We’ve moved to a tactically bearish position in our Elev8 Sector Rotation Model on today’s strong non-farm payroll report. Stronger non-farm payrolls this morning have precipitated an upside break-out in the US 10yr Yield above April 2024 highs. We have been looking for this development to take some risk off the table as we had started the year skeptical of the move. Our skepticism had stemmed from weak commodities prices and a mixed fundamental picture, but with economic prints coming in on the stronger side, we are getting a clearer picture.

Rates Higher

We identified the 4.68-4.7% level as an important resistance level for several weeks now. With stronger payroll prints this morning, that level has been violated to the upside.

Equity Correction Likely to Continue

The chart of the S&P 500 shows a MACD sell signal as the trend indicator moves from positive to negative. A move below the 5844-level today’s trading would act as near-term confirmation.

Large/Mega Cap: Value Starting to Close the Performance Gap vs. Growth

On the Break-out in rates, the performance spread between Value and Growth is likely to narrow more significantly than we’ve yet seen.

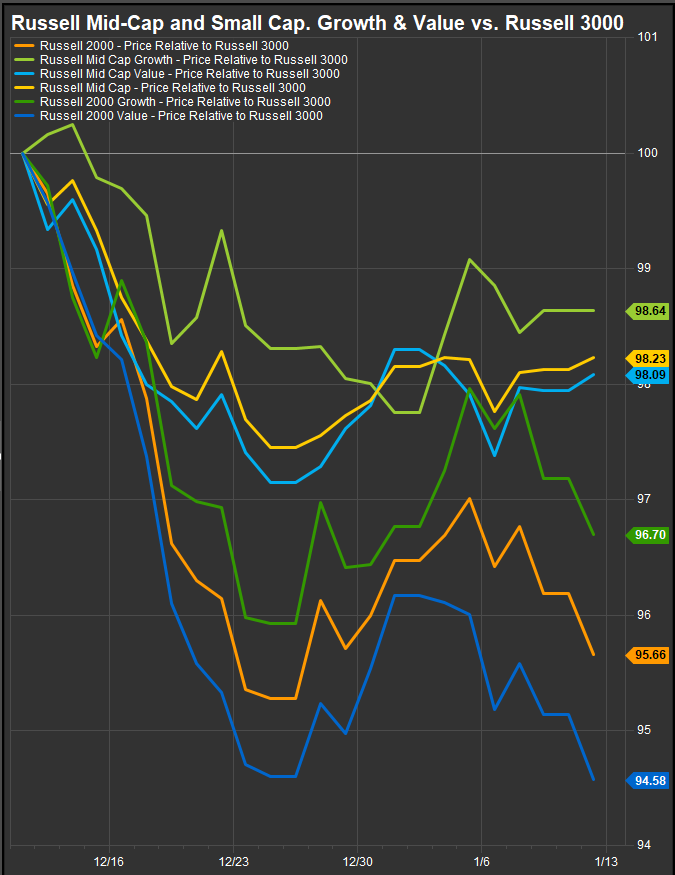

Small/Mid Stocks: Small Cap. Diverging Negatively from Mid

Where large cap. Growth/Value Dynamics are acting as we would expect on bearish/inflationary developments, Small Cap. (R2K) stocks are heading lower as a block while MidCap. Names firm. We will be watching this closely to see if divergence continues as this would be a change from how Small/Mid has acted over the longer-term.

Risk On/Risk Off: Vol. Higher, Risk-Appetite Gages have been Firming

Vol. has moved higher for both equities and fixed income. Somewhat surprisingly, our risk appetite ratios are not reflecting weakness yet, and certainly didn’t deteriorate ahead of our bearish signal. We think this may be because they reflect demand for cyclicality rather than Growth which has been the most popular exposure and the best performing factor in the longer-term bull cycle.

In Conclusion

We now have conditions in place for a deeper correction in equities with rising rates likely to sideline the Fed’s dovish policy initiative for the time being. Market internals had been weak entering 2025, but with the index level trend still intact, we had viewed the setup through a bullish lens. With rates moving higher and confirming inflation concern, we would advise to pare Growth exposure.

Data sourced from FactSet Research Systems Inc.