August 22, 2025

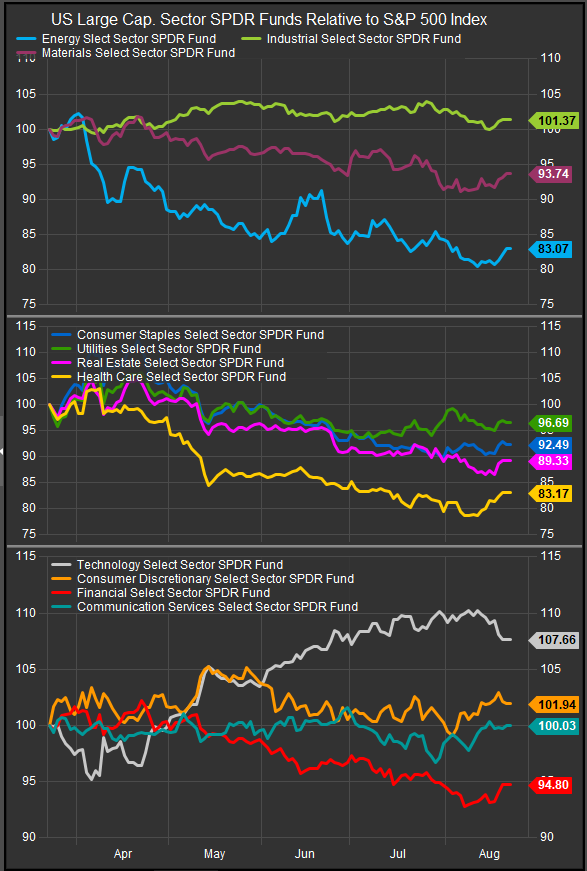

To put it as simply as possible, Tech sector shares are correcting from near-term overbought territory after a strong thrust off the April lows. To tip our hand on the punch line, it’s too early to tell if you should go into the bunker for a while. However, it is clear that, coincidence or not, once Warren Buffett entered the market bottom-fishing on UNH, we’ve had a cascade of others poking around with a similar mindset in the near-term. This puts mega cap. growth stocks in the crosshairs for selling, since they’ve been one of the only parts of the market that has remained bid throughout the last 4+ months (chart below).

Discretionary (Housing, Buffet is there too!), Healthcare, and Comm. Services have been leading sectors to start the month, however each are short of making new 1-month relative highs vs. the S&P 500. Our process sets minimum performance thresholds on excess returns in order to give ourselves better odds of following a strong trend rather than near-term profit taking, and from our view, these moves away from the Tech sector still look counter-trend to us.

Our macro signals have generally had us looking for signs of inflation as a signal to change our exposure mix. As we can see from the US 10yr Yield chart below, rates are backing up modestly in August but remain well below April/May highs. Inflation and recession, broadly, are the two big macro reasons not to own Growth stocks currently. Historically, the other reason has been robust earnings and economic growth across a wide swath of operating co.’s. That hasn’t been the dynamic in this cycle. Commodities are ticking higher from oversold levels and aren’t telegraphing inflation at present.

US 10yr Yield

Bloomberg Commodities Index

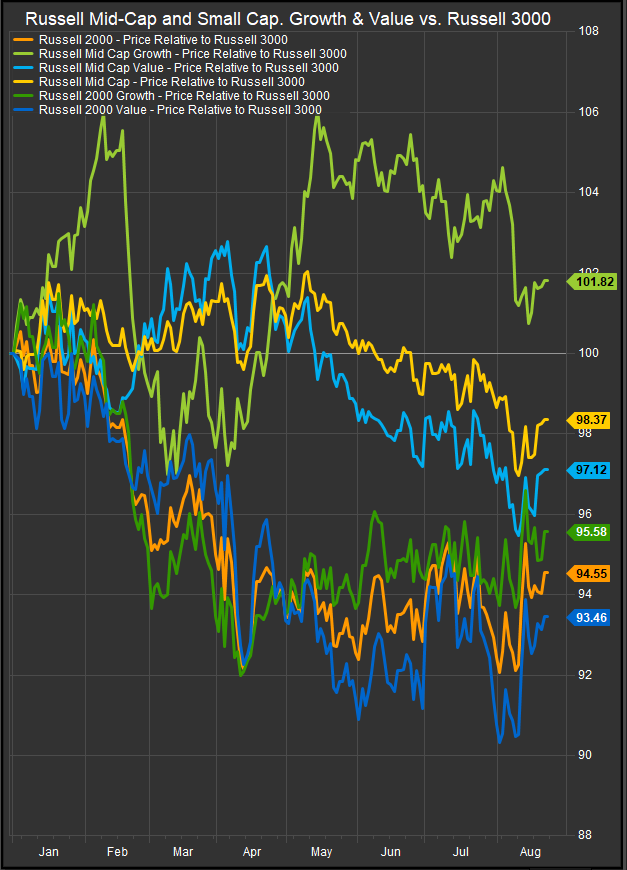

Our Growth/Value chart (below) is showing a classic setup YTD. Value had striking gains while equities went through their flash bear market correction in March. Growth then pivoted to new highs (a bullish break out) and now we have some backing and filling during the weak seasonal period. Our early inclination is to get ready to buy our favored Growth/Tech names on discount between now and mid-October which is usually when the weak fall seasonal period ends.

Looking at Small/Mid Growth and Value (below), MidCap stocks have been under pressure regardless of style, while Small Cap. Growth stocks traded to multi-month relative highs and have our attention as an accumulation opportunity.

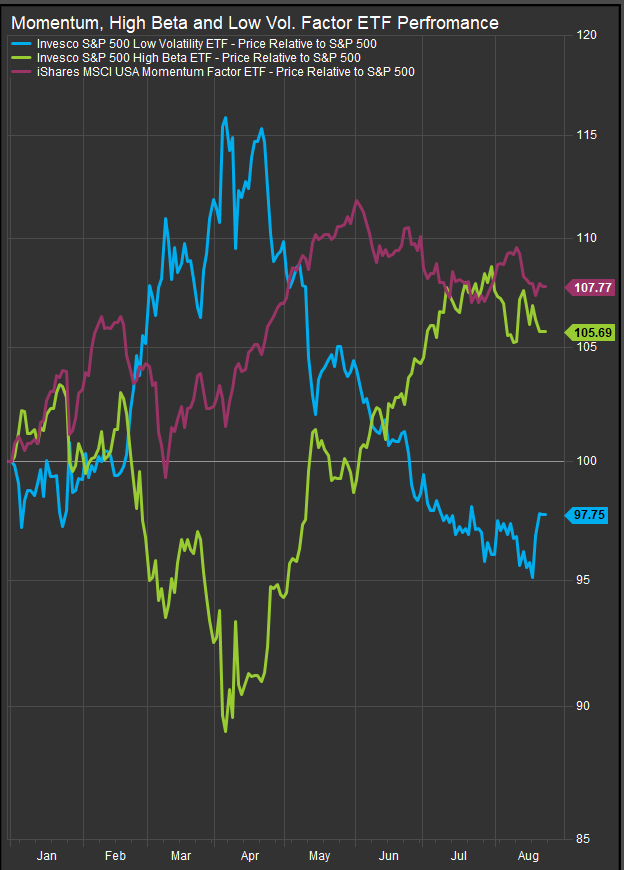

High Beta/Low Vol. proxies (below) are tracing out a very similar arc to our Growth and Value indices. Notably, the iShares Momentum ETF (MTUM) remains above February highs as investors aren’t exactly fleeing out of previous leadership in the near term.

So far, we think the price action looks constructive as a bid away from Tech improves market breadth (chart below). Ideally, we want to see that shorter term series (bottom panel) move above the 80% level.

Complacency does remain a risk, as VIX and MOVE indices, measures of stock market and bond market volatility respectively, are ticking higher from lowest YTD levels. Our 4 risk on/risk off ratios show a big move lower in Copper/Gold, however this was a direct hit on the tariff front. Our other gages remain in more constructive consolidations, however, if they started to move lower from here, that would be a sign to cover up in the near-term.

Conclusion

End of summer is a slow season. Today is Jackson Hole (Wyoming) Day, where the Fed Chairman gives a big policy speech while everyone is on vacation. Next week, we get NVDA earning while everyone else is on vacation and we’re likely to get a signal from the market in early September when everyone is back. As we’ve said for a month now, keep some powder dry, but also keep in mind we are in a long-term bull market, it’s not bunker time.

Data sourced from FactSet Research Systems Inc.