Throughout 2024 we have highlighted fundamental and style factors that have been thematic drivers of sector rotation. Since the current bull market’s inception in 2023, Meg Cap. Growth has been the dominant leadership cohort along with the momentum factor. Corrections in the market have typically benefitted a broad range of other factors and styles, while moves to new highs are typically driven by Mega Cap. Growth.

Here’s a look at CRSP factor benchmarks over the past 12 months. We can see Mega Cap. Growth showing a negative correlation to the other size and style buckets in the chart below. Small and Mid-cap. stocks have been trading against Mega Cap. Growth, regardless of whether those smaller stocks bucket in the Growth or Value styles.

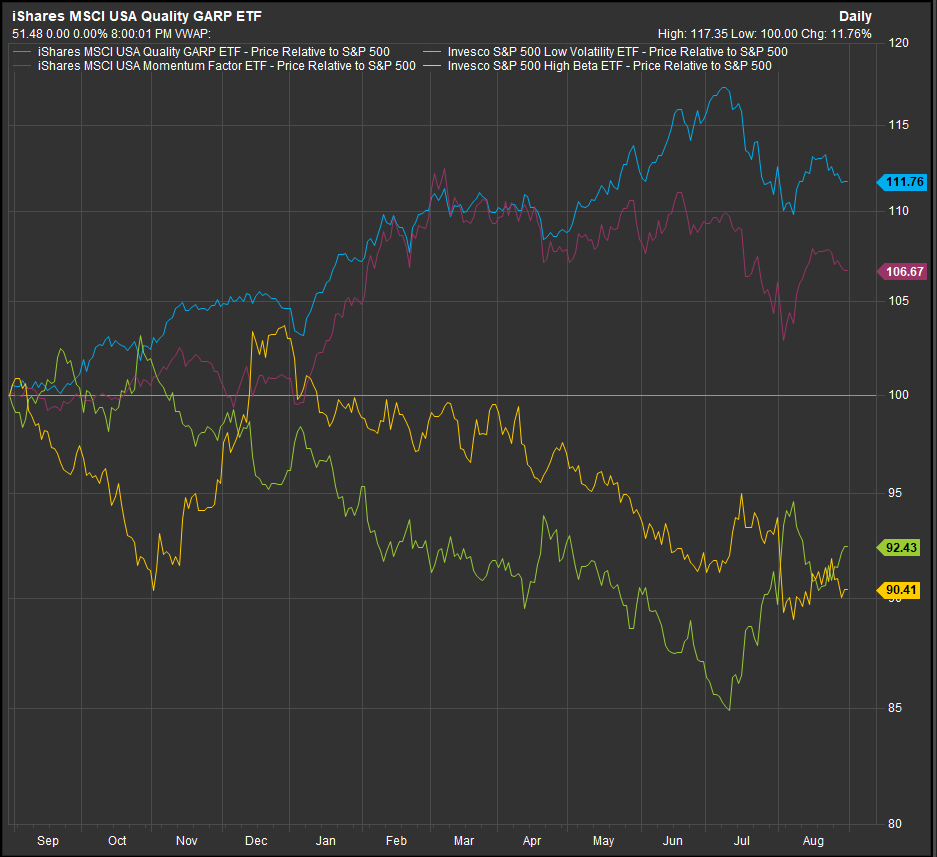

When we strip out size and look at high beta, low vol., quality and momentum we can see that quality and momentum have underpinned the bull market expansion while high beta and low vol. S&P 500 companies have lagged in 2024. With the Fed. on the cusp of policy easing and rates moving lower, the low vol. factor has benefitted in the past six weeks.

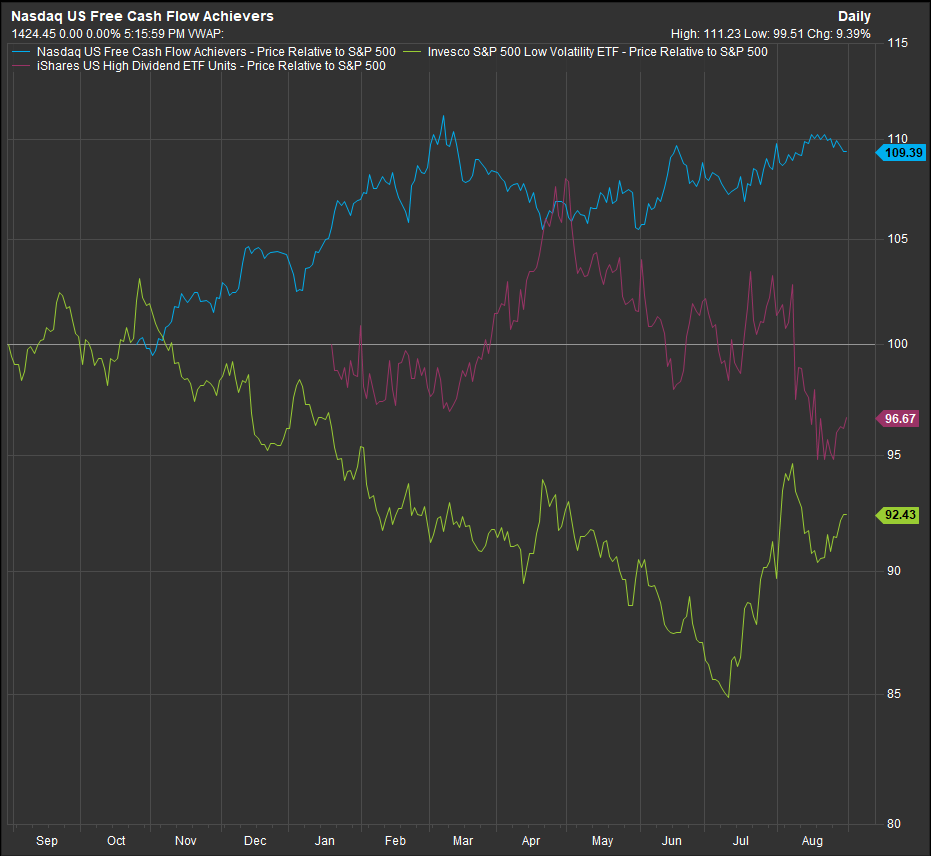

When we look at low vol., dividends and free cash flow as factors, we are seeing a clear preference for free cash flow over the longer term and low vol. in the near-term. Cash generation has actually been less volatile on performance in 2024 than a basket of low volatility stocks as the chart below indicates.

Conclusion

Given the factor behavior throughout this bull market and in the near-term we see a pattern emerging. When we have more news and focus on Fed intervention, we get the tails of the volatility trade responding positively as the lowest AND highest volatility stocks are typically those that come into favor in late cycle and early cycle respectively. We expect strong economic news and data from this point on to support the momentum trade as it will keep the Fed constrained to act on policy easing. We are looking to Crude and Commodities prices to cue us into high beta exposures as the most volatile parts of the equity market are linked to commodities in this cycle.

Data sourced from FactSet Data Systems