June 13, 2025

S&P 500 futures are lower this morning on emerging geo/political tensions. With the index price just shy of all-time highs, we are at a point in the equity bullish reversal where some consolidation is expected. Our S&P 500 price chart (below) shows 5786 and 5504 as key support levels. If consolidation occurs above the former level with buyers defending 5786, that’s a sign of strong buying power and likely comes with rates and commodities prices staying contained.

We think more robust downside scenarios would be on the table with the emergence of inflationary pressures to go along with the geo/political tensions. So far, inflation data has come in on the cooler side which gives equities some cover as it keeps the “Fed Put” in play. The chart of the 10yr Yield (below) shows bond prices have firmed in the near-term with the Yield moving lower from the 4.5% level. We think equities will have trouble if the 10yr backs up above 4.75%

Growth vs. Value Back at Par

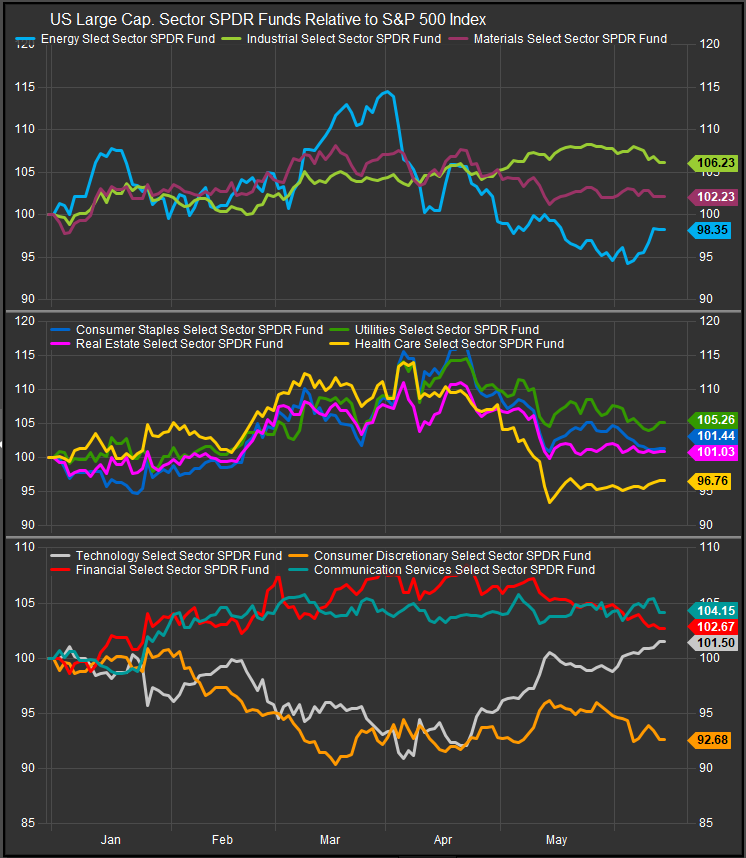

Growth stocks have outperformed driven by Info Tech. stocks, Mag7 reflation and strength in Industrials. However, in the near-term Energy stocks are rallying from a very low level and rotation out of lower vol. sectors has stopped (chart below). We’re expecting to fade min vol. positioning on any near-term rally and look to accumulate into the emerging bullish reversal in Growth shares, all else being equal.

Our primary concern remains inflation. That would present challenges for equities by keeping the Fed on the sidelines and potentially contricting consumer credit as higher costs and higher cost of capital would be dual headwinds in that scenario. The Crude chart has started to firm and we’d be concerned if price took out the April high at $71.71 (chart below).

We’re keeping a close eye on the YTD chart of Growth vs. Value as well (below) as that relationship is back at par after Value outperformed dramatically during the Feb-April correction and Growth has now reciporcated on the bullish pivot.

Conclusion

Geo Political tensions are on the rise as global trade tensions have begun to ease. With equities back near all-time highs, the likely course is a near-term consolidation. We think if interest rates stay contained this should be seen as a risk-on accumulation opportunity.

Data sourced from FactSet Research Systems Inc.