February 20, 2026

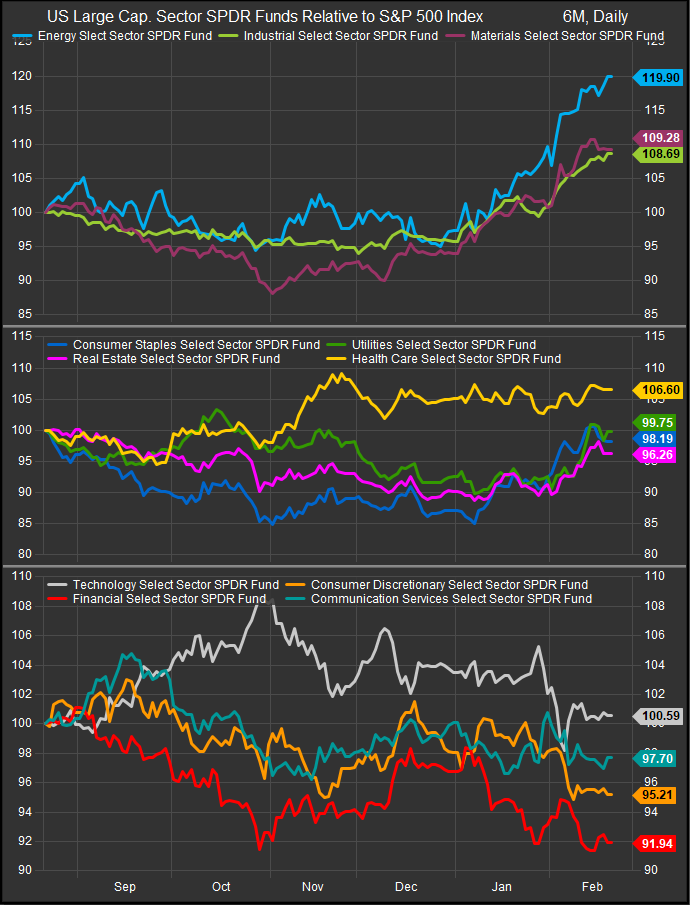

The past six months have marked a meaningful shift in U.S. equity leadership. After an extended run of dominance by Large-Cap Growth—led primarily by mega-cap technology and communication services—performance has broadened into Value sectors such as Financials, Energy, Industrials, and Materials. The catalyst has not been a collapse in Growth earnings. Instead, it has been a macro repricing centered on one variable: real yields.

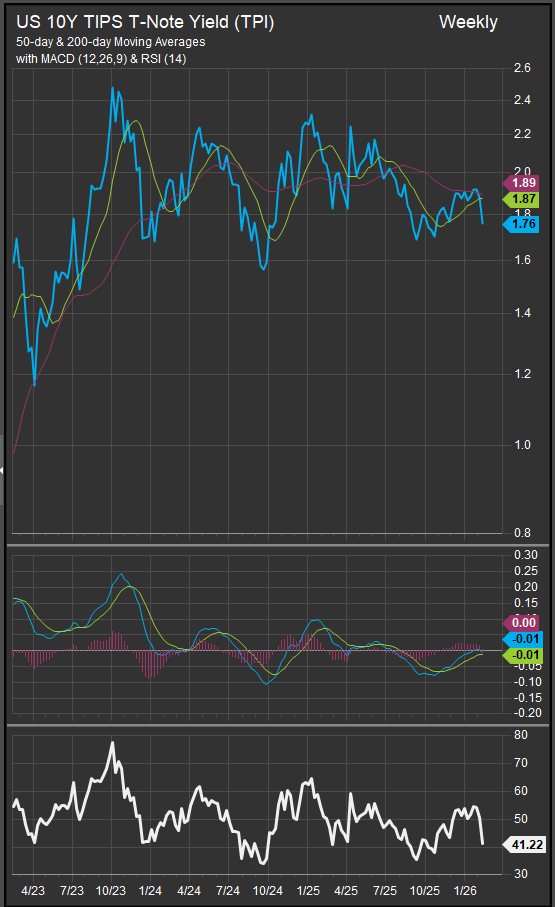

What Are Real Yields—and Why Do They Matter?

At a high level, a real yield is the return investors earn on a bond after accounting for inflation. In practice, markets measure this using the yield on U.S. Treasury Inflation-Protected Securities (TIPS). The 10-year TIPS yield represents the inflation-adjusted cost of capital over a decade.

Real yields matter for equities because they serve as a core input into discount rates. When real yields rise, future cash flows are discounted more heavily. That disproportionately affects companies whose valuations depend on earnings expected far into the future—namely, Growth stocks.

When real yields fall, the opposite occurs: long-duration cash flows become more valuable, and Growth leadership tends to re-emerge.

How Growth and Value Differ Structurally

Large-Cap Growth and Large-Cap Value are not just valuation labels—they reflect fundamentally different sector exposures and earnings characteristics.

Growth sectors typically include:

- Information Technology

- Communication Services

- Consumer Discretionary (select segments)

- Certain Health Care innovators

These companies generally exhibit:

- Higher expected revenue growth

- Elevated reinvestment rates

- Longer-duration cash flow profiles

- Higher price-to-earnings multiples

Value sectors typically include:

- Financials

- Energy

- Industrials

- Materials

- Traditional Consumer Staples

These companies tend to show:

- Higher current earnings yield

- Greater sensitivity to nominal GDP

- More near-term cash flow realization

- Lower valuation multiples

Growth behaves like a long-duration asset. Value behaves more like a current-income asset tied to economic activity.

Why Value Has Outperformed Recently

The recent rotation toward Value has been driven by several overlapping forces:

- Persistently Positive Real Yields

After years of negative real yields during the zero-rate era, 10-year real yields have remained firmly positive. Even modest moves higher in real rates compress Growth multiples because they raise the hurdle rate for future earnings streams.

The level matters—but the change matters more. Periods of rising real yields historically coincide with Growth underperformance and broader market leadership.

- Earnings Breadth Improving Outside Mega-Cap Tech

Growth earnings remain structurally strong, but expectations have plateaued in some areas, particularly where capital expenditures have surged. Meanwhile, Value sectors have delivered incremental earnings resilience:

- Financials benefit from stable credit conditions and solid capital markets activity.

- Energy and Materials benefit from commodity stability and geopolitical uncertainty.

- Industrials gain from infrastructure, reshoring, and defense spending.

Rotations often occur not when Growth weakens dramatically, but when Value improves at the margin.

- Fiscal and Nominal Growth Tailwinds

Infrastructure spending, supply-chain localization, and industrial policy have disproportionately favored cyclicals. These policies support capital goods producers, commodity suppliers, and financial intermediaries—classic Value constituents.

What Is Driving Real Yields Higher?

Several macro forces have kept real yields elevated:

- Resilient Labor Markets

Strong employment and wage growth reduce urgency for aggressive rate cuts. - Sticky Services Inflation

Even as goods disinflate, services remain firm, keeping policy expectations cautious. - Large Fiscal Deficits

Expansive government borrowing increases Treasury supply, which can push yields higher. - Reduced Policy Certainty

Markets require compensation for fiscal and geopolitical risk.

Together, these dynamics maintain a higher structural discount rate environment than investors became accustomed to during 2015–2021.

What Would Cause Real Yields to Fall?

A renewed Growth leadership cycle would likely require:

- Clear and sustained disinflation

- Softer labor market data

- Convincing evidence of slowing nominal GDP

- A decisive Federal Reserve easing cycle

- Reduced Treasury issuance pressure

If real yields move meaningfully lower, Growth multiples could expand again—especially if earnings revisions accelerate simultaneously.

How Likely Is the Value Regime to Continue?

The persistence of Value leadership depends on whether current macro conditions hold.

If:

- Real yields remain positive and stable,

- Earnings breadth continues expanding beyond mega-caps, and

- Nominal growth remains firm,

then Value can continue outperforming.

However, if inflation falls faster than expected and policy easing becomes clearer, the valuation tailwind for Growth could reassert itself quickly.

Factor leadership is rarely permanent. It responds to shifts in the cost of capital and earnings revisions. At present, the cost of capital remains structurally higher than the ultra-low regime that fueled Growth’s historic outperformance.

Bottom Line

The shift from Growth to Value is not a repudiation of innovation—it is a response to discount rates and earnings dispersion. As long as real yields remain elevated and macro uncertainty persists, Value sectors with tangible cash flows and exposure to nominal activity are likely to retain an edge.

But if disinflation deepens and real yields roll over, Growth leadership could return just as swiftly as it faded.

Investors should monitor real yields, earnings revisions, fiscal developments, and inflation composition—not narratives. In factor investing, the discount rate is key to determining leadership.

Sources

- Federal Reserve Bank of St. Louis (FRED): 10-Year Treasury Inflation-Indexed Security, Constant Maturity (DFII10)

- U.S. Bureau of Labor Statistics (CPI and employment data)

- FactSet Research Systems: Earnings revisions, sector composition, factor performance

- MSCI and Russell Index Methodology: Growth and Value factor construction

- Congressional Budget Office: Federal deficit projections

- CME FedWatch Tool: Policy expectations

Additional charts and data provided by FactSet Research Systems Inc.