December 5, 2025

Growth vs. Value: A Historical Playbook for a Market at a Crossroads

Few debates in equity investing are as persistent—or as cyclical—as the tug-of-war between Growth and Value. Across decades, the performance leadership between the two styles has shifted with changes in interest rates, productivity cycles, corporate profitability trends, and investor appetite for risk. Today’s macro environment sits at a rare intersection: the fundamental catalysts that have traditionally powered both Growth and Value are present, but neither dominates decisively. That tension is why style leadership in 2025 has felt choppy, rotational, and unusually sensitive to small changes in policy expectations and macro data.

Historically, Growth outperforms when interest rates fall, inflation moderates, and productivity accelerates. This is intuitive: the majority of a Growth stock’s cash flows lie far in the future, which makes valuations highly sensitive to changes in discount rates. The late 1990s, the post-GFC decade, the 2020 pandemic era, and the early phase of the AI boom all produced a similar pattern: falling real yields, abundant liquidity, and strong innovation cycles created an environment in which long-duration assets—technology, software, communications platforms, and medical innovation—could expand multiples while still delivering top-line acceleration. Growth also tends to lead when the business cycle is softening but not collapsing, allowing investors to pay up for secular earnings visibility when cyclical profits are under pressure.

By contrast, Value outperforms when inflation rises, rates are moving higher, and the economic expansion is dominated by nominal growth rather than productivity. This regime favors sectors with high asset intensity, pricing power tied to real assets, or strong sensitivity to the economic cycle—energy, financials, industrials, and materials. The 1970s inflation era, the 2003–2007 global expansion, and the 2021 reopening trade all featured environments in which Value outpaced Growth. Rising rates compress Growth multiples, but they boost financial-sector net interest margins. Higher commodity prices lift the earnings of energy and materials producers. And re-accelerating PMIs or strong capex cycles naturally benefit cyclicals over companies whose revenues are less sensitive to GDP.

The striking thing about the current macro landscape is that it contains elements of both historical regimes. On the Growth side, investors face moderating inflation, a Federal Reserve that is leaning (if unevenly) toward easing in 2026, and a historic productivity boom driven by AI, automation, and data-center infrastructure. The extraordinary earnings strength of mega-cap technology—particularly in semiconductors, cloud, and AI platforms—continues to validate the long-duration thesis. Even with recent volatility, these companies are growing revenue at a pace unmatched in the rest of the index, with margin expansion powered not only by demand but by operating leverage. Slowing consumption and cooling labor markets also give Growth an advantage: when economic visibility weakens, the market bids up companies whose future earnings streams are less tied to near-term cyclical swings.

At the same time, the present conditions also support a Value countertrend. Inflation has not fully returned to the Fed’s 2% target, and services inflation remains sticky. Long-term yields, while off their highs, remain elevated relative to the post-GFC average, compressing the relative attractiveness of high-multiple Growth. Energy markets have been supported by geopolitical risk and structurally rising electricity demand tied to AI. Financials benefit from higher-for-longer real rates as long as credit conditions do not deteriorate sharply. Industrials and materials continue to ride large fiscal tailwinds in the US and Europe—energy infrastructure, grid modernization, defense spending, and onshoring initiatives all support Value-heavy subindustries. The global manufacturing cycle, though uneven, appears to be bottoming, giving cyclicals a tentative foothold.

This duality explains why neither Growth nor Value has established decisive leadership in recent months. Investors are reacting to a tug-of-war between falling inflation, which favors Growth, and still-elevated nominal yields, which offer refuge for Value. The AI investment boom reinforces Growth, but the capex required to build AI infrastructure supports Value sectors that supply the materials, energy, and industrial components of that ecosystem. Financial conditions tighten on hawkish Fed rhetoric (helping Value) but loosen on weak economic prints or dovish commentary (helping Growth). Style volatility is the logical result.

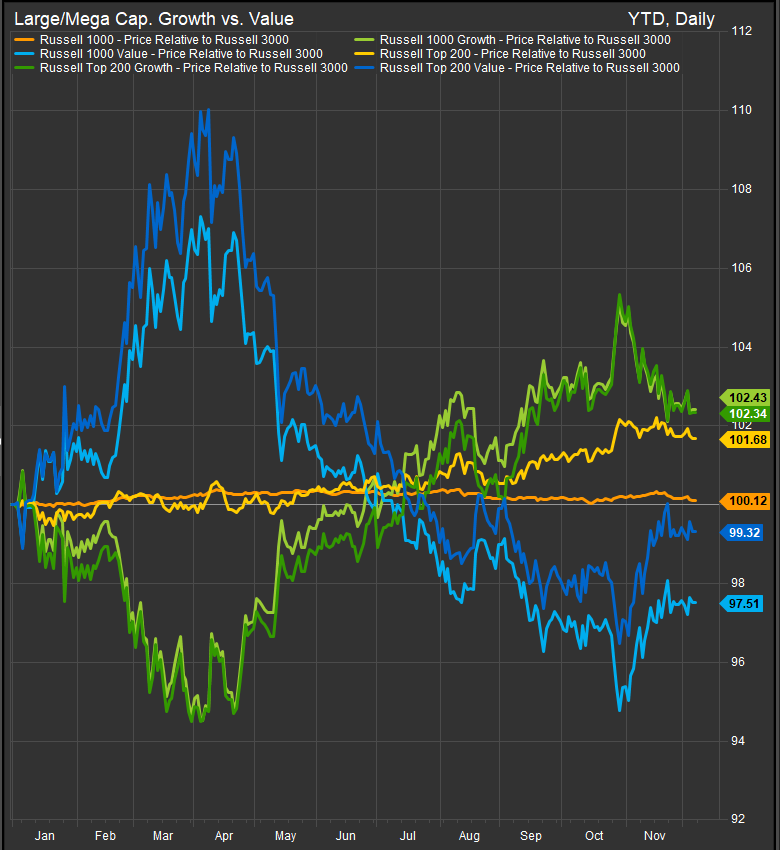

Growth vs. Value, YTD

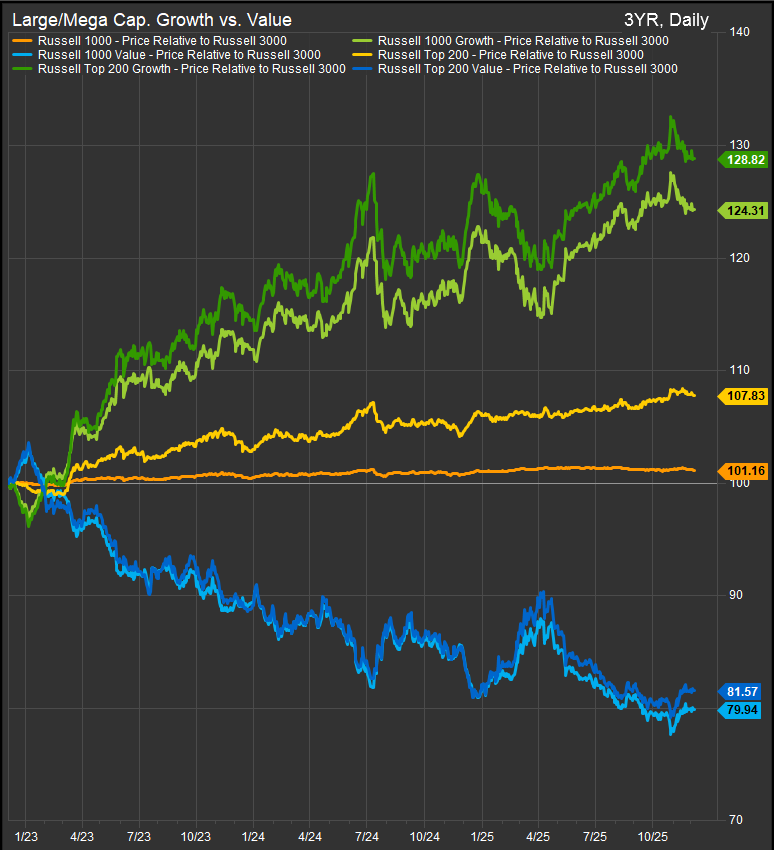

Growth vs. Value, 2023-present

Going forward, the balance of evidence still tilts slightly toward Growth, but the margin is narrow and dependent on policy clarity. If the Fed signals a stable path of rate cuts into 2026 and inflation continues to cool, long-duration equities should regain leadership. Continued earnings outperformance in semiconductors, cloud computing, cybersecurity, and AI-driven enterprise software would reinforce that trajectory. But if macro data stay hot, forcing real yields higher, or if the AI capex cycle shows signs of slowing, Value will find room to outperform—particularly in energy, financials, and defense-linked industrials.

The lesson from history is that Growth–Value leadership rotates when the market undergoes a shift in its perception of future discount rates and future profitability. Today, both are in flux. The present cycle is not a repeat of the post-GFC liquidity era nor the commodity-driven inflation shocks of the 1970s and 2021. It is a hybrid regime—part innovation super cycle, part late-cycle tightening, part supply-side restructuring—where the drivers of both styles coexist.

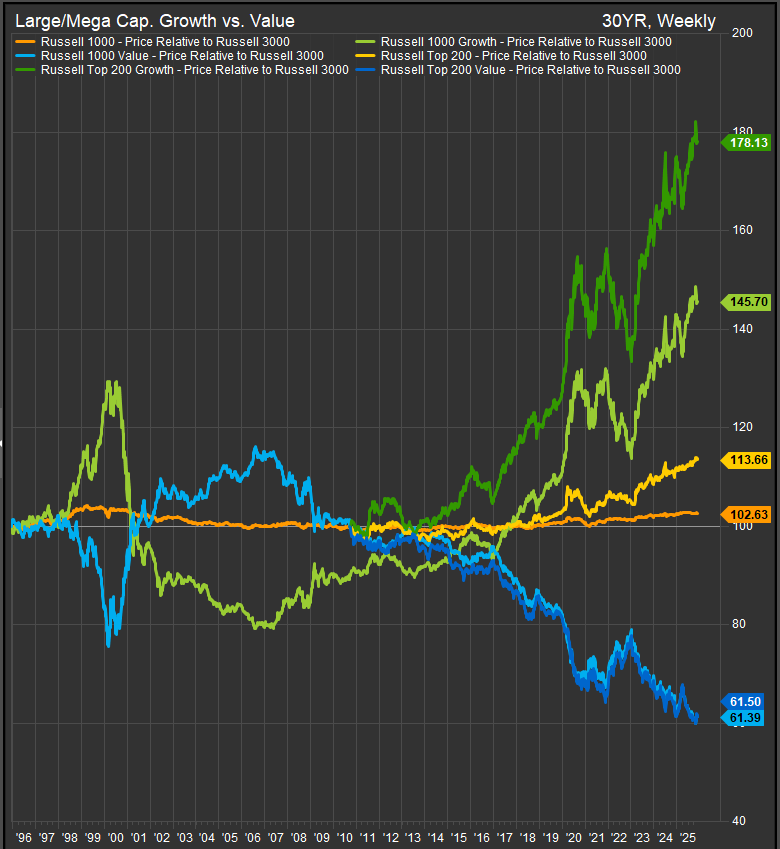

Growth vs. Value, 1995-Present

For investors, the implication is clear: this is a moment to be style flexible rather than dogmatic. Growth deserves an overweight as long as AI-driven earnings and productivity remain powerful, but Value should not be abandoned, particularly in sectors directly benefiting from higher nominal GDP, energy demand, and industrial investment. The market is unlikely to deliver a straight-line victory for either side in the near term. But understanding the historical catalysts behind each style and recognizing how they map onto today’s mixed macro environment, gives investors a clearer playbook for navigating one of the most important allocation decisions of the next year.

Other Data sourced from FactSet Research Systems Inc.