January 16, 2026

As 2026 gets underway the clear near-term message from US equities, style profiles and sectors is a near-term shift from Growth towards Value and cyclicality. In many cycles this shift is driven by a combination of earnings abundance and inflation dynamics that underpin “late-cycle” environments. That may be exactly where we are today, but the countervailing dynamic has been a fairly extreme bifurcation in performance during this bull cycle (2023-present) where Growth stocks have dominated Value on performance over the longer-term. This setup frames the current rotation as somewhat of a dilemma. Is this move an intrinsic result of late cycle dynamics emerging, or is this a round of profit-taking from the leading trend that could transition back to accumulation at oversold levels. This week we dive into the recent drivers of style rotation.

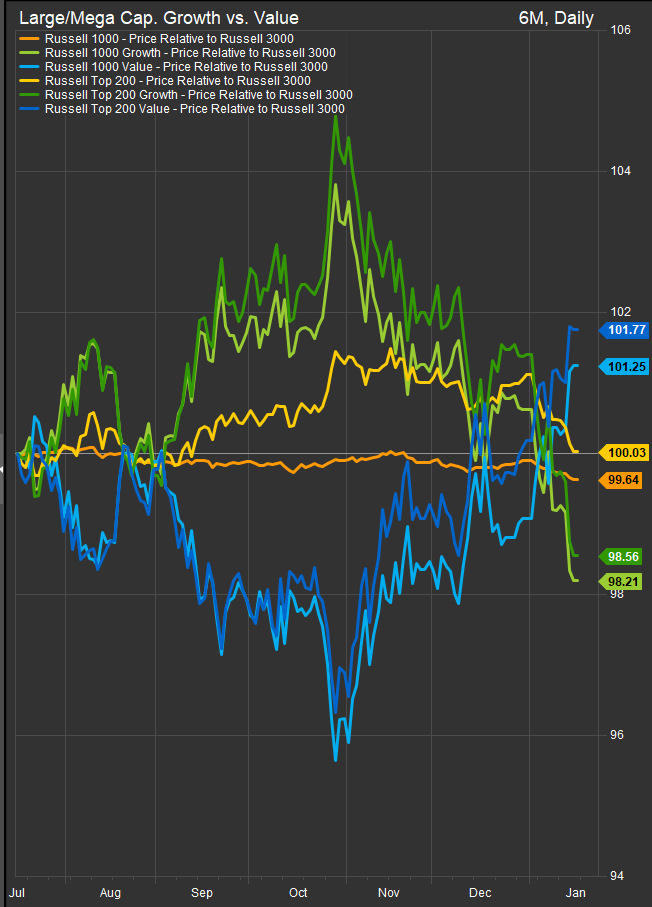

Growth vs. Value: Trailing 6-months

Growth vs. Value: 2023-present

The longer-term outperformance trend for Growth stocks is still intact but approaching a key pivot from a longer-term perspective.

We think Value has clear tailwinds in the near-term, but the door is open for the Growth style’s re-emergence as long as inflation remains sidelined.

Growth vs. Value: What Recent Events Are Signaling About Style Leadership

The recent shift in market leadership is not occurring in a vacuum. A series of specific macro, policy, and earnings-related developments are actively reshaping how investors are discounting future cash flows and assessing valuation risk. When viewed through the lens of Growth versus Value style investing, these events collectively tilt the balance toward Value-style strategies.

Interest Rates, Inflation, and the Fed’s Posture

One of the most important recent developments has been the Federal Reserve’s reaffirmation that policy will remain restrictive, despite incremental progress on inflation. December CPI showed core inflation running near 2.6% year over year, still above target, and was followed by repeated signals from Fed officials that rate cuts are not imminent. Market pricing has adjusted accordingly, with January and early-2026 cuts largely priced out.

This matters disproportionately for Growth investing. Growth stocks derive a larger share of their valuation from long-dated earnings expectations, making them highly sensitive to discount rates. The persistence of higher real yields following the CPI report and subsequent Fed commentary raises the hurdle for Growth-style outperformance. By contrast, Value stocks—whose return profile is more anchored in current earnings and dividends—are less exposed to this shift in rate expectations.

Policy Uncertainty: Tariffs, Trade, and State Intervention

Trade and industrial policy developments have also weighed more heavily on Growth than Value. Recent headlines include a U.S.–Taiwan trade agreement that reduced tariffs but reinforced strategic supply-chain realignment, renewed pressure on allies to reduce dependence on China for critical minerals, and ongoing uncertainty around the scope and legality of U.S. tariff authority pending Supreme Court review.

At the same time, the Trump administration’s “Main Street over Wall Street” affordability push, including proposed caps on credit card interest rates and heightened scrutiny of corporate pricing, has increased regulatory and political uncertainty. These developments introduce risks to Growth-oriented companies that rely on global supply chains, long-cycle capital investment, and stable regulatory assumptions.

Value-oriented sectors—particularly Financials, Industrials, Energy, and defensives—tend to operate with shorter investment cycles and more tangible cash flow streams, making them less sensitive to abrupt policy shifts. In environments where political intervention risk rises, markets typically favor earnings visibility over long-term optionality.

Earnings Season: Concentration vs. Breadth

Recent earnings results and previews further highlight the stylistic divide. While headline S&P 500 earnings growth expectations remain positive, a disproportionate share of that growth is concentrated in a narrow group of Growth-oriented mega-cap technology and AI-linked firms, such as TSMC, which recently delivered strong results alongside sharply higher capex guidance.

Mag7: Mega Cap. Growers have been a funding source in the near-term.

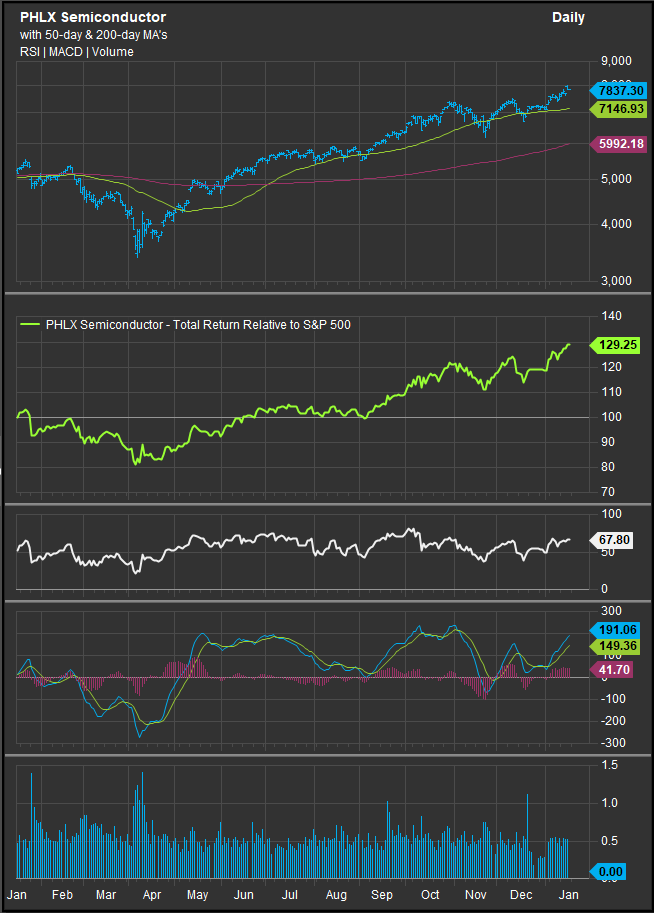

Sox Index: Semiconductors remain a leading industry within equities despite rotation away from more pure Growth stocks

At the same time, bank earnings revealed improving capital markets activity, strong trading revenues, and substantial capital return capacity, even as expenses drew scrutiny. Financials—a Value-heavy sector—reported record buybacks and dividends in 2025, reinforcing their appeal in a higher-rate environment where income and balance-sheet strength matter.

This contrast—concentrated Growth leadership versus broader Value participation—has historically coincided with periods of Value outperformance, especially when investors become more selective about where incremental earnings growth is coming from.

Inflation Pass-Through and Pricing Power

Another recent development influencing style leadership is evidence of tariff-related cost pressures beginning to pass through to prices, as noted in the Fed’s Beige Book and PPI breakdowns. Goods inflation tied to energy and trade-sensitive categories has re-emerged even as services inflation cools.

Value sectors often exhibit greater near-term pricing power or operate in industries where price adjustments occur more rapidly. Growth companies, particularly those reinvesting heavily for future scale, face a tougher tradeoff between protecting margins and sustaining long-term growth assumptions.

Market Action Confirms the Message

Market performance has reflected these developments. Year-to-date, Value indices have outperformed Growth indices, even as broader equity markets remain supported. Importantly, this rotation has occurred without a broad risk-off move, indicating that investors are re-pricing styles, not abandoning equities.

This is consistent with environments where rates stay higher for longer, policy uncertainty rises, and earnings leadership narrows—conditions under which Growth’s valuation premium becomes harder to sustain and Value’s lower expectations become an advantage.

Bottom Line

Recent events—including persistent above-target inflation, a Fed signaling policy patience, heightened trade and regulatory uncertainty, concentrated Growth earnings leadership, and improving capital return dynamics in Value sectors—collectively favor Value-style investing over Growth. This is not a judgment on innovation or long-term secular trends, but a recognition that the current regime rewards cash flow today, valuation discipline, and earnings visibility more than distant growth optionality. While interest rates remain contained, there is potential for rotation back into Growth exposures, but in the meantime the incremental investment dollar is rotating towards potential near-term tailwinds rather than sticking with longer-duration stories promising future prosperity.

Data sourced from FactSet Research Systems Inc.