September 19, 2025

Equities are at all-time highs (yet again) and the Fed has begun lowering interest rates with the goal of supporting employment. Investors continue to discount positive outcomes from Fed policy and on global trade as they bid both US and ex-US equities to fresh highs. Skepticism regarding the AI trade has given way to optimism that there are growth opportunities for both US-centric and China-centric AI supply chains to thrive side by side. That optimism is reflected in renewed bids for Mega Cap. Growth stocks, Asian Tech stocks and equities in general.

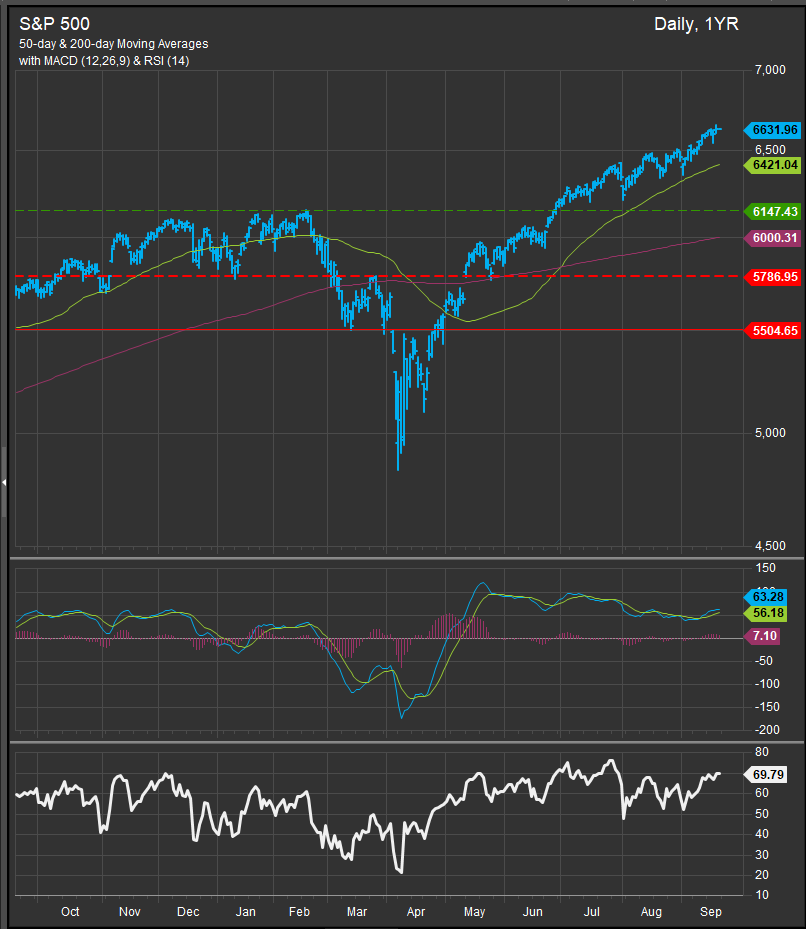

The S&P 500 is at all-time highs (chart below) with the MACD momentum study giving a tactical buy signal in September. The present rally has taken the index to within <5% of our year-end price target at 6800.

We’ve been impressed by the resiliency of the AI trade, however, we think the real test will be how enthusiastic Tech investors will handle a move higher in interest rates. After investors positioned to get ahead of the Fed’s September cut, interest rates have pivoted higher in the near-term on both the 2yr and 10yr yield (charts below). The deflationary bull market playbook is a Growth centric playbook, but what happens if optimism around AI and a renewed capex cycle spur inflation? Now that the Fed has committed to propping up the economy with low rates, that is the scenario on the table.

US 2yr Yield

US 10yr Yield

With rates lower over the last 3-months and equities making new highs Growth has re-established its dominance over Value in the near-term (chart below). We continue to see the setup as vulnerable to exogenous developments, with inflationary pressures and earnings risks to primary sources of risk. However, as the modern economy evolves and is shaped by concentrations of wealth at the upper ends of the income distribution and with Mega Cap. stocks generating an increasing share of Growth, the AI cycle is proving to be somewhat insulated from the vagaries of the mass market.

Just as the Main Street consumer posts economic results worthy of a Fed intervention, record profits are on the table for AI majors and hyperscalers. Infrastructure and other capex spending seems to be firm and share buybacks are re-emerging as a bullish factor for equities. This has prolonged the cycle and while there is some potential vulnerability, investors need to appreciate the contours of this new normal.

Conclusion

We think a sustained move higher in interest rates could potentially spoil the party for equities into year end, but at present, upwards pressure on rates has been hard to sustain. Dovish policy is being interpreted as a tonic for the consumer. We think that works on a conceptual level while interest rates continue lower, but is going to run into problems if investor enthusiasm for riskier assets sparks rotation out of treasuries and pushes yields and all the consumer credit rates that are benchmarked to them higher.

Data sourced from FactSet Research Systems Inc.