June 20, 2025

Potential US involvement in the latest Israel/Iran conflict has seized headlines. The S&P 500’s reflationary advance has paused and commodities prices, led by crude (charts below) have sparked Energy Sector outperformance.

WTI Crude (NYMEX)

Bloomberg commodities Index

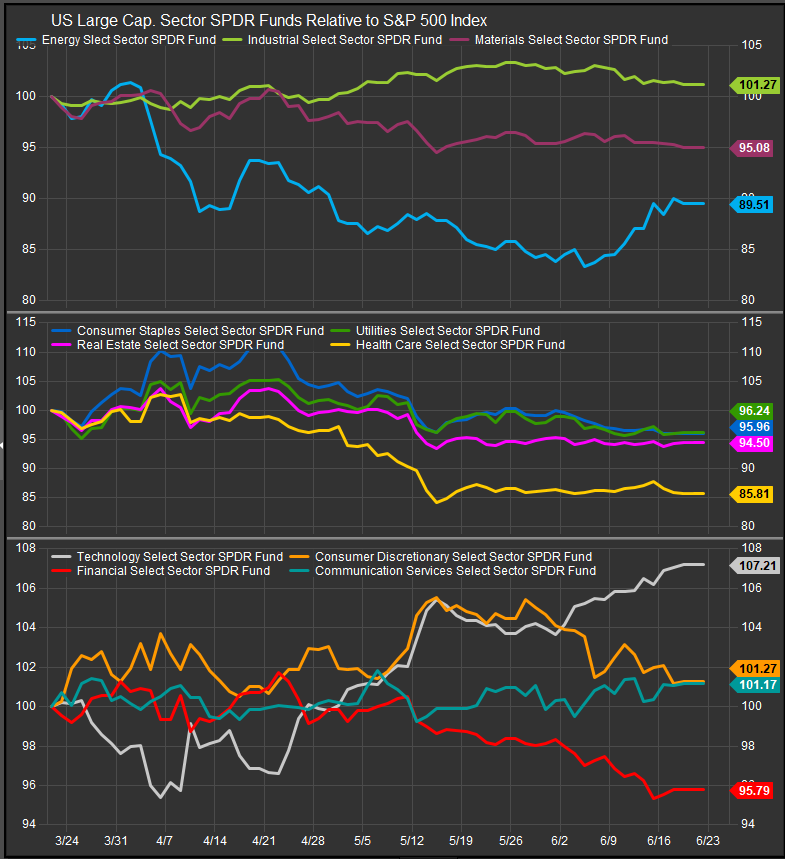

While Energy shares have hooked higher with crude, Technology shares have continued to lead US equities off the April low (chart below). Min Vol. sectors (chart, panel 2) have stayed at equilibrium.

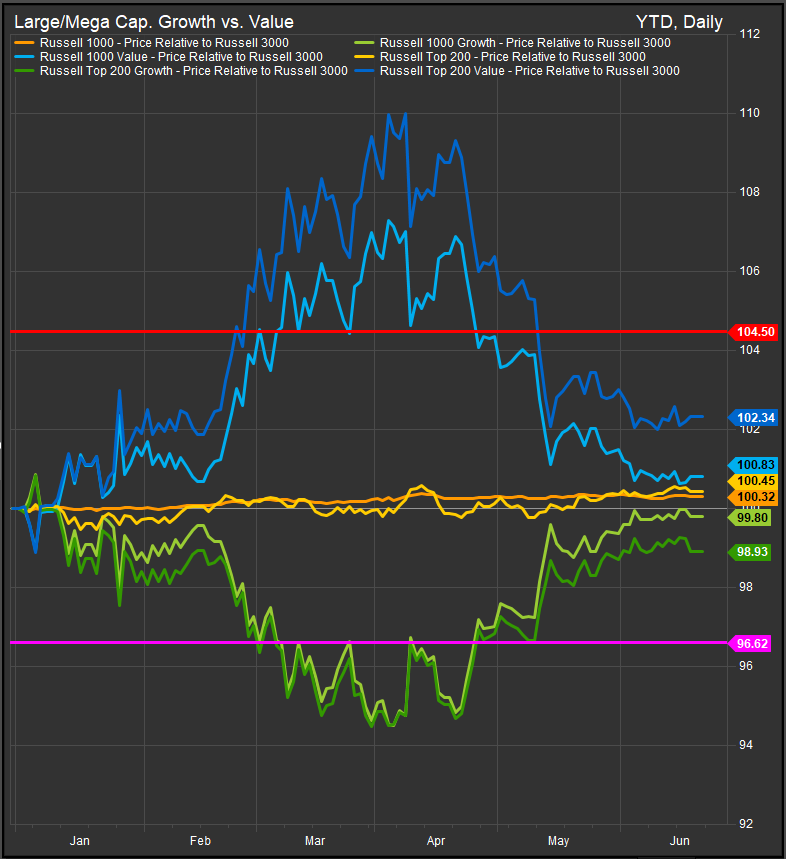

The upshot here is that Growth and Value are at equilibrium as investors hit pause. We’re looking for resolution in one direction or the other as signal. Our bet during this stasis period is that equities will resolve higher in favor of Growth, but we think rising commodities prices on the back of a clear exogenous catalyst could knock budding risk-on sentiment down again. We think Growth breaking out into positive territory for the year (chart below) would be an indicator of bullish continuation for the primary equity trend.

For the present, equities remain in a holding pattern as saber-rattling plays out.

Data sourced from FactSet Research Systems Inc.