October 24, 2025

The AI investment trend remains the dominant motif in the longer-term bull market that started in 2023. How long it lasts and whether it brings the promised efficiency and prosperity that bullish speculation implies is one of the key questions for every investor with longer-term time horizons.

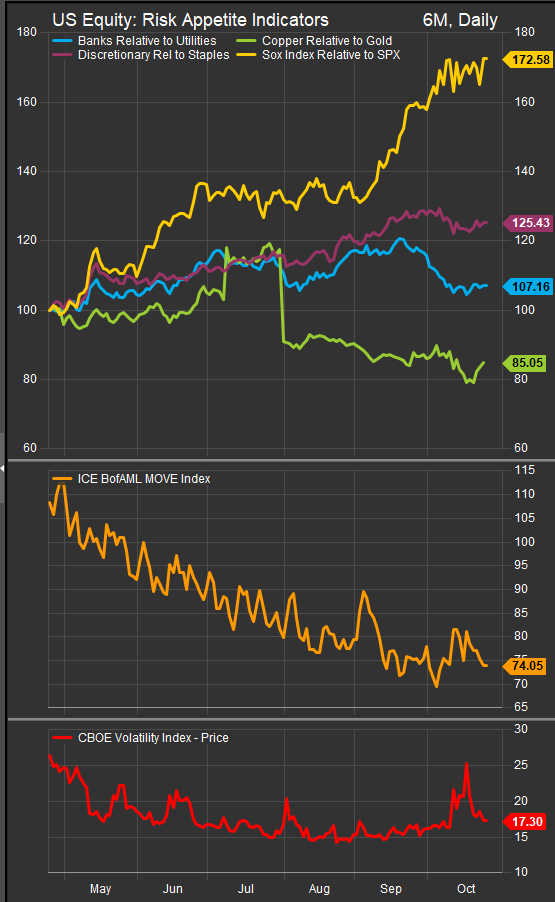

AI has been a difficult concept to gage since its potential applications are almost universal across industries and the promises of its capabilities are theoretically almost limitless. This makes it something that’s potentially worth everyone’s time. So, when we see our risk appetite gages crack like they have recently (chart below) and we get rumors of circular funding and self-dealing juicing AI fundamentals, investors must balance that skepticism against the broadness of the paradigm shift AI technology represents.

We’ve seen Semiconductor stocks maintain their edge against the S&P 500 despite the recent consolidation, though Staples have outperformed Discretionary stocks and Utilities have outperformed Banks. This is classic pre-recession behavior out of legacy parts or the US equity market. With the VIX recently moving above the 25 level there’s the at least the beginnings of an elevated volatility regime forming.

However, without more actual selling pressure in evidence on the top line, it’s hard to diagnose this as anything but a consolidation in the long-term uptrend. The S&P 500 has had several corrections since 2023. Only one, March-April of 2025, approached a bear market threshold in price terms, but October-November 2023 was also a market clearing event with a complete washout in market breadth measures for the S&P 500 (long-term breadth chart below).

Per the chart, readings below 10% for the percent of stocks above their 50-day moving average (above, middle panel, yellow line) are our threshold for a market clearing event and are typically a setup for a contrarian buy signal. The dilemma for investors at present is we have deteriorating market breadth, but the series isn’t close to that kind of “wash out” buy signal.

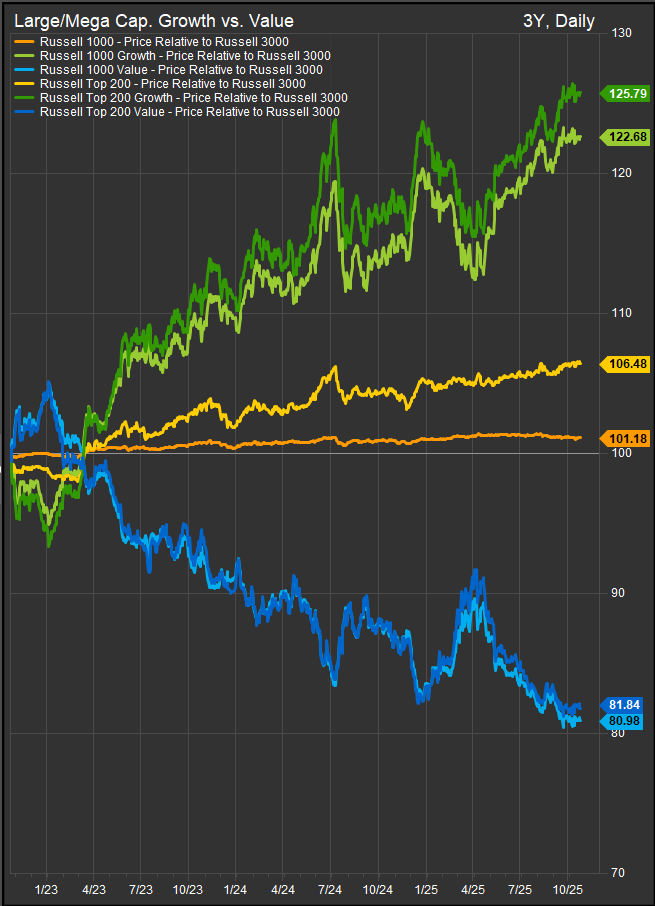

We think the bull trend will be in real trouble in two scenarios. If we get a sell-off in Growth and AI stocks against this current backdrop of sluggish economic growth and rising unemployment, that could cause the kind of drawdown we wouldn’t want to stick around for. Growth stocks have outperformed to the point (chart below) that the Mag7 now represents roughly 35% of the index market cap and the combined cap. of the Tech sector plus the Mag7 constituents in other sectors is > 50% of the S&P 500.

The other scenario is if we get an inflationary shock that completely punches out the consumer, more of the classic recession scenario. Inflation would likely cause a Growth correction due to credit and cost of capital concerns. That would likely be a big tailwind to Value stocks if the scenario developed.

Conclusion

Our key takeaway from the equity market technicals is that we should be vigilant for higher rates and inflation signals, but we also want to be sensitive to the price action of our largest stocks. Either development would threaten the trend and could potentially lead to a deep correction or recession. However, if rates stay low and price structures remain intact, that’s an indication that the buyer remains in control and there isn’t enough fear or selling pressure to knock the bull over.

Other Data sourced from FactSet Research Systems Inc.