Throughout 2024 we have highlighted fundamental and style factors that have been thematic drivers of sector rotation. Since the current bull market’s inception in 2023, Meg Cap. Growth has been the dominant leadership cohort along with the momentum factor. Corrections in the market have typically benefitted a broad range of other factors and styles, while moves to new highs are typically driven by Mega Cap. Growth. As Equities continue their correction in September, this dynamic has not changed.

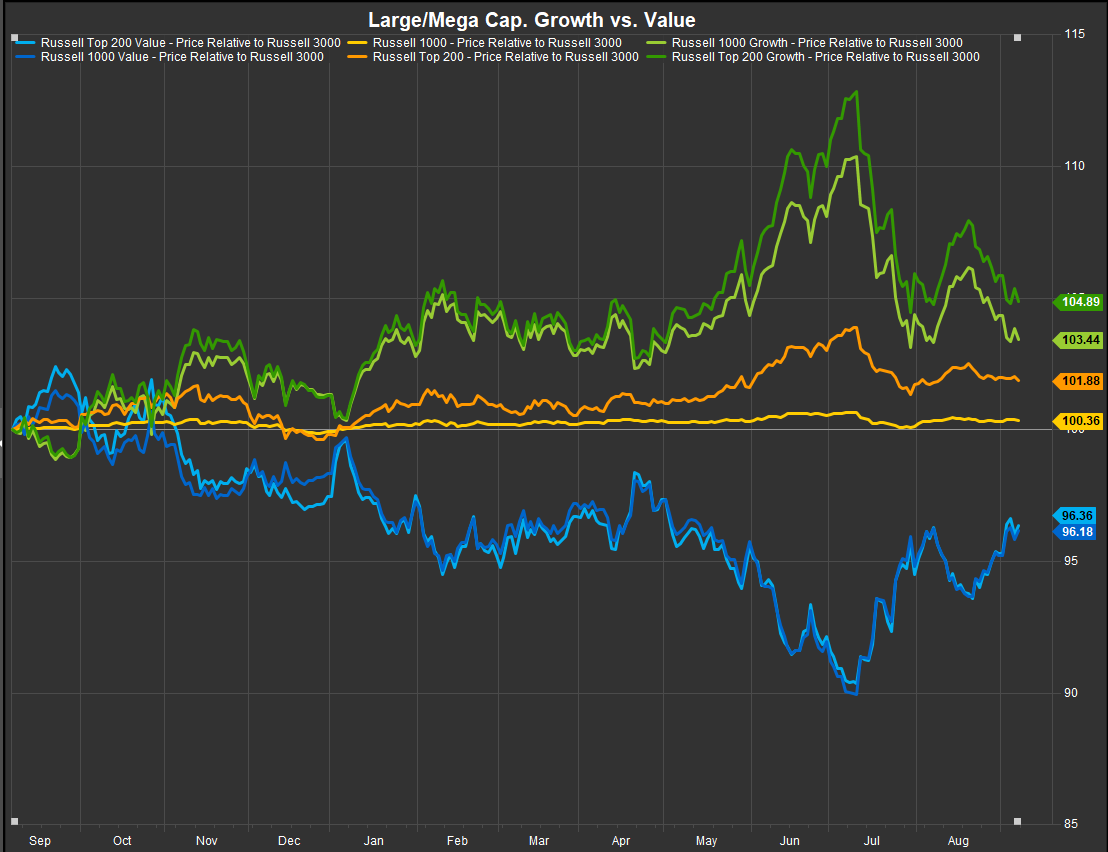

Looking at Large and Mega-Cap. Growth vs. Value in the chart below, we can see Mega Cap. Growth and Value as proxied by the Russell Top 200 Growth and Value Indices continuing to close the performance spread. That spread had widened out to a high of 23% on July 10 and has now closed to a little above 8% as of today. Value is in the driver’s seat vs. Growth in the near term.

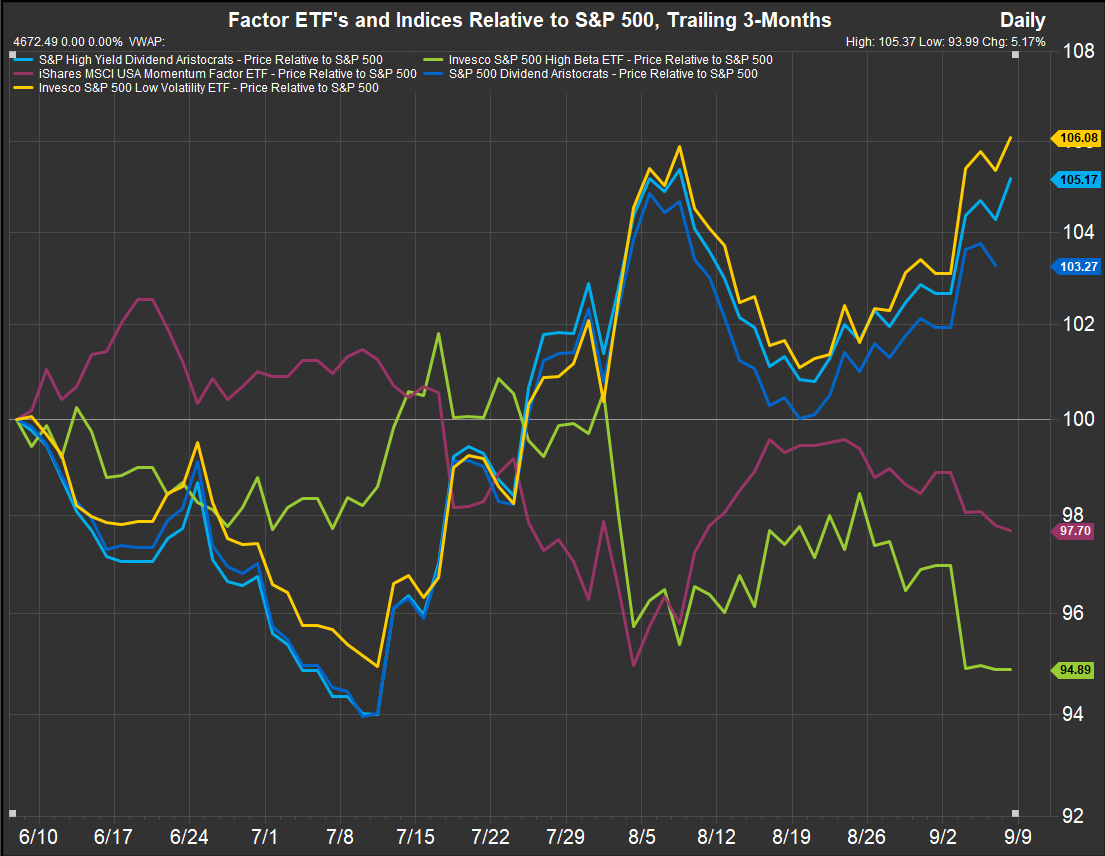

When we look at some fundamental factors we get confirmation of the corrective tone in the market since mid-July. Low Vol. is breaking out to new 3-month highs today while the dividend factor has, unsurprisingly, also surged. Momentum and High Beta have likely been a source of funds, with High Beta testing 3-month lows and the iShares MSCI USA Momentum Fund rolling over since early August.

Conclusion

This week we’ve seen a return of the “good news is bad news” dynamic. As Eco data has gone from “just right” to a mixture of strong and weak prints, investors are showing more caution in their near-term allocation decisions. There also seems to be a pretty big bet on the Fed coming in with a more aggressive stance on easing, perhaps consensus is hoping for a 50 point cut at the Septermber 17-18 FOMC meeeting. With some somewhat stronger data points in the most recent employment report, that trajectory may get muddled.

Data sourced from FactSet Data Systems