The S&P 500 made another all-time high last week (chart below) with the bull market in a solid position from a technical, macro, policy and earnings perspective this week. Our Factor Friday report takes a look at the leadership characteristics of the advance to monitor for meaningful changes in trend. Our Elev8 Sector strategy continues to operate under a bull market scenario. Our intermediate term price target for the S&P 500 remains near 6200. Our key question moving forward is whether rising yields, now sparked higher by policy optimism, will gum up the prevailing consensus of deflationary relief for all. We presently have a mild Growth bias in our positioning, but one implication of higher rates, even in bullish scenarios, would be the Value style taking a leadership turn. One of the benefits of using Sector instruments to invest is you get a broad exposure to Value in many sectors, but particularly Energy, Materials, Industrials and Financials. We’re short the first one and long the latter 3 presently.

Sectors

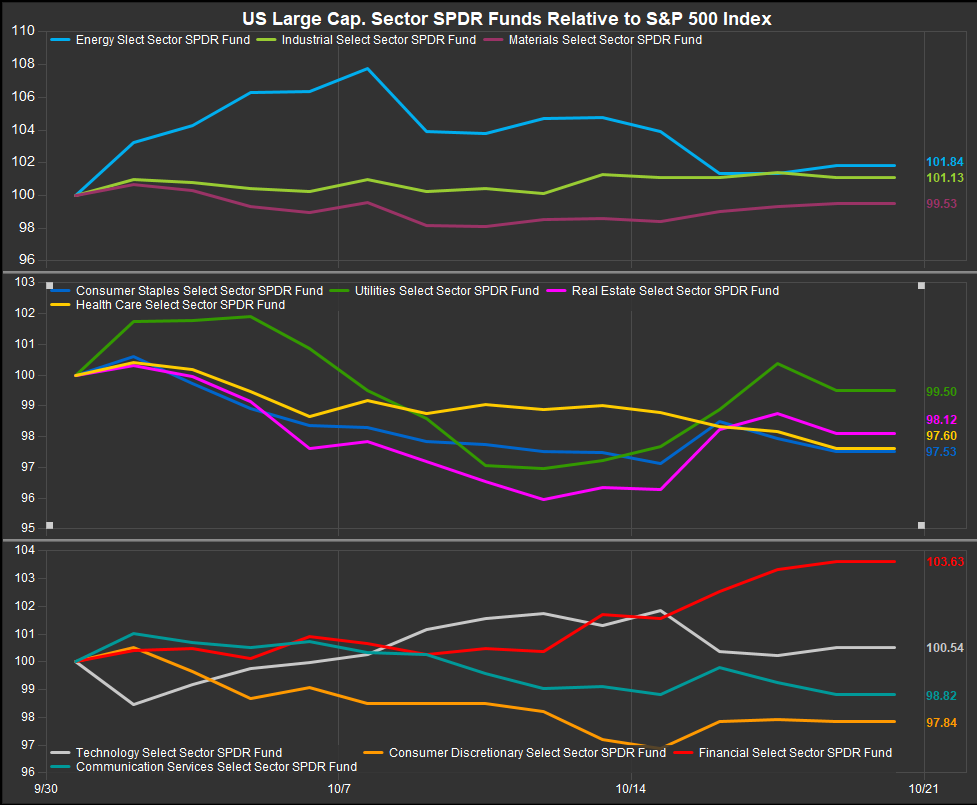

We have a large portion of earnings to go, but banks and other big financial companies have kicked the season off on a positive note. We’ve seen the US 10yr yield move higher while commodities and crude oil prices have rolled over near term. MTD S&P 500 Sector performance shows a continued correction for defensive shares (chart below, middle panel). The Energy Sector has faded after a hot start and Financials have led MTD. The Technology Sector persists in a holding pattern. Overall, the performance spread remains very tight.

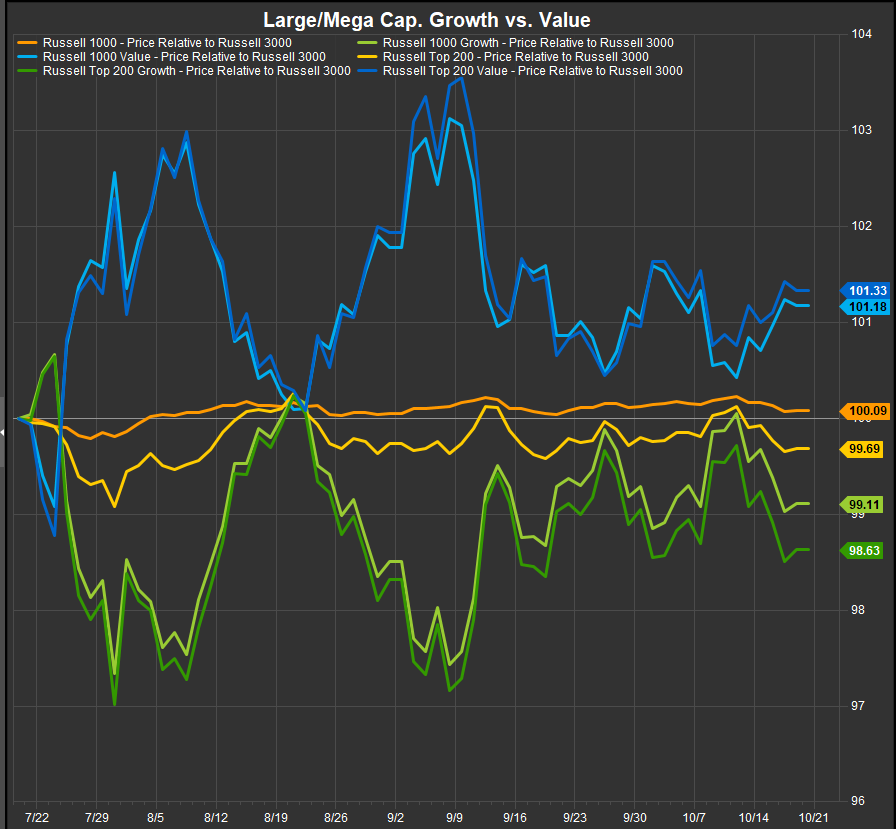

Large/Mega Cap. Value had a Strong Week

The past week has seen Value bounce from support directly at the expense of Growth in the large/meg cap. tier. The largest stocks have also been giving way to smaller over the past week. That is something to pay attention to as Small/Mid stocks have been structural laggards in this cycle. Historically Value stocks do well when earnings growth is plentiful. Any further Mag7 stumbles likely open the door for the Value and SMID trades to spread their wings. The bullish reversal in Growth is on the ropes after last week. This is the single biggest alpha determinant for sector positioning at present in our opinion.

Small/Mid Stocks: Everything SMID improved Last Week

In contrast to the Large/Mega Cap. space, the Small/Mid tiers of the US equity market continue to be a scrum. As the chart below shows, dispersion of returns over the past 12 months has been narrow and highly correlated. Mid-Cap. Growth has been the on cohort trending positively over the past 3 months, but this past week has seen the entire cohort surge higher. Trend change signal is established at extreme overbought levels historically (and mathematically). A move higher from these levels would be significant.

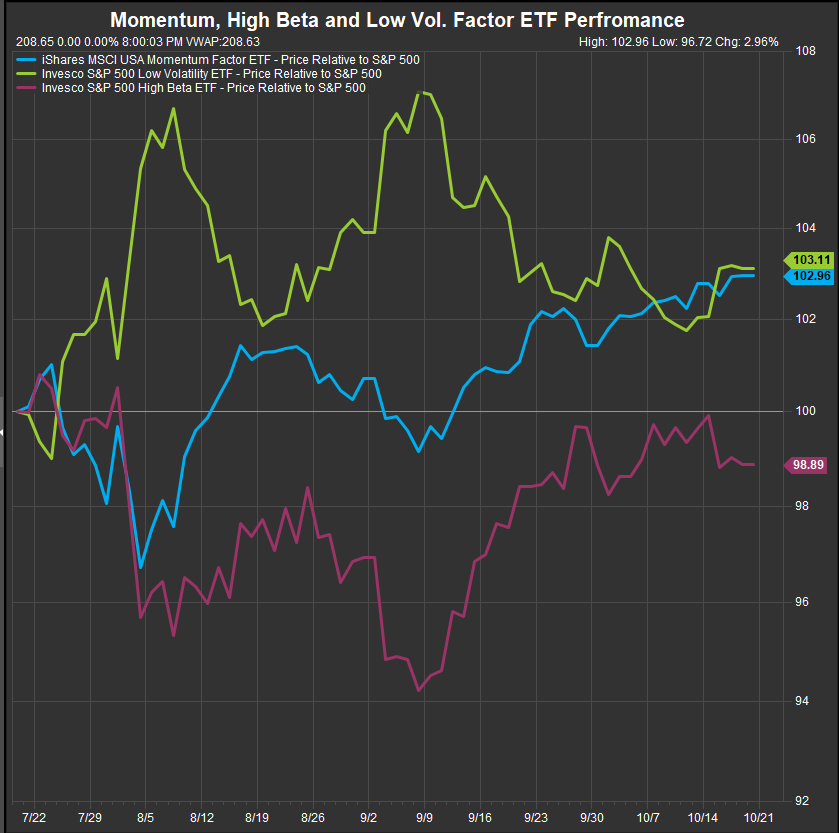

Momentum, High Beta & Low Vol: Min Vol. Continues to lag near-term

Reviewing our key factor ETF’s, the Invesco S&P 500 High Beta ETF outperformed its Low Vol. counterpart in September, but that dynamic has paused in October. Momentum continues to make new near-term relative highs. We follow resolution whichever way it breaks, but we are positioned for higher beta performance to resolve higher at the expense of min vol. moving forward based on what we see in our process right now.

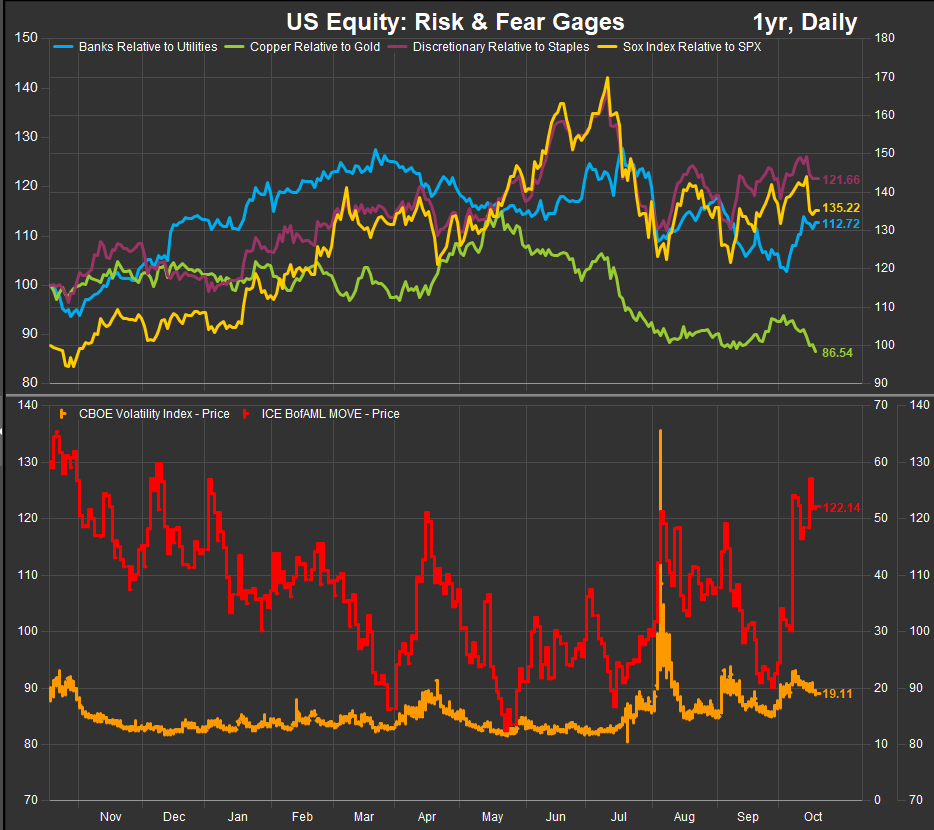

Risk On/Risk Off: Bond vol. remains high as Equity vol. settles

As we mentioned in our lead, bond vol. and generally rising rates in the very near-term reminds us that there are vulnerabilities to the current bullish scenario being discounted on the equity side. VIX has settled from its move up to the 20’s.

Looking at our equity market risk gages, Banks have executed a sharp positive turn against Utilities while Semiconductors and Discretionary stocks remain in constructive patterns despite a respective pullbacks vs. defensive counterparts in the past week. On the Commodities side, Copper has given back vs. gold and has made new relative lows over the past 12 months. Aligning with our bullish thesis longer-term, we are looking for rates to continue sideways to lower but will take a move higher as a caution flag.

In Conclusion

Equity leadership has been fleeting since July and we are seeing an uptick in volatility, particularly as interest rate markets try to digest the implications of a dovish Fed. Upward pressure has come off Commodities prices while rates have pushed higher regardless. The forward direction of rates will likely have a big impact on leadership. We’d expect a mix of defense (on inflationary recession fears) and Value (on inflationary growth scenarios) to outperform with rates rising. We’d expect Growth factor exposures to outperform if rates end the year on a 3-handle.

Data sourced from FactSet Research Systems Inc.