June 27, 2025

Equities are a few bps shy of all-time highs as June comes to a close. Inputs to our models are supportive of a continued bull trend for equities at present. Oil prices collapsed last week, and the Energy Sector coughed up month-to-date gains. This has taken pressure off of interest rates (chart below) which remain a key pivot for equities.

If rates stay contained with the 10yr Yield remaining below our 4.75% threshold, there is a path forward to sustained recovery. Growth stocks are generally allergic to rising rates, so with input prices and rates falling, we are developing increased conviction that the bull trend can sustain. Given the adroit reflation in Growth shares since April (chart below) we expect investors to continue to interpret low rates as a green light for accumulating Growth exposures.

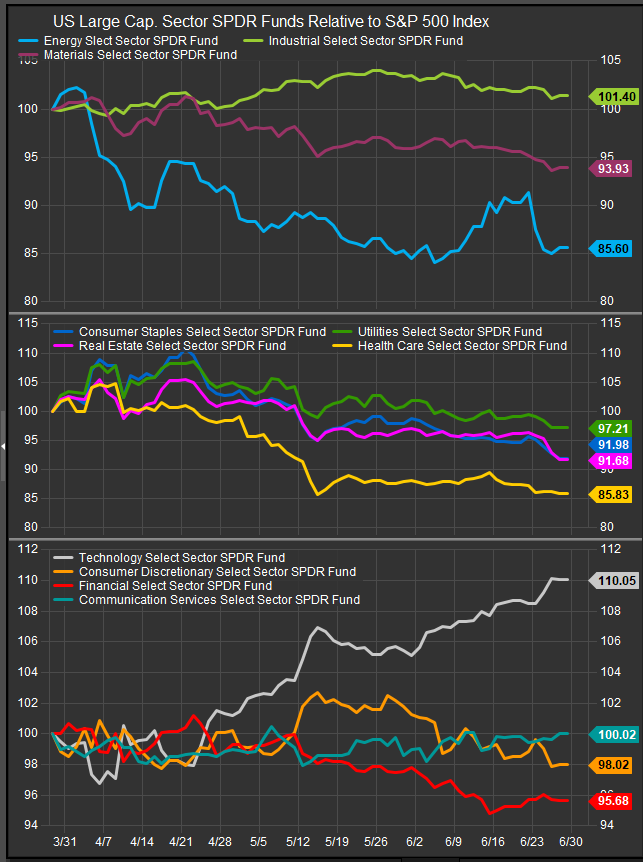

Sector performance since the beginning of April (chart below) has favored Technology stocks at the expense of almost everything else. Comm. Services and Industrial sectors are the only other outperformers over the trailing 3-month period.

That said, volatility in both the stock and the bond market have receeded (chart below, panels 2-3) and our risk on/ risk off ratis are demonstrating risk seeking behavior. Semiconductors have outperformed the S&P 500 by more than 40% since equities put in their low in early April, but our other gages are also firming with Banks outperforming Utilities and Discretionary outperforming Staples by >10% since the lows as well.

For the present this is a very bullish setup. We should note that our VIX and MOVE indices on the previous chart are back at levels associated with complacency. At this point we need to think about low vol. sectors as a hedge against downside as financial markets have digested the previous round of challenges constructively.

We’ve noted some weakness out of Mag7 constituents Alphabet and Apple Corp (charts below). We think this is likely to open the door for other stock level themes to come to the fore. Typically in an extended bull trend there is rotation among growth themes. Mag7 stocks have been seen to dominate the present, but they are not native AI companies. Eventually AI technology will push past these core businesses if past cycles are any hint, the way the internet nurtured and then de-emphasized the capabilities of a premium personal computer. We’re already seeing concerns emerge for Alphabet, in that AI is a threat to their search business.

GOOGL

AAPL

New high beta themes like nuclear, space exploration, crypto innovation are among present top performers. And we’re expecting legacy businesses to eventually unlock some value from AI as well.

Data sourced from FactSet Research Systems Inc.