June 6, 2025

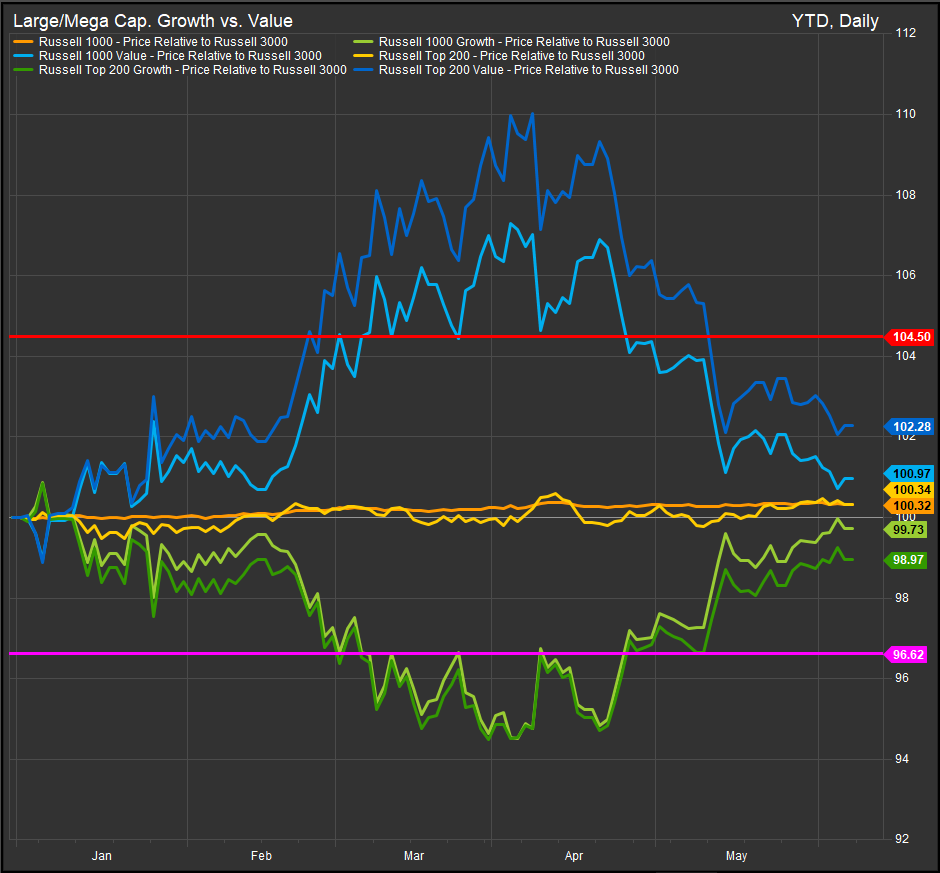

Factor performance in the context of shifting narratives on global trade has been the story of 2025. Threats of tariffs on the global supply chain boosted Value style shares over the broad market Russell 3000 index from February to early April while Growth has come charging back since equities put in their low and are almost back to par for the year vs. the benchmark (chart below). Mega-Cap. shares have held a slight edge regardless of style.

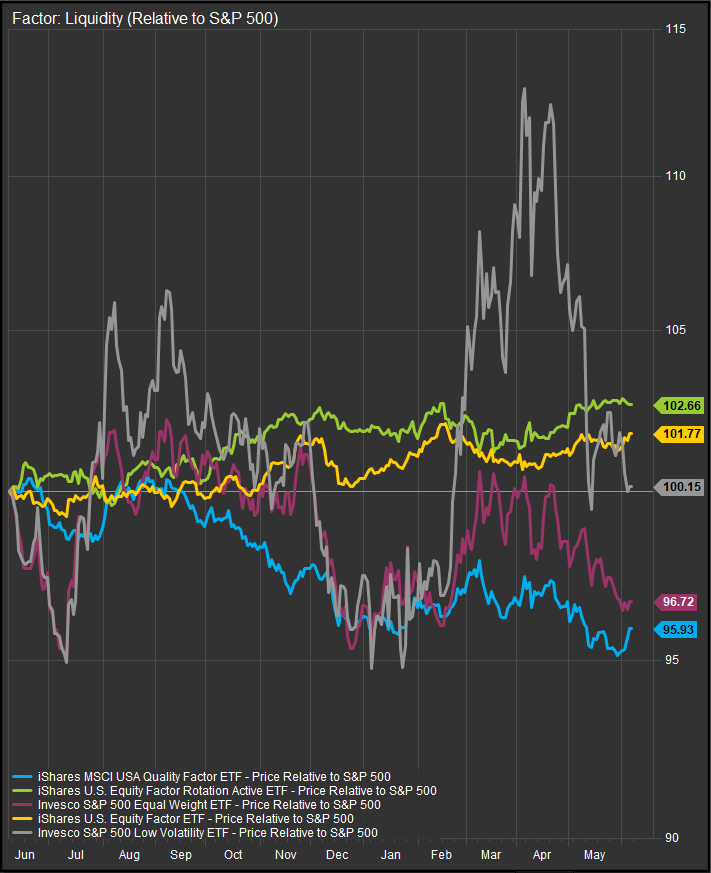

Today, we’re highlighting the performance of two multi-factor funds which have navigated the give and take between Growth and Value with aplomb. The chart below shows 5 different ETFs with liquidity overlays including the Invesco S&P 500 Low Vol. ETF (SPLV), iShares MSCI Quality (QUAL), Invesco Equal Weight S&P 500 ETF (RSP) and two iShares Factor Rotation ETFs, DYNF and LRGF (chart below).

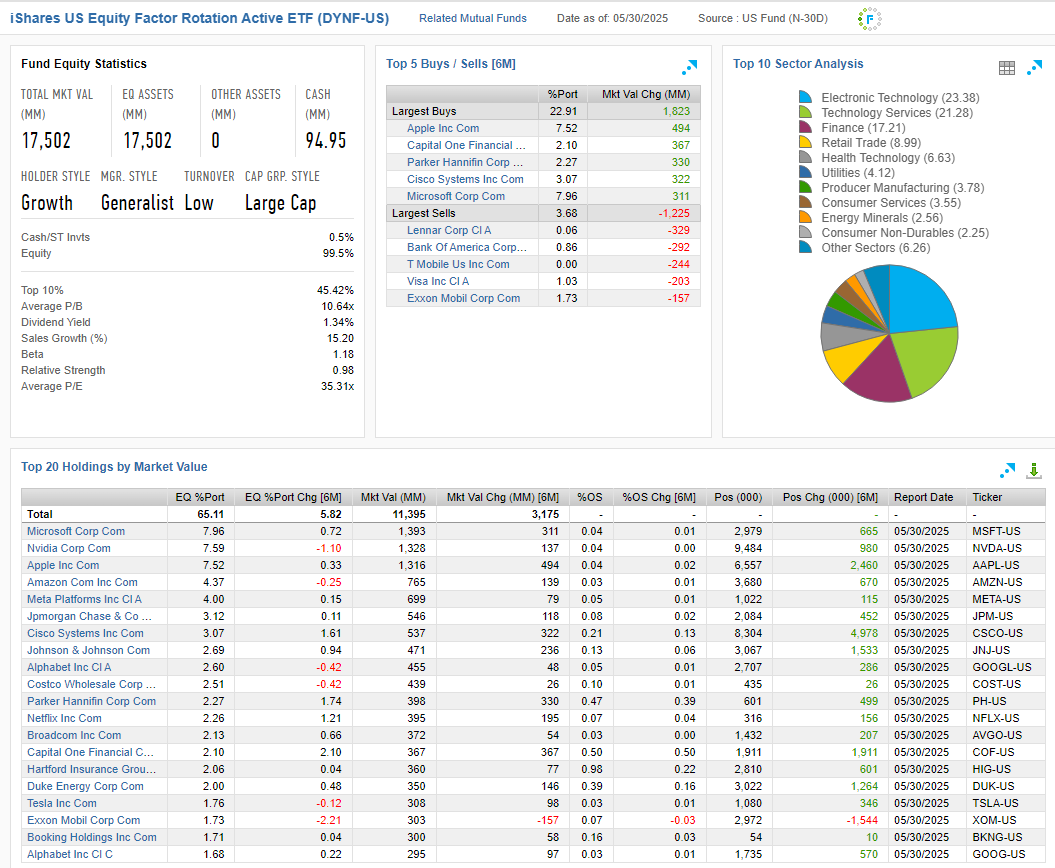

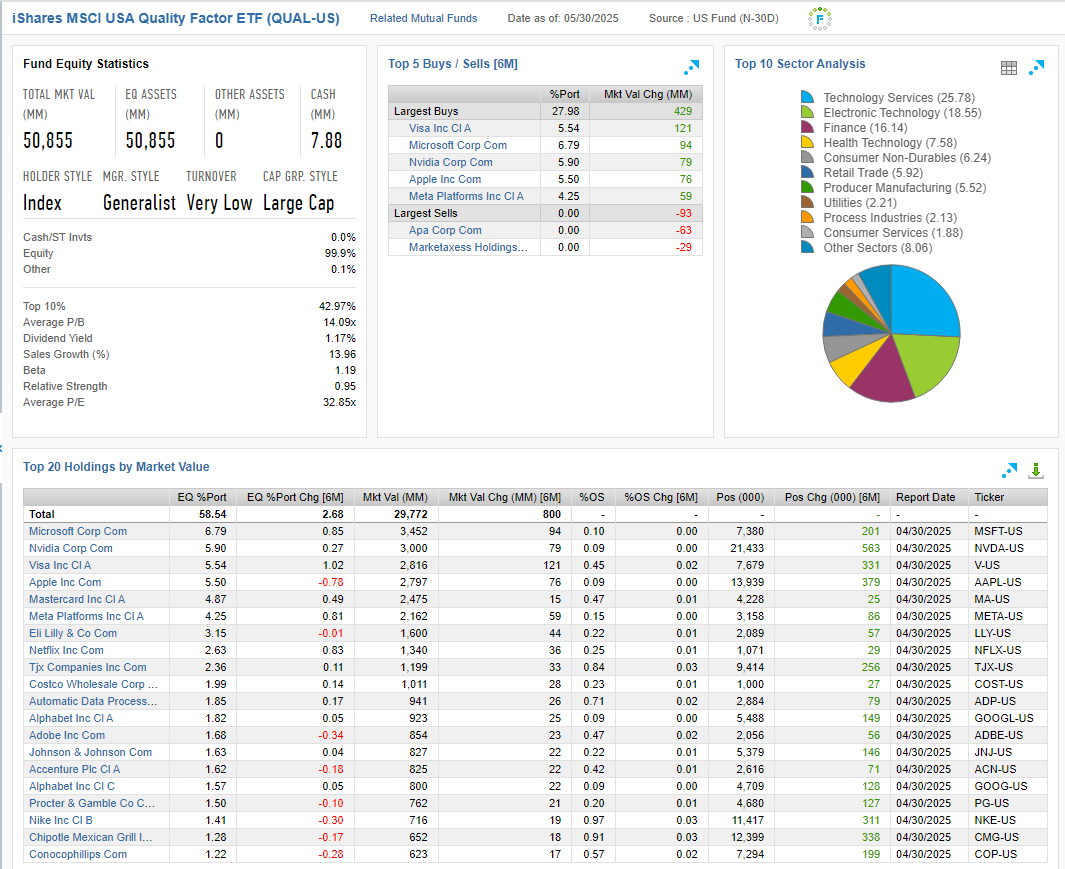

We can see from the YTD performance of each of these funds that the factor rotation funds were able to smooth out mean-reversion in performance. Ironically, the SPLV fund has had the most volatile performance in 2025 based on the capriciousness of global trade posturing. When we look into the holdings and aggregates for both funds (below), we can see the DYNF methodology nets out to a much lower Price to Book ratio for its holdings (10.64x vs. 14.09x for QUAL) while the rotation ETF has also been more active in selling out of Housing and Energy stocks over the past 6-months while adding to a broader mix of sector exposures as equities rebounded.

DYNF

QUAL

Conclusion

With so many different flavors of ETFs out there, it’s important to keep an eye on the actual outcomes generated by the various factor strategies. One thing that is increasingly apparent is that equity rotation can add volatility to any tranche of funds that become the focus of a macro driven trade. We find that funds with a momentum component like DYNF and LRGF have an ability to navigate the sharp inflows and outflows when equities are in a dramatic rotation like Q1 of 2025. Trading on Momentum in this case can help lower the volatility of performance.