April 4, 2025

Tariffs are here and they brought the Bear with them. Wednesday afternoon’s pronouncements and news of reciprocal measures coming out on Thursday evening has equities taking the elevator downwards. Speed is the weapon of the bear, patience that of the bull. As we survey our various factor fund groupings this week, we should keep in mind that we want to look for positive divergence away from the current bear (down) trend. We can evaluate investor’s appetite for bottom fishing by looking at the performance of higher beta exposures relative to the broad market performance. If it keeps going in the direction of 2025’s year-to-date rotation we can infer consensus towards stagflationary recession. If we see any kind of outperformance from Growth, Mag7, Semiconductors, and other traditionally higher-beta exposures, that’s typically a sign that selling is drying up and it’s time to bottom-fish.

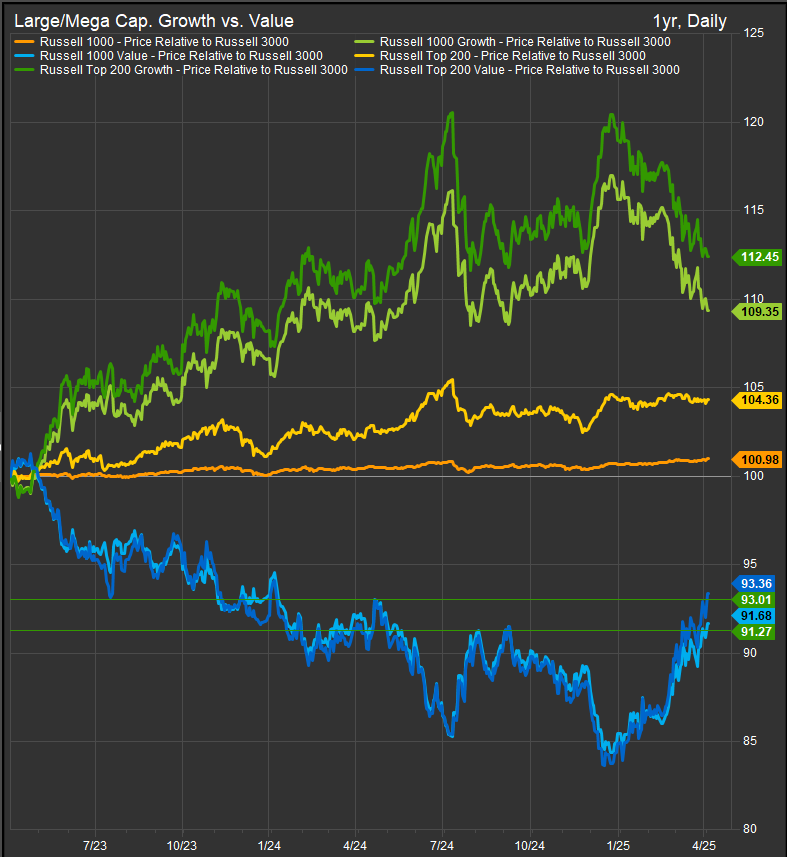

Growth, Value & Size

The chart below shows Russell Large and Mega cap. Growth and Value Indices relative to the Russell 3000 broad market benchmark. The Yellow lines are the Russell Large and Mega Cap. Indices relative to the R3K. The YTD performance trend is very clearly in favor of Value over Growth. We can see the bullish reversal in Value shares starting to take out levels from its previous decline. Growth shares would need to regain some level of equilibrium for us to start speculating on an entry point into the down tape.

Looking at the same factor performance chart of Russell Small and MidCap style indices relative to R3K we’ve generally seen Small/Mid shares underperform with the broad market. Mid Cap. Value has been an exception as shares have outperformed over the past 5-weeks.

High-Beta, Low Vol., Momentum

Min Vol. (chart below) is in the driver’s seat vs. High Beta, while the stark rotation from Growth to Value and into safe haven areas of the equity market has put momentum behind some of these non-traditional momentum exposures. That’s kept the momentum factor above water in the near-term despite the fact that it’s typically a more offensive factor exposure.

Capitulation into Risk-off Exposures since the last week in March

Since the beginning of February risk appetite has been steadily abating. Now 3 of our 4 risk-on/risk-off gages (chart below) have moved to new 6-month lows while the 4th (Copper relative to Gold) is heading in that direction. This comes as stock and bond volatility gages, the VIX Index and MOVE Index respectively, have elevated in the near-term.

Macro Level Dynamics are Taking on a Recessionary Look

Along with a clear rotation from risky assets towards safety assets over the last 2 months, we are seeing a change in the correlation between stock and bond market performance. For most of the 2023-2024 US bull market, stocks and bonds were positively correlated with lower rates generally meaning higher stock prices. In the near-term we are seeing a return to more traditional dynamics as money flows out of equities and into Treasuries and other lower volatility fixed income exposures. This is recessionary type behavior and should continue to be a tailwind to risk-off assets in the near-term.

When equities broke lower in mid-February, we pointed out the 5200 level for the S&P 500. Recession would open up potential for a deeper bear market than that. The average bear market drawdown with an economic recession is near 40% while the average market correction (>10% decline) without a recessionary backdrop is around 20%. Considering the S&P 500 chart (below), price is heading towards the neighborhood of non-recessionary support between 4953 and 5263 with the lower level almost exactly 20% below the all-time high for the index. That’s the first zone where we would look for accumulation to occur and it’s likely we will be there soon.

Conclusion

Bearish “recognition” is upon us as President Trump left no ambiguity to the direction (pugnacious) he’s going in with regard to his trade policies. Counter tariffs have now been deployed and the global supply chain about to get a lot less efficient. We would advise reviewing what worked in 2022 as supply chain issues were a dynamic then as well. Divergence in momentum and the relative performance of risk assets is what we’re looking for to call a potential low for the decline. We are not seeing any developments along those lines at present.

Data sourced from FactSet Research Systems Inc.