August 15, 2025

The S&P 500 continues to sit at or near all-time highs despite some clear challenges to economic activity and input price levels. We want to take this time of relative calm to talk about how to get high dividend exposure as a sector investor. The highest yielding sectors have been structural laggards in the current bull market, but they have provided downside capture when prices have corrected. Managing risk with low vol., high dividend exposure is a feature of our Elev8 Model and sector rotation strategies in general.

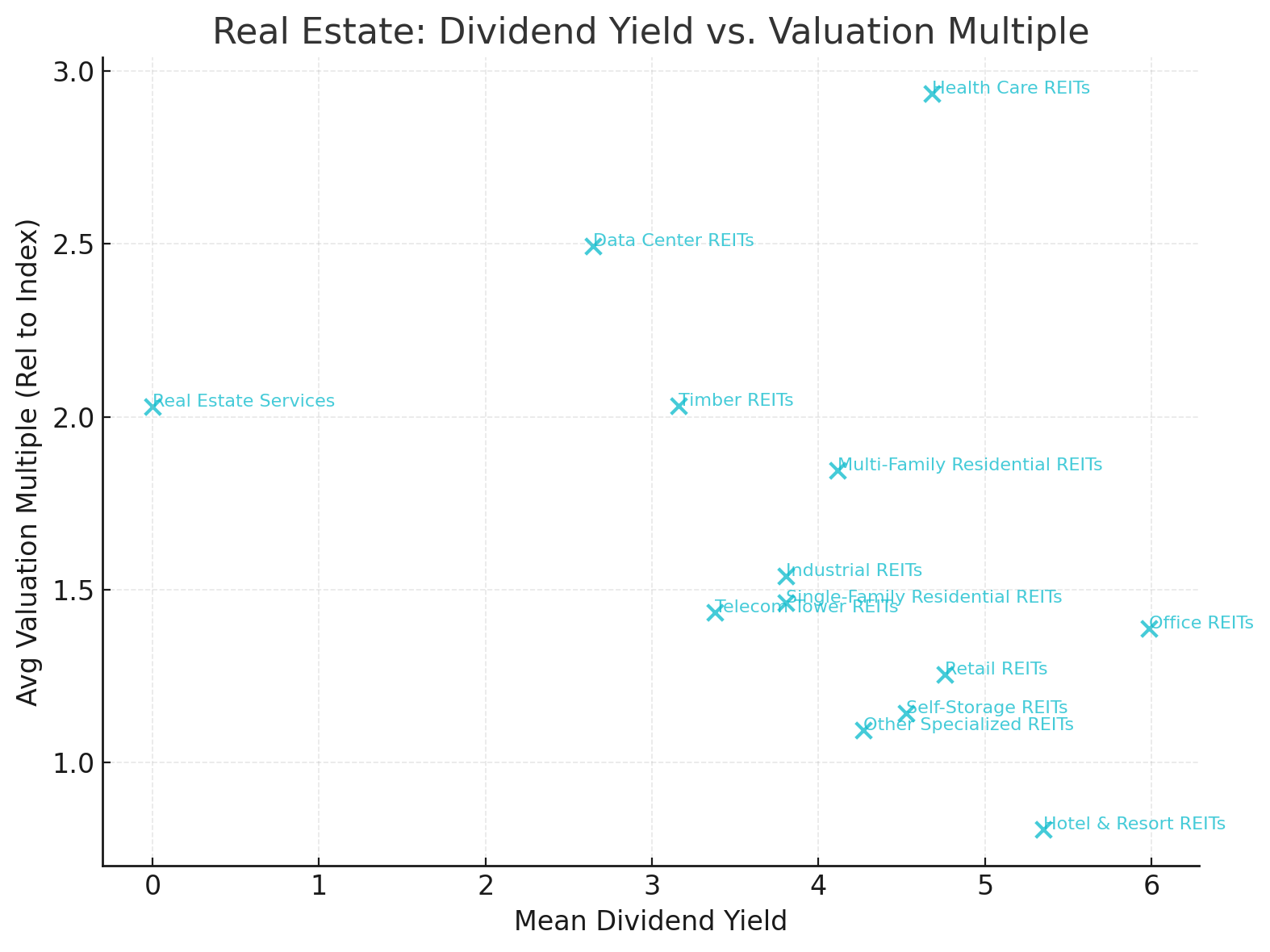

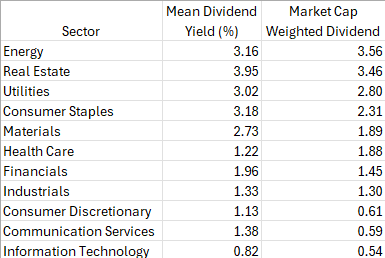

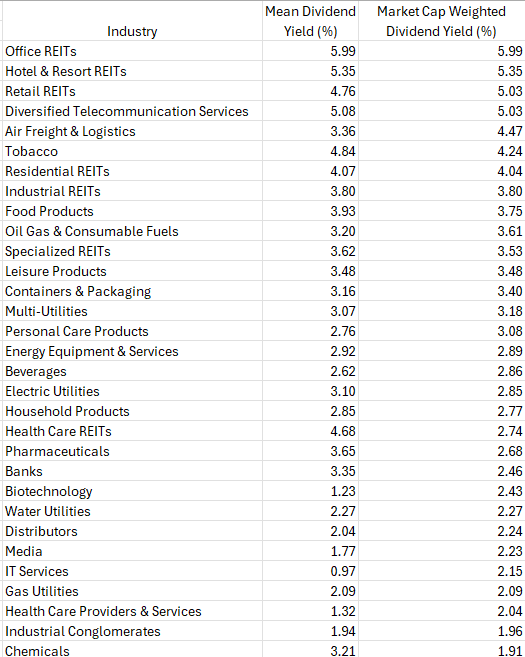

Dividend income opportunities within the S&P 500 are heavily concentrated in a few key sectors. On an equal-weighted basis, Real Estate leads with an average yield of 3.95%, supported by moderately above-market valuations and a beta near 1.0, suggesting market-like volatility. Consumer Staples follows with a 3.18% yield, trading at a discount to the index and offering a notably low beta of 0.58, while Energy ranks third at 3.16% with deep valuation discounts and moderate volatility. When weighted by market capitalization, Energy rises to the top with a 3.56% yield, ahead of Real Estate at 3.46%, and Utilities at 2.80%, each offering defensive qualities through lower betas and more stable cash flows.

At the industry level, Office REITs dominate both equal- and cap-weighted rankings with yields near 6%, albeit with slightly elevated valuations and moderate volatility. Hotel & Resort REITs follow, yielding 5.35% at discounted valuations but with a higher beta, indicating greater cyclical exposure. Diversified Telecommunication Services, Tobacco, and Retail REITs round out the top five equal-weighted industries, all offering yields above 4.7% and generally trading at valuation discounts. In cap-weighted terms, Air Freight & Logistics replaces Tobacco in the top five, reflecting strong payouts from a few large constituents.

Sector & Industry Level Average Dividend Yields (Equal Weight & Market Cap. Weight)

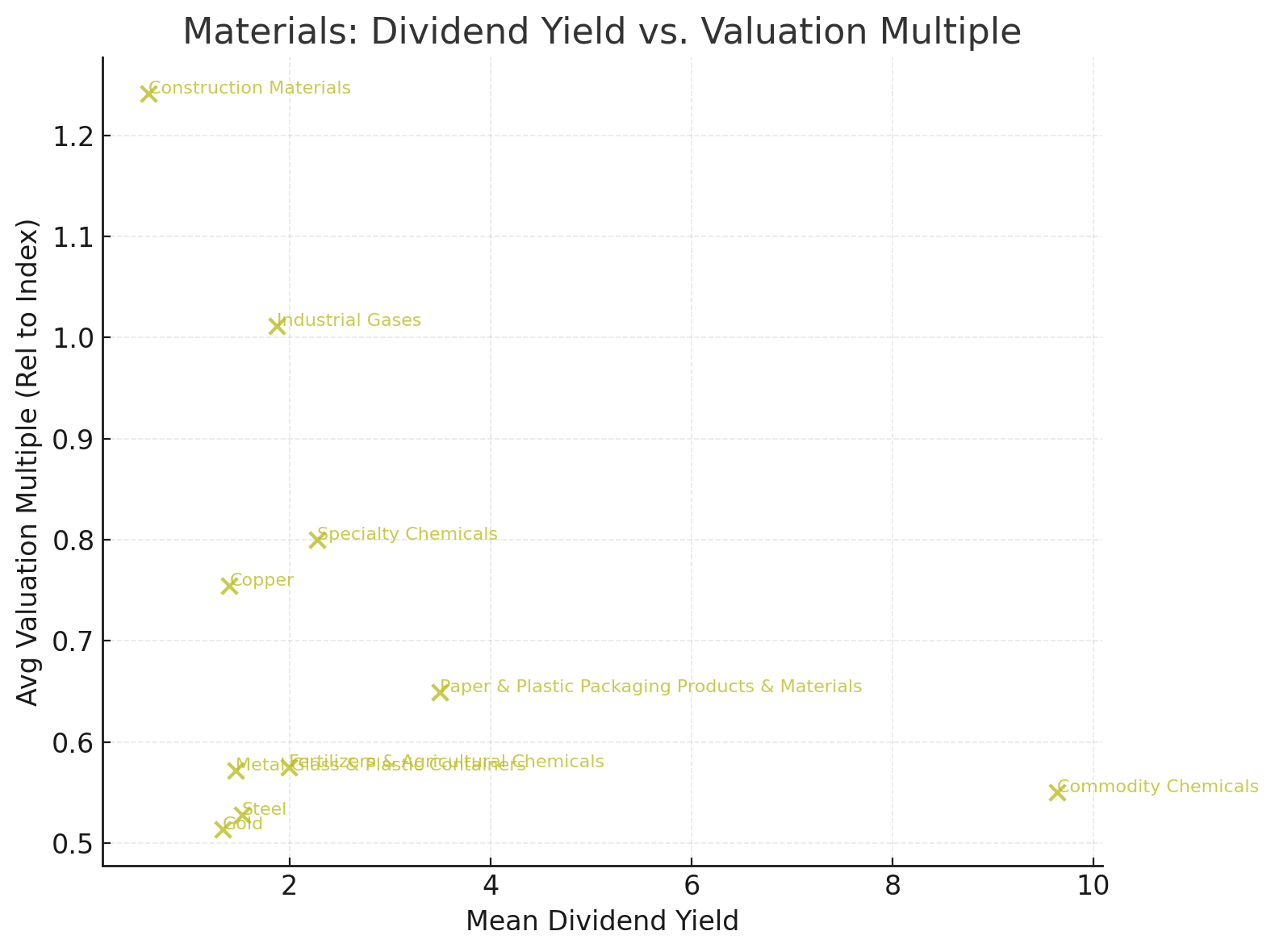

Sub-industry analysis reveals that Commodity Chemicals is the standout income source, with yields exceeding 9.6% alongside deep valuation discounts. This is followed by Office REITs, Drug Retail, Hotel & Resort REITs, and Computer & Electronics Retail, each delivering yields above 5% but with varying levels of valuation support and risk. Integrated Telecommunication Services and Tobacco appear in both equal- and cap-weighted top lists, providing stable, high-yield income streams with relatively low betas. In contrast, higher-volatility categories like Hotel & Resort REITs and Computer & Electronics Retail trade at discounts but carry greater earnings and price variability.

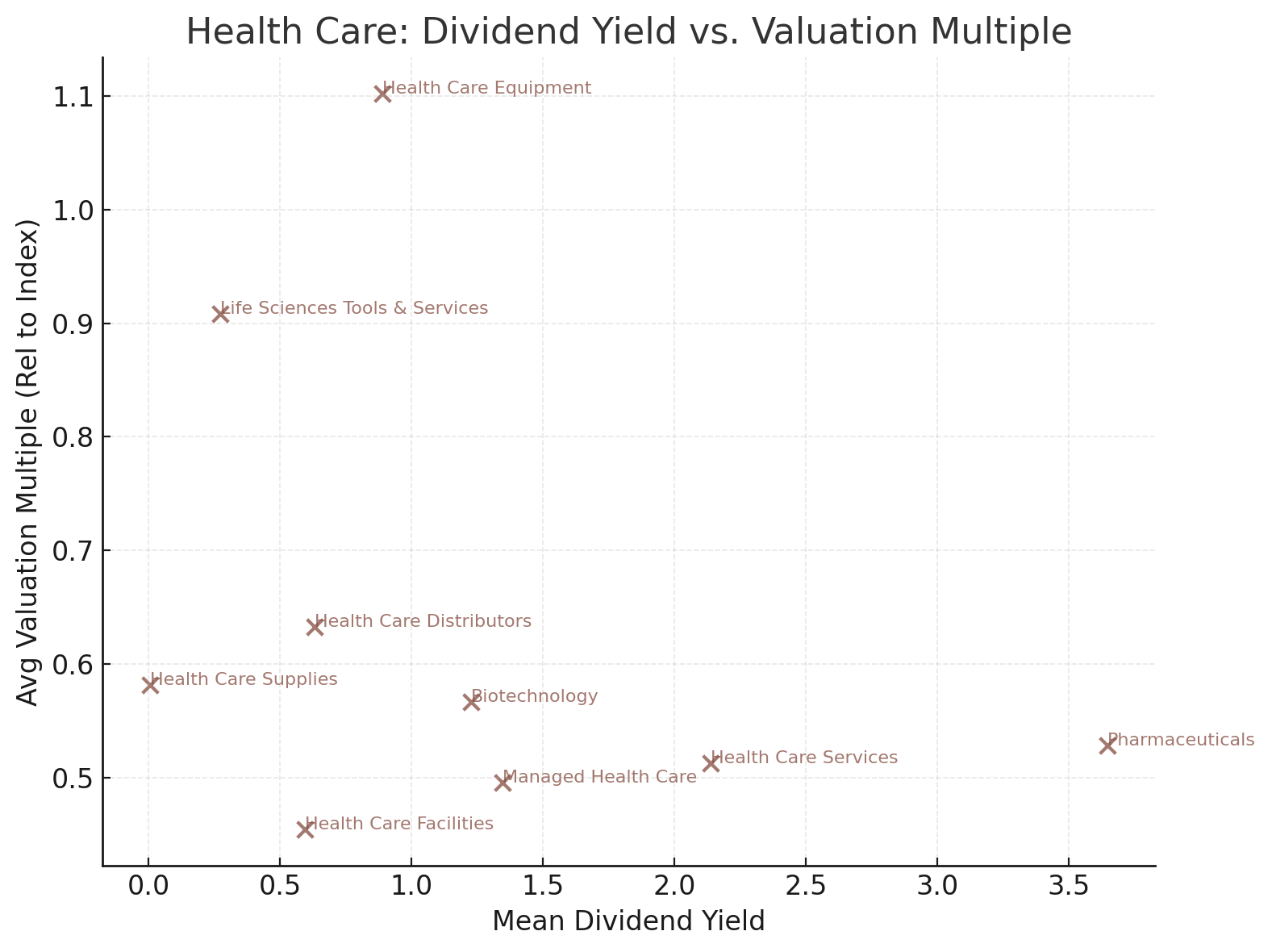

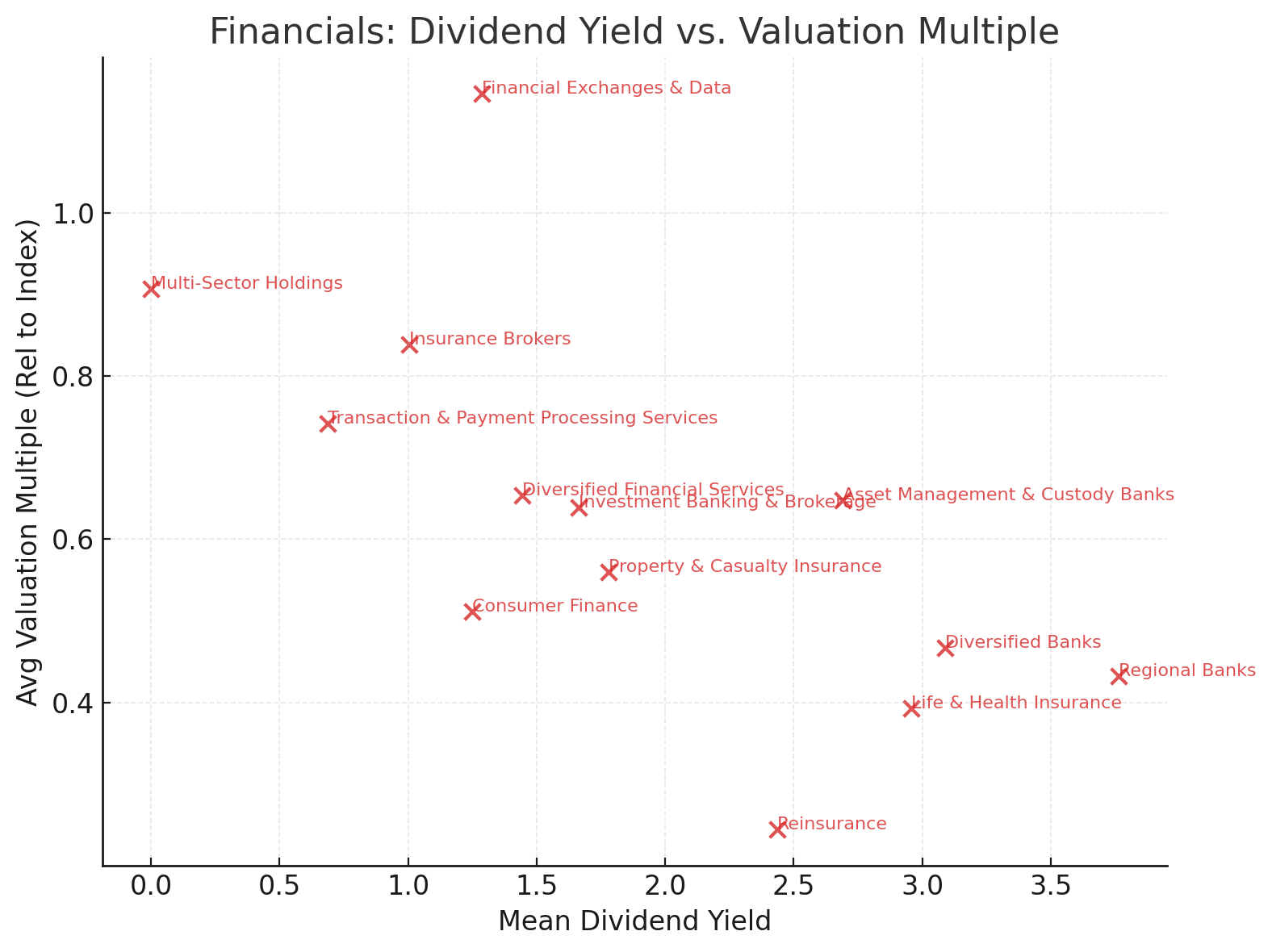

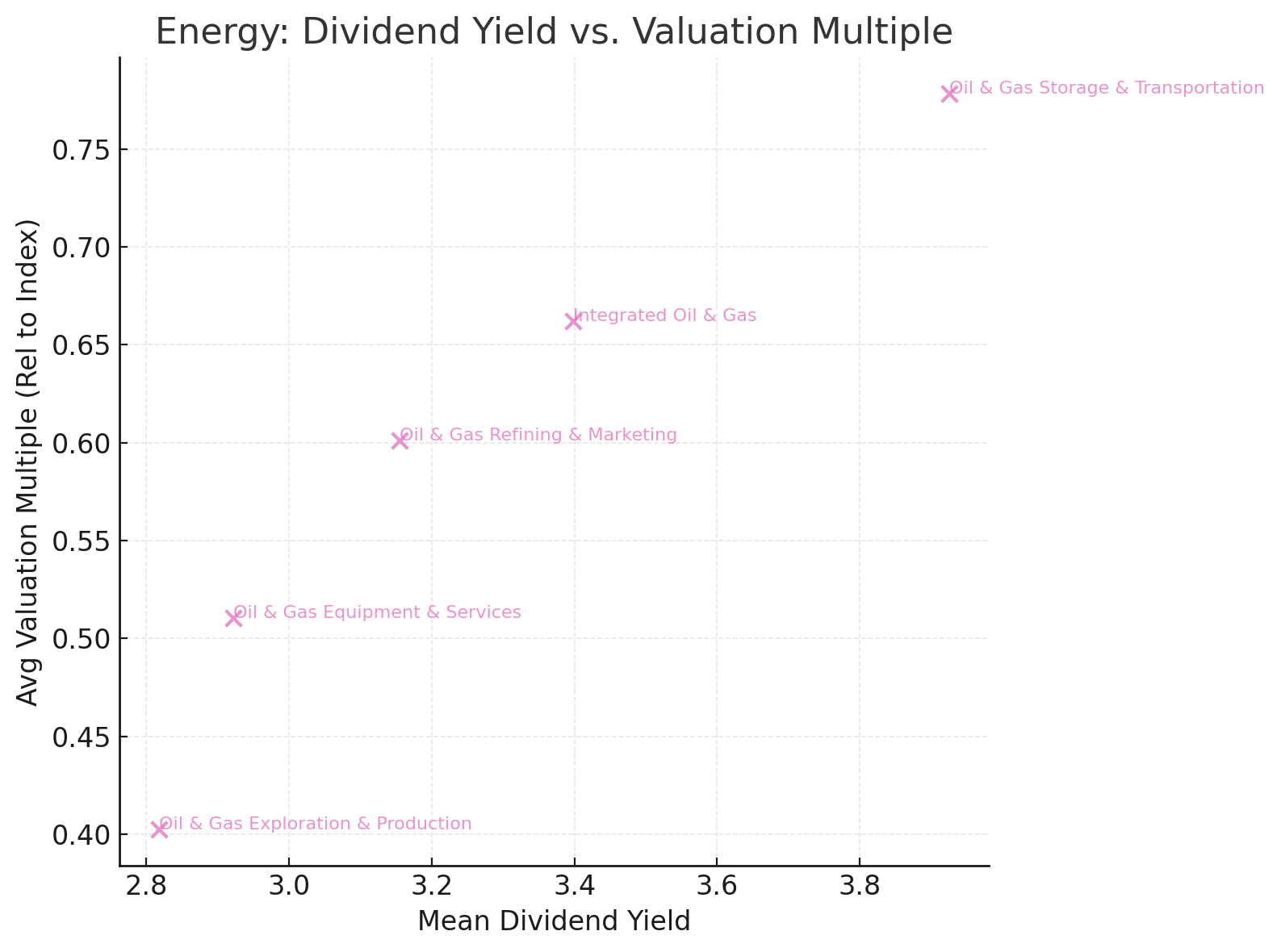

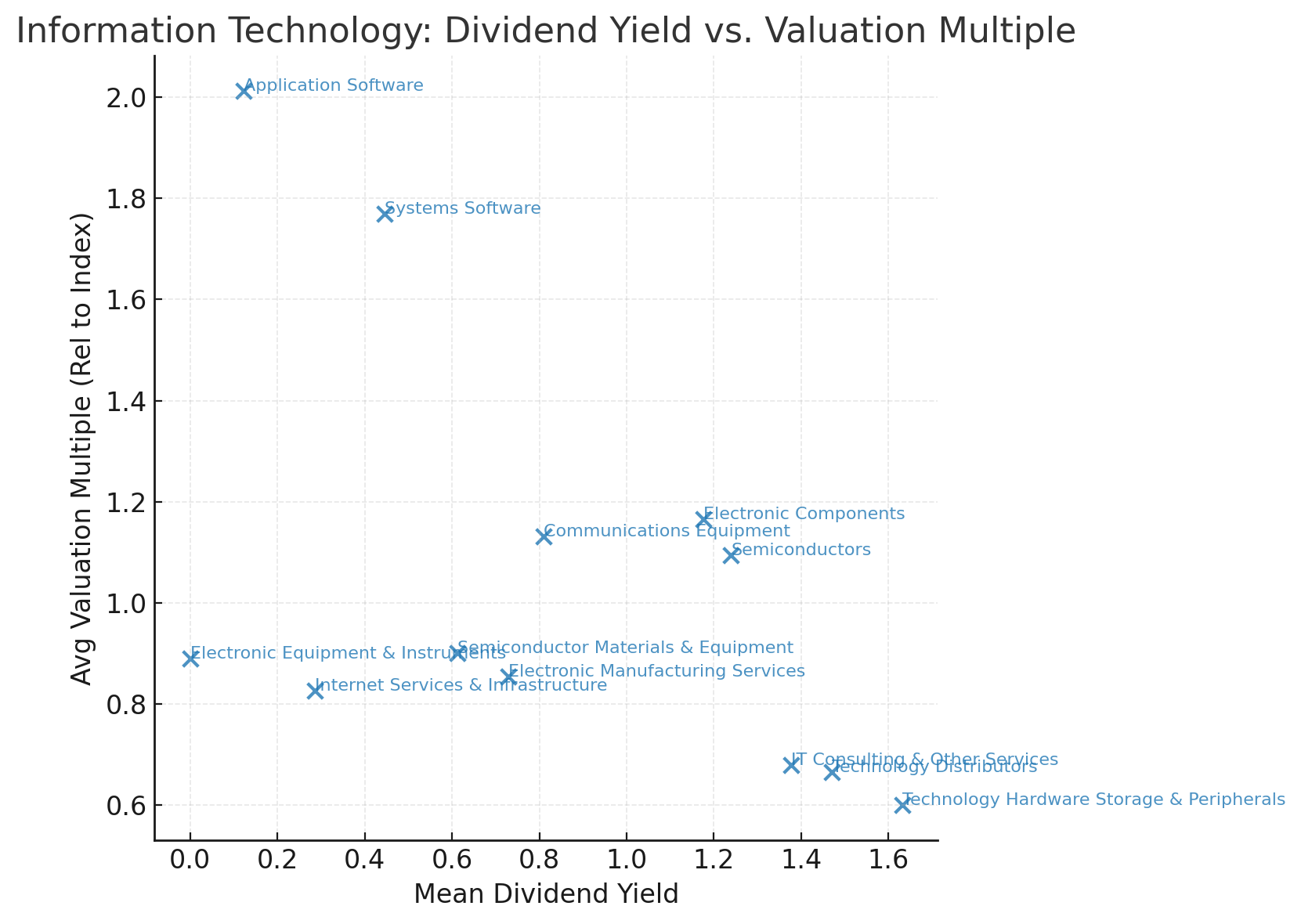

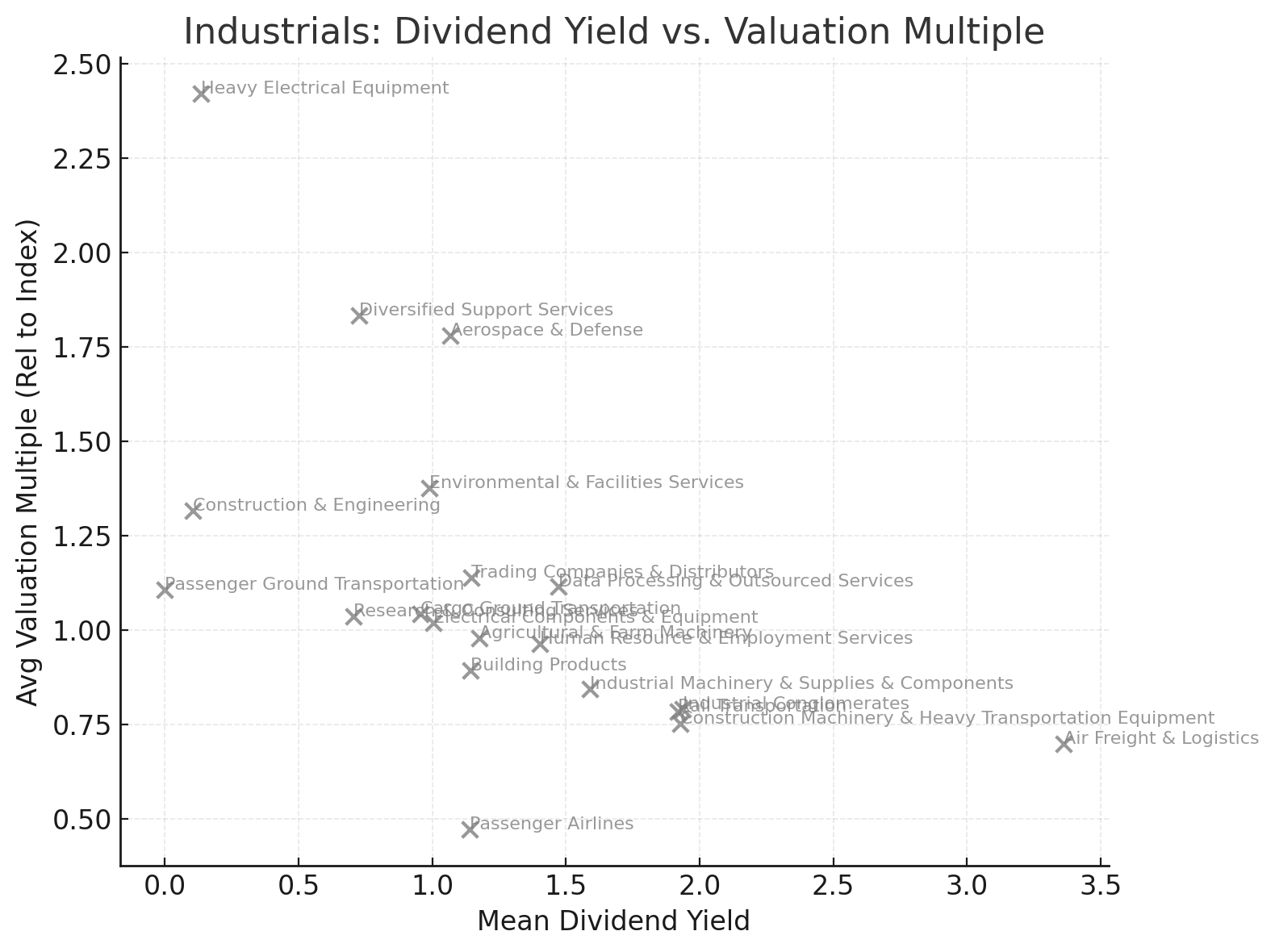

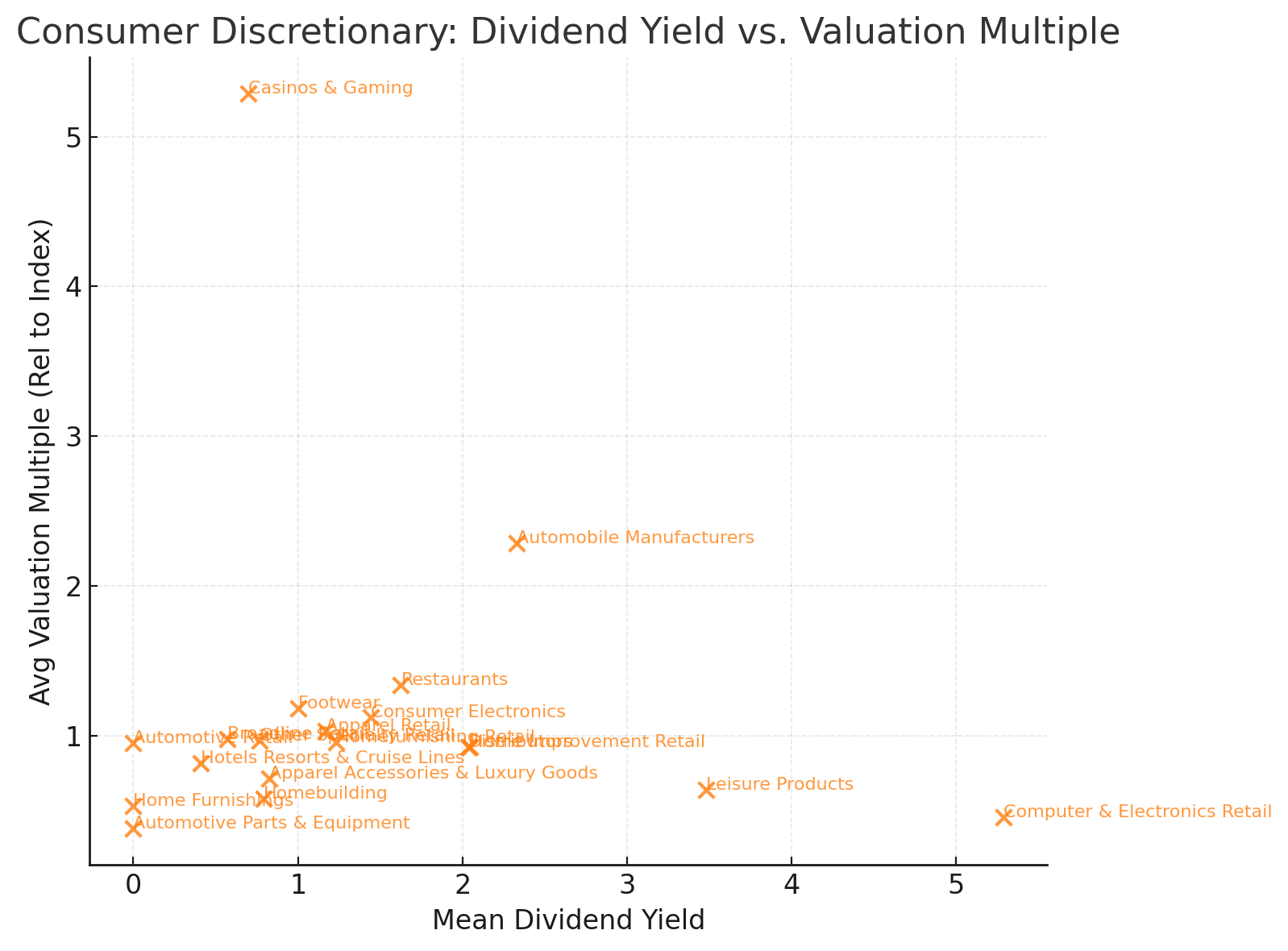

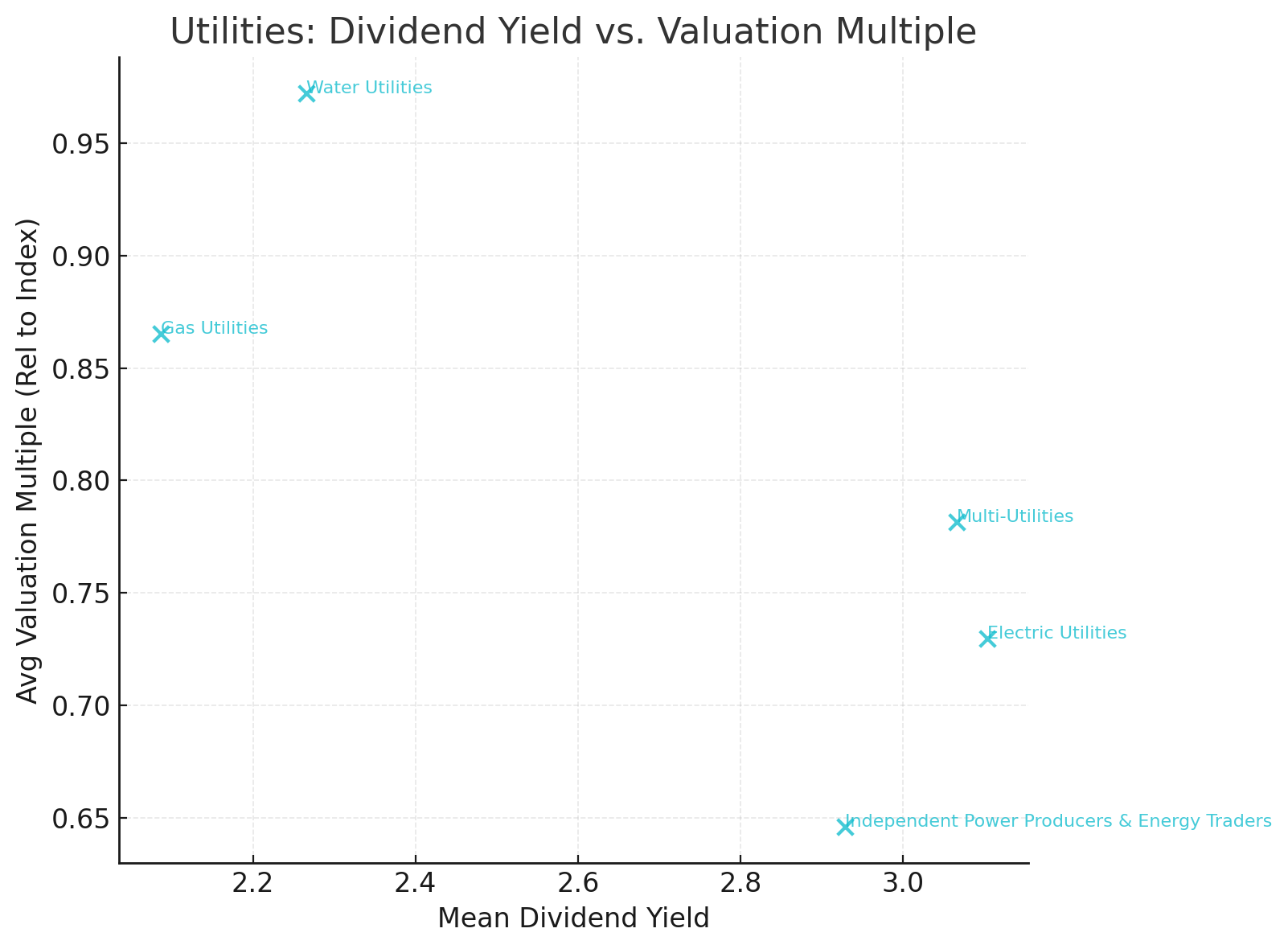

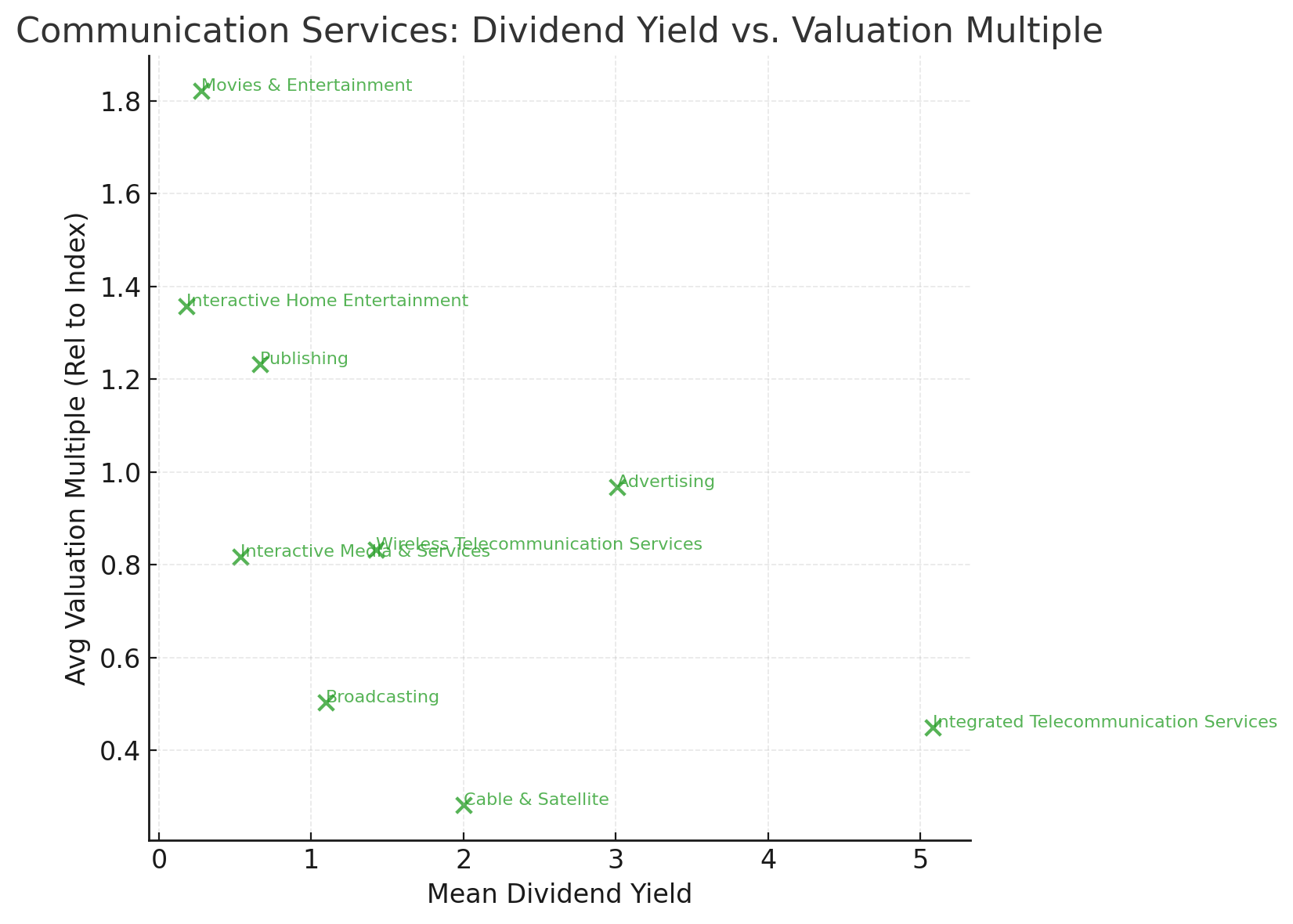

The scatter plot of sub-industry mean dividend yields versus valuation multiples shows that many of the highest-yielding groups—such as Commodity Chemicals, Drug Retail, and Telecom—trade at deep discounts, potentially offering value-oriented income opportunities. The relationship between yield and valuation is not purely linear; defensive income plays can command higher multiples, while cyclical high-yield names often remain discounted.

Sub-Industry Level Scatter Plots by Sector: Dividend Yield & Valuation (Valuation Multiple Relative to S&P 500 Index P/E)

Financials: A Strong Mix of Income and Capital Appreciation

When we consider these income and valuation metrics in the context of technical trends, we confront the reality that high dividend sectors tend to underperform the equity benchmark over longer periods of time as the typically fail to keep pace in bull markets. There are two ways to think about this. We’ve spent our time in this piece highlighting sources of income, but the combination of income, return and stability in the present trend are also a clear consideration. Strategically, we watch our breadth, sentiment and volatility indicators to look for strength and weakness in the trend, where we can then allocate to lower beta exposures, however, income generation can also produce stable return profiles in bull markets as well. At the sector level, high dividend is concentrated in lower vol. areas, but we think the strongest performance trends in the dividend space are currently with Banks and Asset Managers. These are stocks that have outperformed the S&P 500 in many instances and pay out a dividend yield about 1.5 – 2x higher than the S&P 500’s which is currently 1.5%. Some of our favorite names are below.

MS

BX

C

NTRS

Conclusion

At the sector level, income opportunities present as low vol. exposures that have trouble keeping pace with other equities in strong bull markets. However, our analysis shows that valuations for higher beta income players are more reasonable and valuations for dividend stocks in general are at a low point due to structural headwinds facing Healthcare and Real Estate sectors. Investors should be prepared for rotation into lower vol. securities when volatility spikes, but there are also dividend stocks like Banks and Capital Markets co.’s that have shown the ability to keep pace with equities while paying a heavier dividend than the index. We recommend some low vol. hedging with dividend paying stocks given present market conditions.

Data sourced from FactSet Research Systems Inc.