July 18, 2025

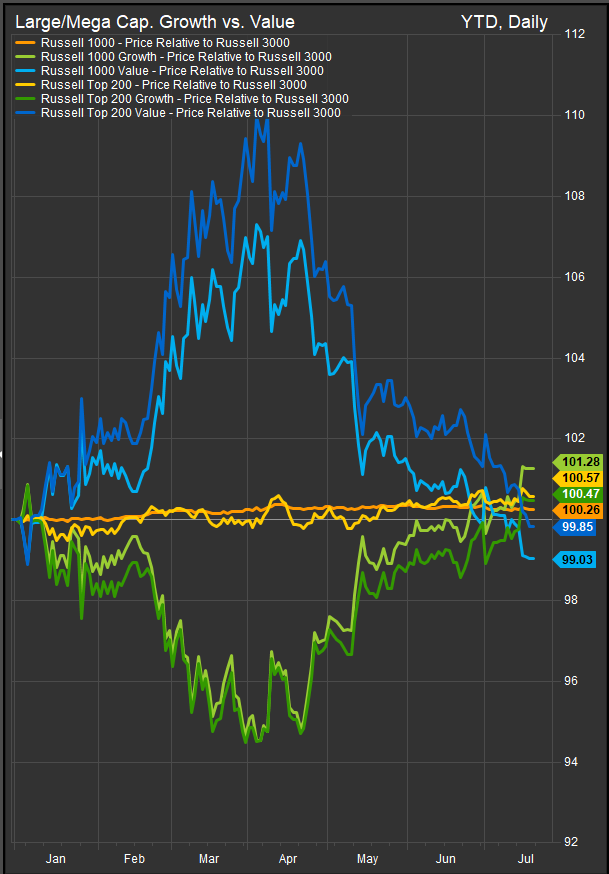

Big Tech is dead…Long live Big Tech! Recent export concessions for NVDA have sparked renewed buying in Large Cap. Tech and Growth names more broadly. This is shaping the US equity market’s leadership profile in a way that’s eerily similar to 2023. We can see in our Growth/Value chart below that Growth stocks relative to the broad market are back in positive territory for the year after troughing in early April.

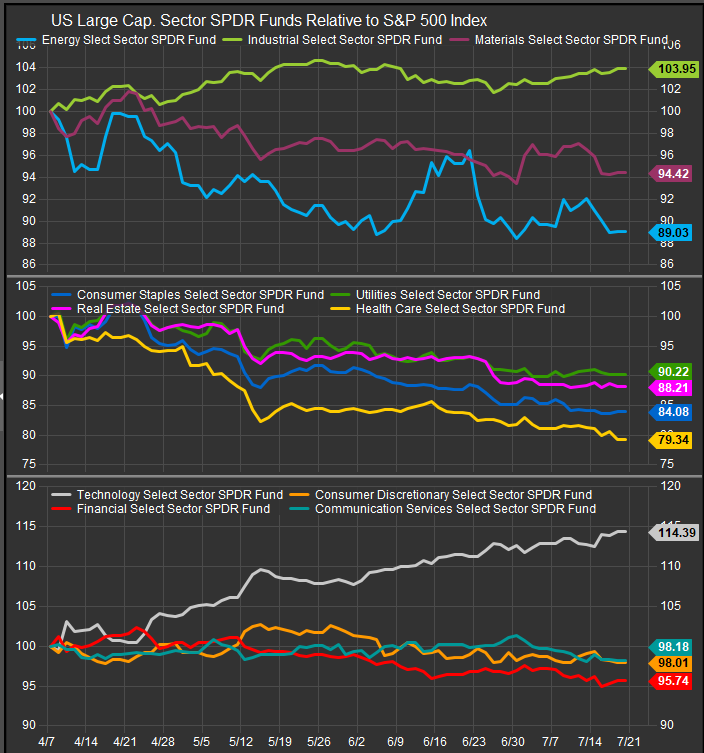

Looking at S&P 500 sector performance of the April 7 low (chart below), it’s notable that only two sectors (Technology and Industrials) are outperforming during the recovery. Low vol. sector performance has retraced the entirety of their previous gains into April. While that is expected given the adroit path of the recovery, we are surprised that Financials, Discretionary and Comm. Services Stocks aren’t receiving more of a bid. Discretionary names in particular reflect concerns about the slowing economy (uptick in unemployment, soft manufacturing and services PMI’s), while we expect inflation concerns and potential for interest rates to rise is a drag on Financials.

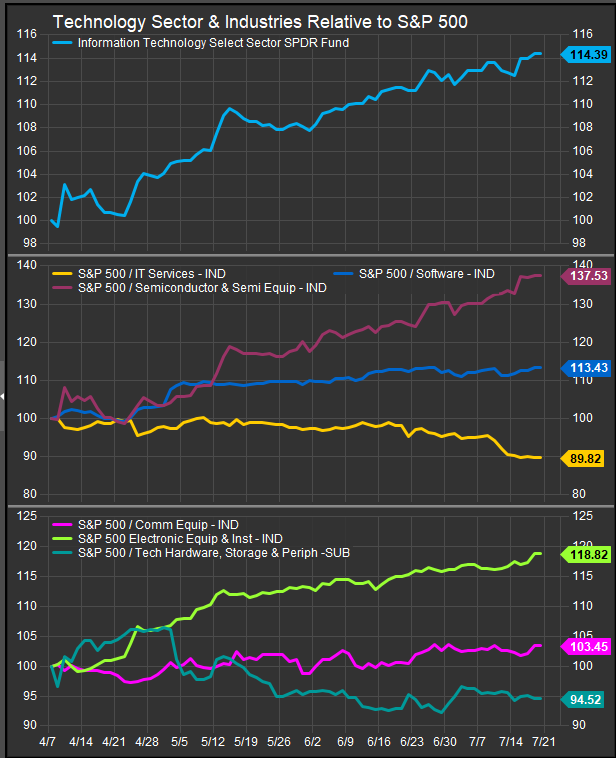

Within the Tech sector (chart below), Semiconductor stocks are driving gains with help from software, Comm. Equipment and Electronics industries, while AAPL continues to act as a drag on the hardware industry.

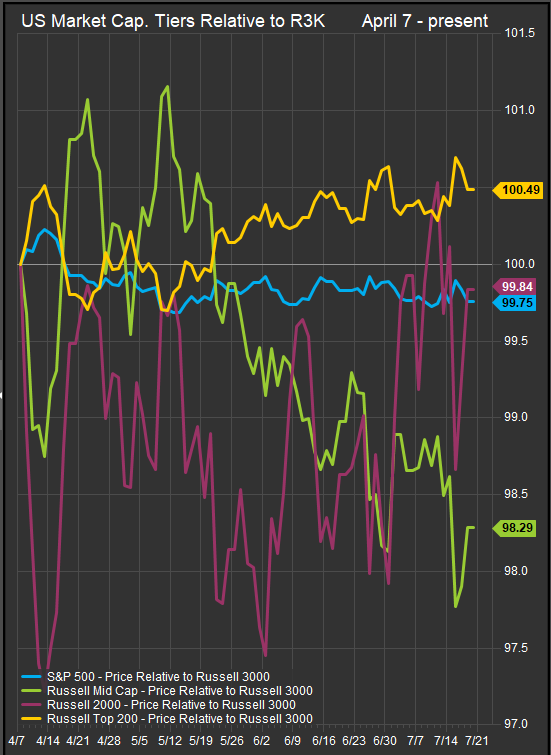

One place where we continue to see strength is Small/Mid stocks. The chart below shows the Russell Mega Cap., S&P 500, Russell MidCap and R2K indices vs. the Russell 3000. We can see that while R2K stocks broke into positive territory in early July, Mega Cap. stocks have firmed as well.

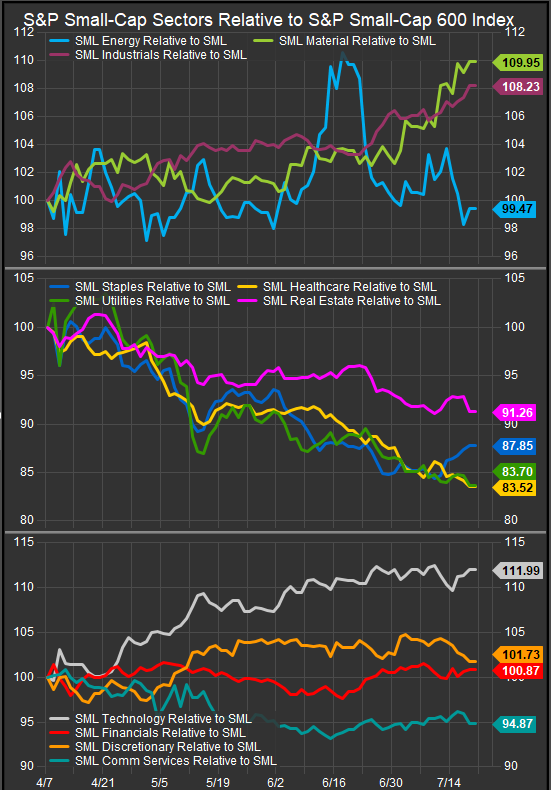

While we don’t have the R2K sectors to show you, the chart below is S&P Small Cap. 600 Sector performance. Similar sector leadership dynamics pervade the small cap. space with Small Cap. Tech stocks outperforming by almost 12% off the April 7 lows for equities. Materials stocks are a positive standout vs. Large Cap. counter parts. Global trade creates a bid for smaller, less efficient producers as the Trump Administration tries to gain leverage over China with tariffs on rare earths, graphite and other big exports.

Conclusion

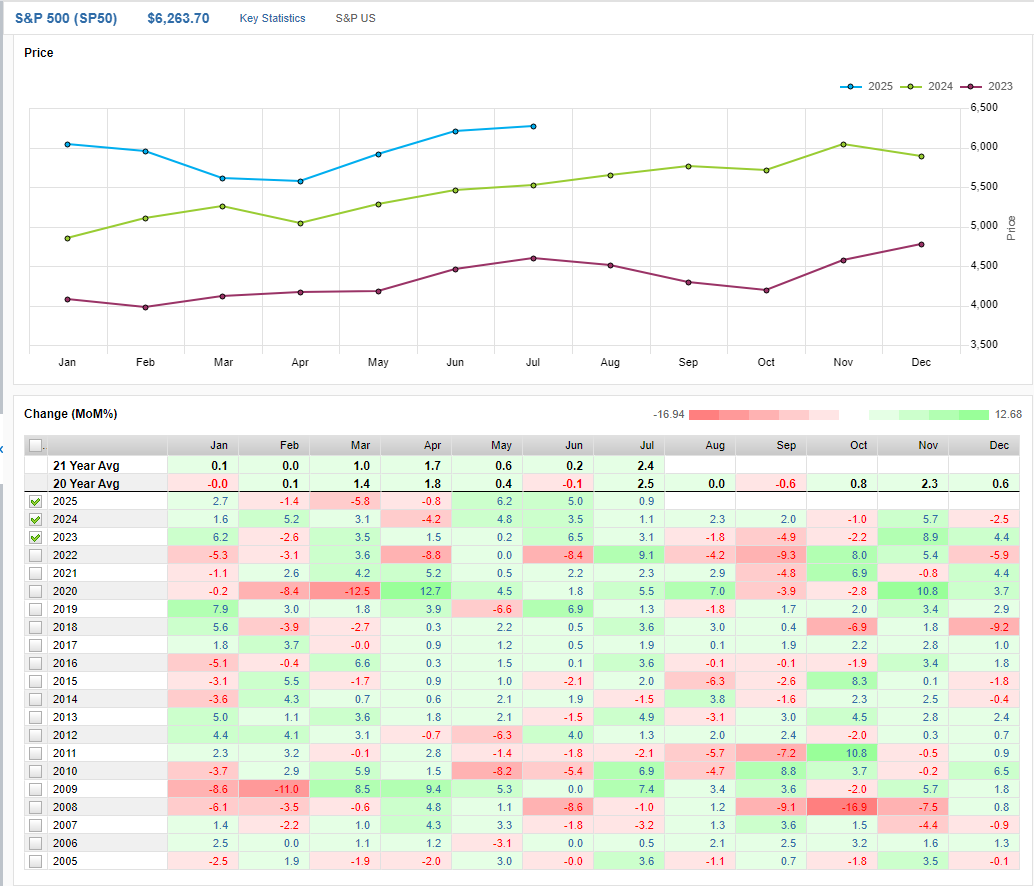

Softer economic data in the near-term has investors holding back on fully embracing the bull market narrative. Given some continued potential for inflation as details emerge on global trade negotiations, we may be set up for a holding pattern in equities as the calendar enters the weakest seasonal period of the year (chart below).

A big performance spread between Tech stocks and low vol. stocks is a table-setter for rotation into the latter group if we get a negative catalyst. We will likely want to trim offensive exposures tactically entering the August-October period, given the big spread between Growth and Min Vol. factors at present.

Data sourced from FactSet Research Systems Inc.