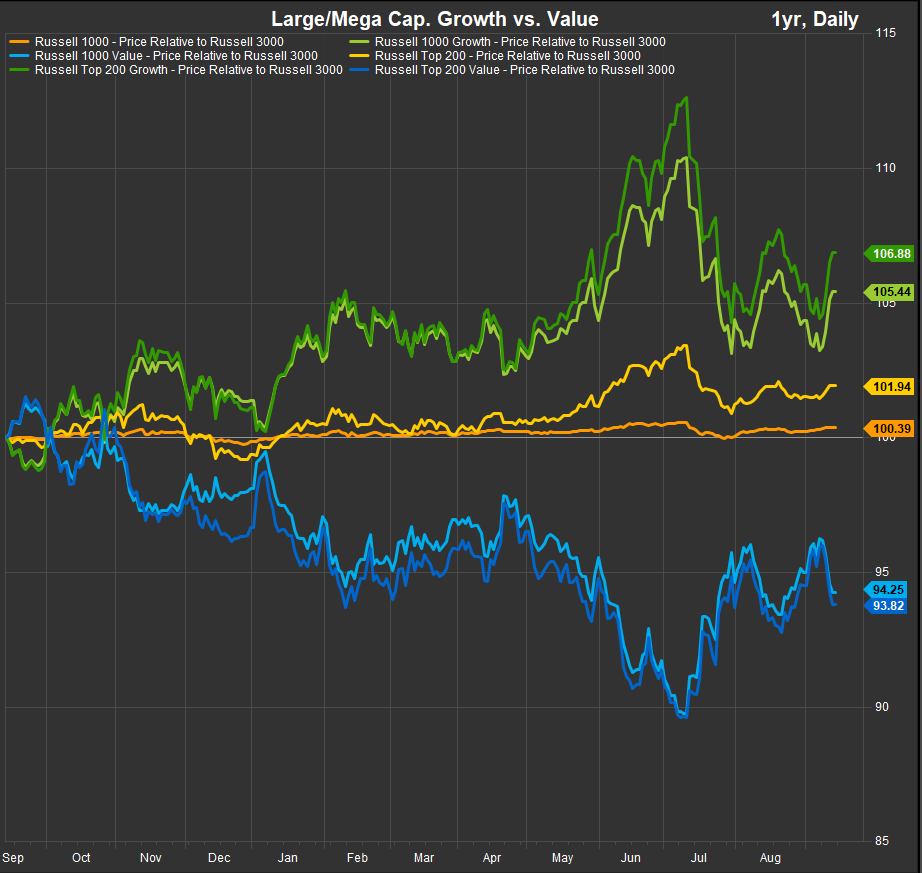

Throughout 2024 we have highlighted fundamental and style factors that have been thematic drivers of sector rotation. Since the current bull market’s inception in 2023, Meg Cap. Growth has been the dominant leadership cohort along with the momentum factor. Corrections in the market have typically benefitted a broad range of other factors and styles, while moves to new highs are typically driven by Mega Cap. Growth. As Equities continue their correction in September, this dynamic has not changed.

Looking at Large and Mega-Cap. Growth vs. Value in the chart below, we can see Mega Cap. Growth and Value as proxied by the Russell Top 200 Growth and Value Indices have seen performance spreads widen out in favor of Growth over the near-term. That spread had widened out to a high of 23% on July 10 and has no closed to a little above 8% last week. This has put Growth back in at least a neutral position vs. Value. We are looking for new 2-month relative highs or lows to cue us on the direction of the new tend.

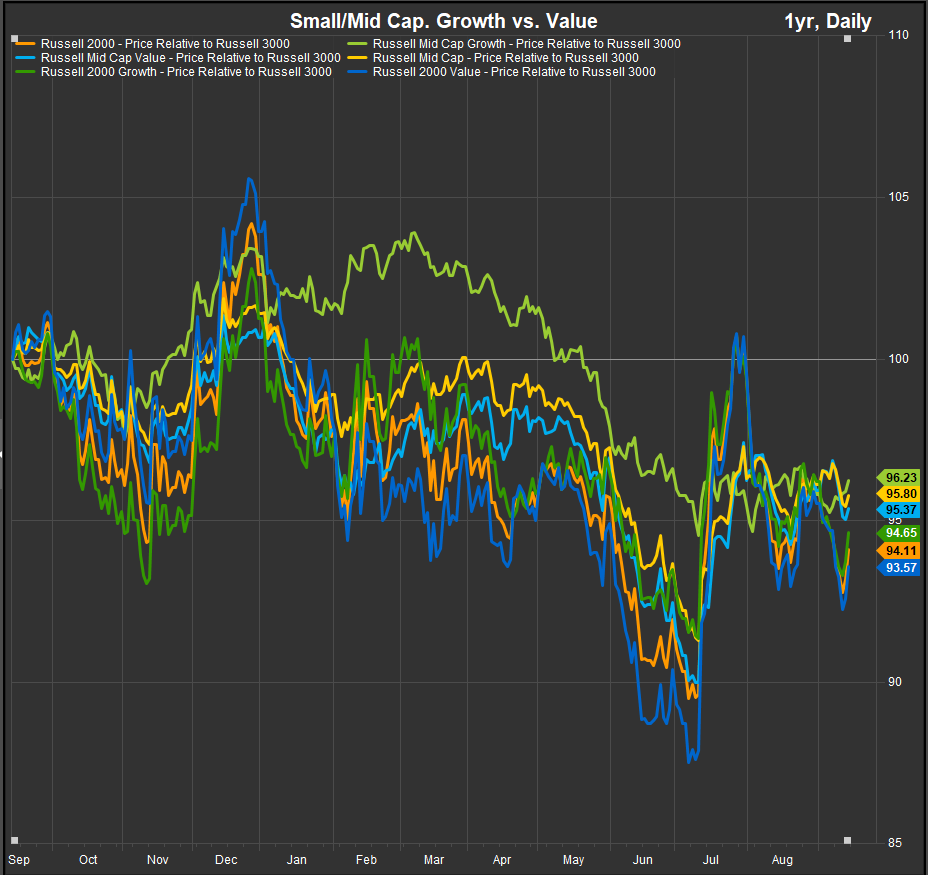

While larger stocks continue to show clear delineation between the performance of Growth and Value, smaller stocks continue to trade more uniformly regardless of style. The chart below shows low dispersion of performance vs. the Russell 3000 for both Russell 2000 and Russell Mid-Cap. Regardless of style, smaller stocks have faced a headwind in this bull market and haven’t sustained gains from early 2024.

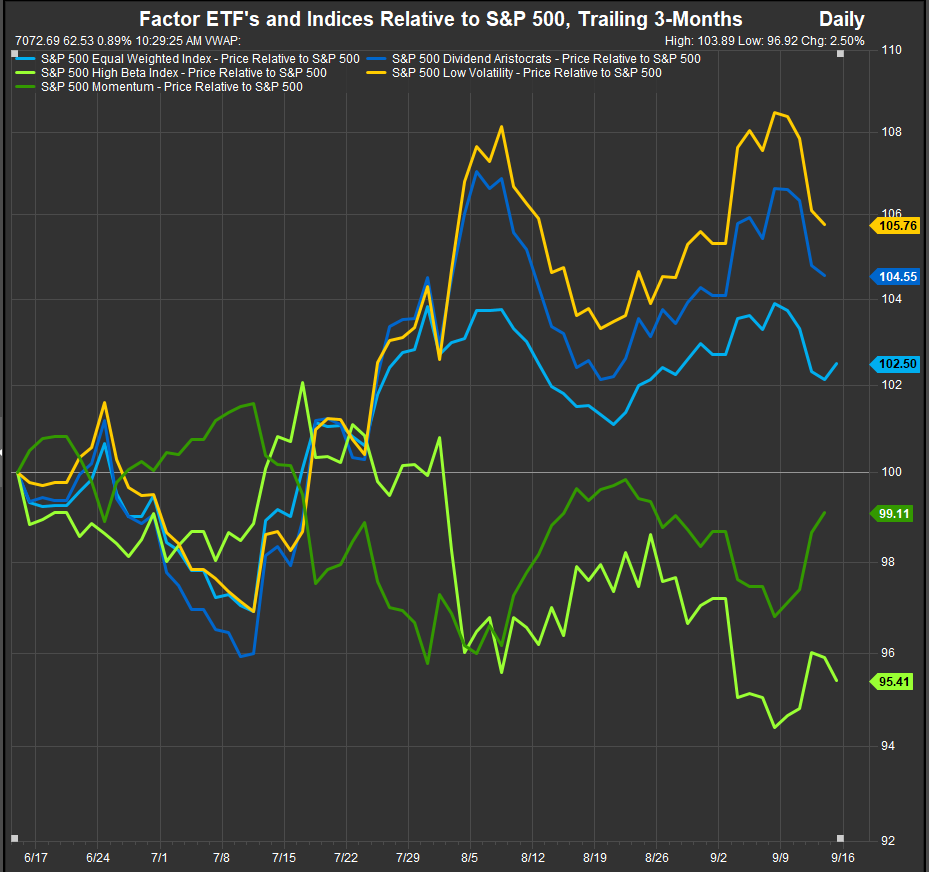

When we look at some fundamental factors the picture becomes clearer. Value is paired with low vol. and income as factors that are benefitting from corrective action in the equity market while Growth and Momentum have underpinned upside leadership.

Conclusion

This week we’ve seen equities bounce off oversold conditions to start the month and consensus on the Fed’s next move coalesce around a quarter-point cut next week. This has buoyed risk on exposures as fears of a deeper correction have subsided for now.

Data sourced from FactSet Data Systems