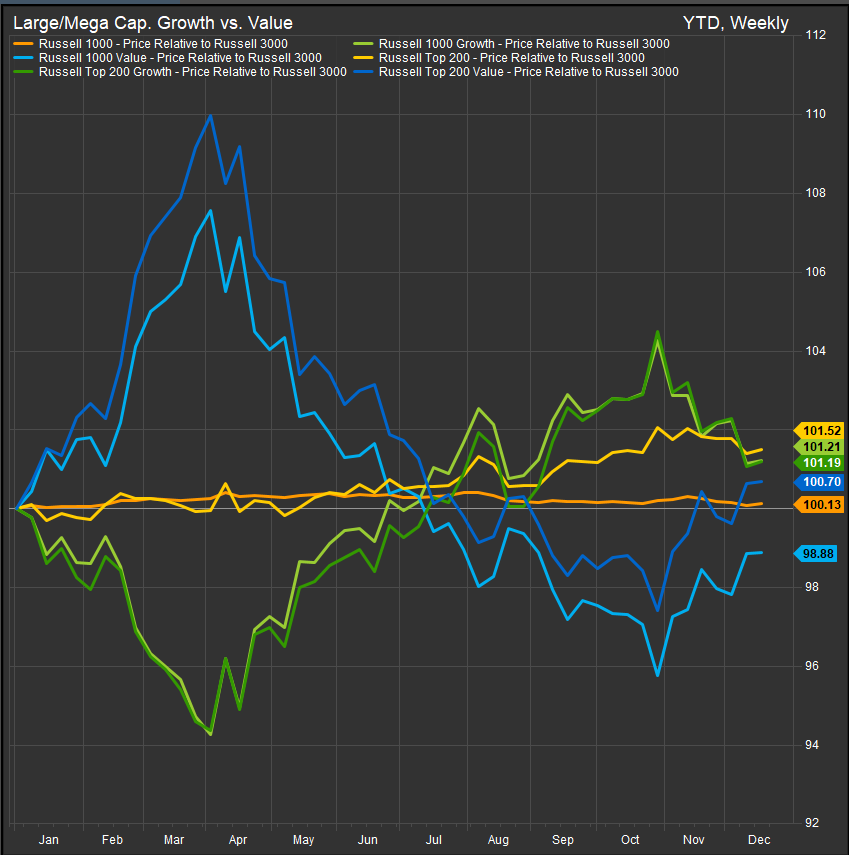

Fed easing has triggered an initial move to Value from Growth.

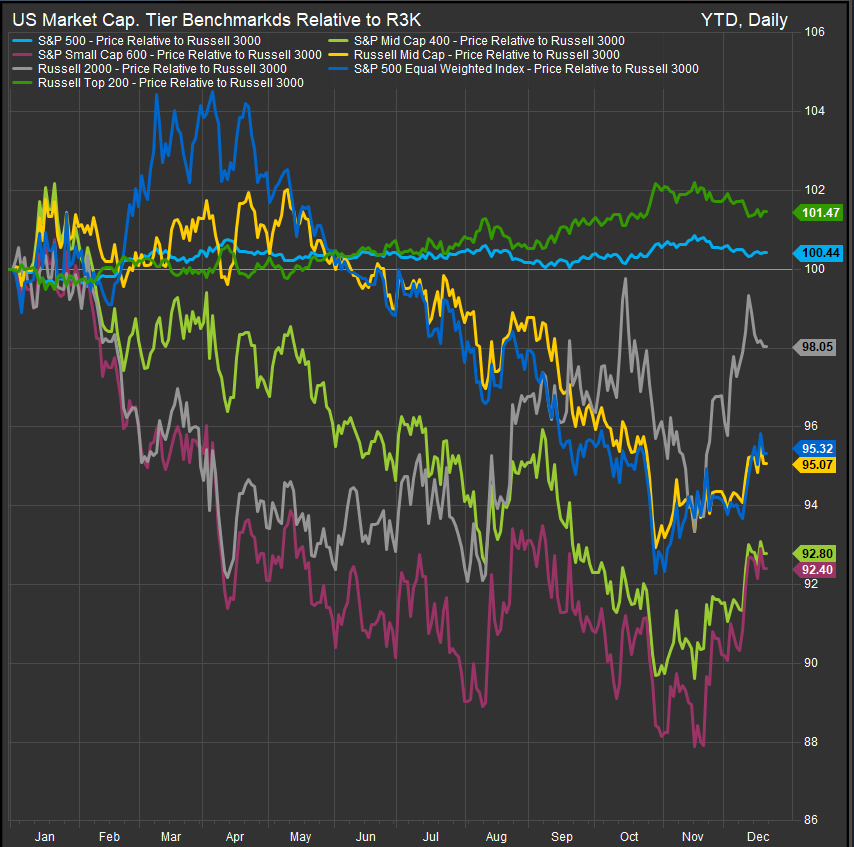

A move from Large to Small/Mid exposures has also been evident, but this is has likely been a symptom of Mega Cap./AI profit-taking in the near-term.

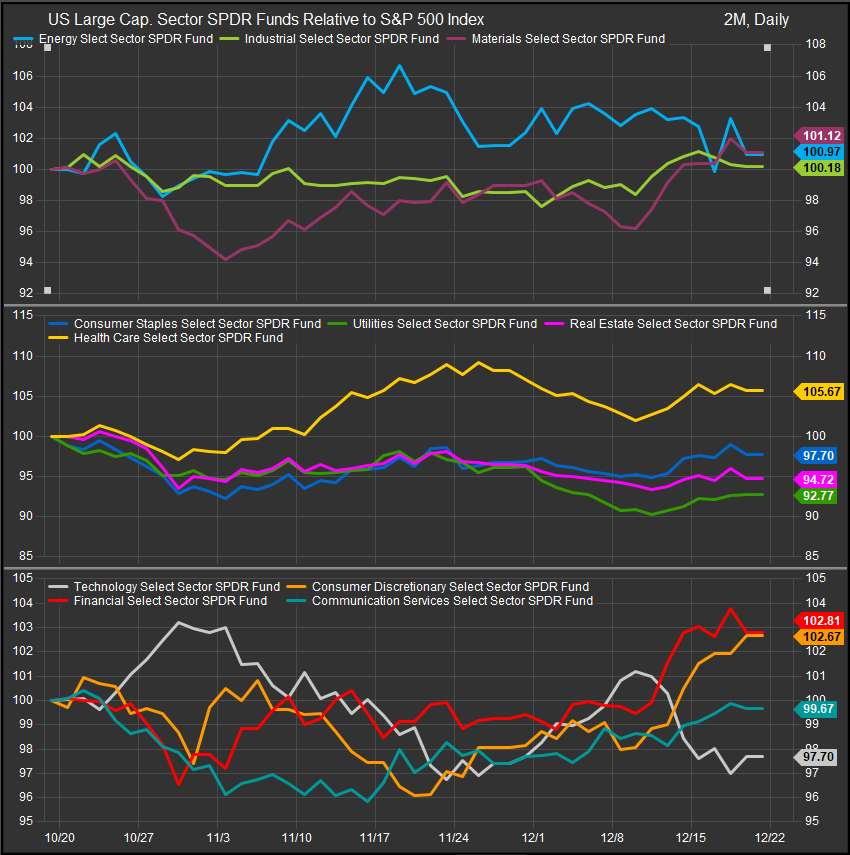

The Tech Sector has corrected to the benefit of most other sectors over the past 2-months.

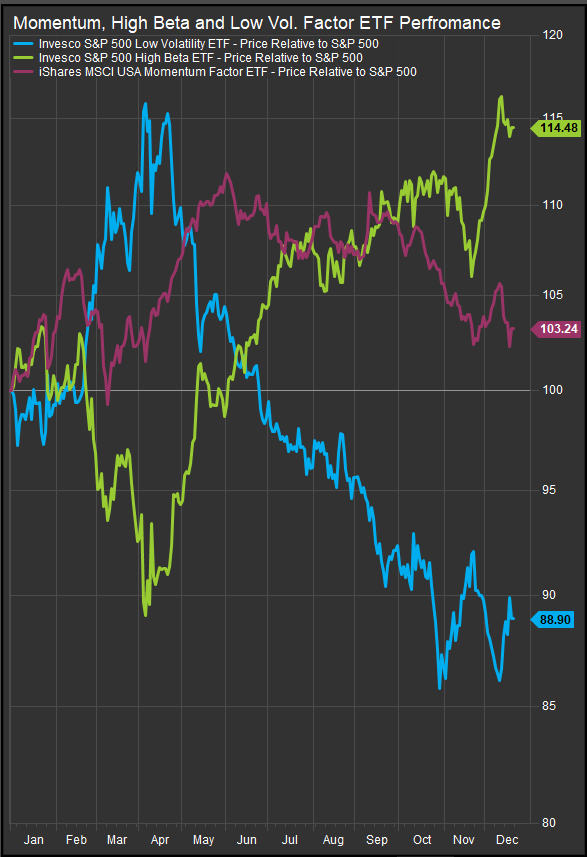

Despite economic softness, high beta has been preferred over low vol.

The single most important sentiment catalyst was November CPI. Both headline and core inflation surprised decisively to the downside, with core inflation slowing to its weakest pace since early 2021. Shelter inflation—long the primary source of stickiness—has rolled over convincingly, while tariff-sensitive categories such as apparel, footwear, and appliances remained stable. Even with the caveat that the October government shutdown likely introduced some noise into the data, the signal was clear enough for markets: the inflation problem is easing, not re-accelerating. That alone removes a major tail risk that had kept investors defensive through much of the second half of the year.

Importantly, this disinflationary signal arrived without evidence of an abrupt economic downturn. Payroll growth remains uneven but positive, unemployment has drifted higher in a gradual and non-threatening way, and wage growth has slowed back toward pre-pandemic norms. Surveys like JOLTS and the NY Fed’s consumer expectations point to stabilizing labor perceptions and anchored inflation expectations. While manufacturing data remain mixed—regional Fed surveys and PMIs still oscillate between contraction and modest expansion—forward-looking indicators show optimism improving even as pricing pressures moderate. This combination has reinforced the “soft landing with volatility” narrative rather than a recessionary one.

Against that macro backdrop, earnings have continued to do much of the heavy lifting for sentiment. Bottom-up S&P 500 earnings estimates for Q4 have edged higher at a time when they typically fall, and 2026 growth expectations remain robust. Micron’s outsized beat and raise was especially important psychologically. Coming just days after heightened scrutiny around AI infrastructure spending following Oracle and Broadcom, Micron’s results helped reframe the AI debate. The message was not that AI demand is fading, but that the winners will be those with tight supply, pricing power, and clear paths to monetization. That distinction has mattered: investors have become less fearful of an indiscriminate “AI bubble,” even as they grow more selective about where capital is allocated.

This more constructive tone has been reinforced by central bank communication. While the December FOMC meeting delivered only a modest cut, the broader message from Fed officials has turned incrementally more dovish. Governor Waller’s remarks that policy remains 50–100 basis points above neutral, coupled with Powell’s acknowledgment that official jobs data may be overstating labor strength, have reassured markets that the Fed is not inclined to overtighten into a slowing economy. At the same time, the ongoing debate around the next Fed Chair—while a source of headline noise—has paradoxically highlighted how sensitive policymakers and markets remain to long-term rate stability. That sensitivity itself has helped cap fears of a policy-induced shock.

All of this has translated into tangible improvements in sentiment and positioning. Investor surveys show some of the most bullish readings since 2021, cash levels have fallen to cycle lows, equity inflows have been persistent, and cyclicals have begun to outperform defensives. Breadth has improved, small caps and economically sensitive sectors have rallied on less-hawkish Fed interpretations, and even commodities-linked assets have found support amid geopolitical risks and easing truce optimism. While these indicators do raise the risk of short-term consolidation, they also suggest that the market is no longer positioned for bad news—a meaningful change from earlier in the year.

From a style perspective, the implications for Growth versus Value are nuanced. On one hand, cooling inflation and a Fed that is increasingly open to further easing are classic tailwinds for Growth. Lower discount rates support long-duration cash flows, and sustained earnings growth—particularly tied to AI and productivity—remains a powerful structural driver. Micron’s results and Citi’s bullish 2026 S&P 500 outlook underscore that Growth is not losing its fundamental case.

On the other hand, recent events have clearly introduced new discipline into how Growth is priced. Oracle’s miss, rising capex scrutiny, financing concerns, and widening CDS spreads around highly capital-intensive AI infrastructure have sharpened investor focus on free cash flow, balance sheet strength, and return on invested capital. Growth is still favored, but only where monetization is visible and self-funded. That environment naturally advantages higher-quality Growth and opens the door for Value and cyclicals to regain relevance, particularly as easing financial conditions and fiscal tailwinds improve the outlook for industrials, financials, and select commodity-linked sectors.

Value’s emerging tailwinds are therefore less about inflation fears and more about breadth, cash flow certainty, and valuation asymmetry. As long as growth slows gently rather than collapsing, Value benefits from lower expectations, improving margins, and a market increasingly unwilling to pay for distant or uncertain returns. The recent outperformance of cyclicals versus defensives, alongside improved earnings revisions across a broader swath of the market, is consistent with this shift.

In sum, recent news flow has lifted sentiment by removing extreme downside risks while preserving upside optionality. Inflation is cooling, policy is loosening gradually, earnings remain supportive, and the economy is slowing in an orderly fashion. The resulting environment favors neither pure Growth nor pure Value in isolation. We think risk appetite has moved away from high beta concept stocks with investors looking for clear evidence of emerging AI beneficiaries away from the “picks & shovels” theme that has dominated AI investing to this point. We also think the re-alignment of global trade will produce some durable winners in this cycle as regional re-alignment create winners and losers.

From a sector perspective, Consumer Discretionary and Financial stocks have benefitted in the near-term. We’d expect some reflation in lower vol. and Technology shares if rates resume moving lower after yesterday’s print. A more robust bull trend would feature a healthy back and forth between Growth and Value oriented businesses and we think that would be a healthy development after several years of Growth style dominance.

Data sourced from:

U.S. Bureau of Labor Statistics (BLS) — Consumer Price Index (CPI), Nonfarm Payrolls, Average Hourly Earnings

Federal Reserve System — FOMC statements, Summary of Economic Projections (SEP), public remarks by Federal Reserve officials

StreetAccount — Macro event recaps, earnings summaries, policy and market commentary

Bloomberg L.P. — Macroeconomic data, Federal Reserve coverage, corporate earnings, AI infrastructure, credit markets, and geopolitical developments

Reuters — Inflation, labor market data, energy markets, geopolitical news, and corporate reporting

Financial Times — Monetary policy analysis, AI investment trends, corporate strategy and capital expenditure coverage

CNBC — Corporate earnings, macroeconomic releases, and technology sector developments

FactSet Research Systems Inc. — S&P 500 earnings estimates, revisions data, forward EPS growth projections

Bank of America Global Research — Global Fund Manager Survey and asset allocation commentary

Citi Research — Equity strategy outlooks and thematic analysis

JPMorgan — Equity strategy, cyclical vs. defensive performance analysis

Goldman Sachs — Market strategy, positioning analysis, CTA and sentiment indicators

New York Federal Reserve — Survey of Consumer Expectations

Institute for Supply Management (ISM) — Manufacturing and Services indices

S&P Global — U.S. Manufacturing and Services PMI data

Other Data sourced from FactSet Research Systems Inc.