March 28, 2025

The S&P 500 has rallied off recent lows made on March 13, but the RSI momentum study (chart below, panel 3) has hit a near-term peak at an area of expected near-term resistance. Equities have been setting up for a pivot on Wednesday April 2 as the Trump Administration will be announcing the breadth and depth of its reciprocal tariffs at that time. There is a chance some of the more onerous measures will be walked back, but that is hard to count on given the aggressive rhetoric that has preceded the announcement. Also, per the chart below we are expecting the current rally to terminate around 5900 level where the 50-day moving average currently resided.

We continue to be skeptical of the near-term equity rally because it has come with rising rates. We are of the opinion that the US Consumer is in danger of tapping out for the cycle if upwards rate pressure continues to erode purchasing power after several years of price increases following the pandemic. The chart of the 10yr Yield has crept higher since bottoming at the beginning of March and now faces a test at near-term downtrend-channel resistance as proxied by the 50-day moving average. We’re expecting yields to fail here as well, and we think that would set a risk-off tone for equities and act as a tailwind to low vol. and dividend factor exposures.

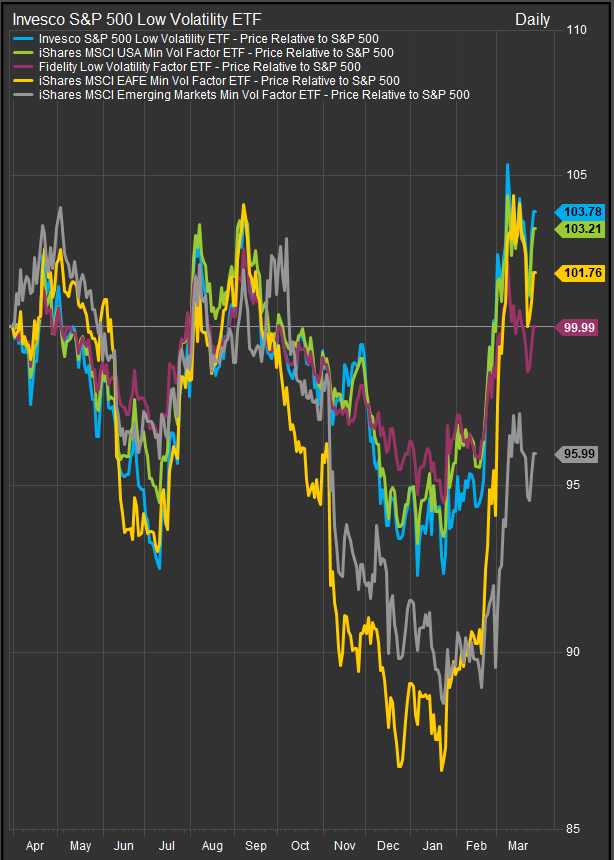

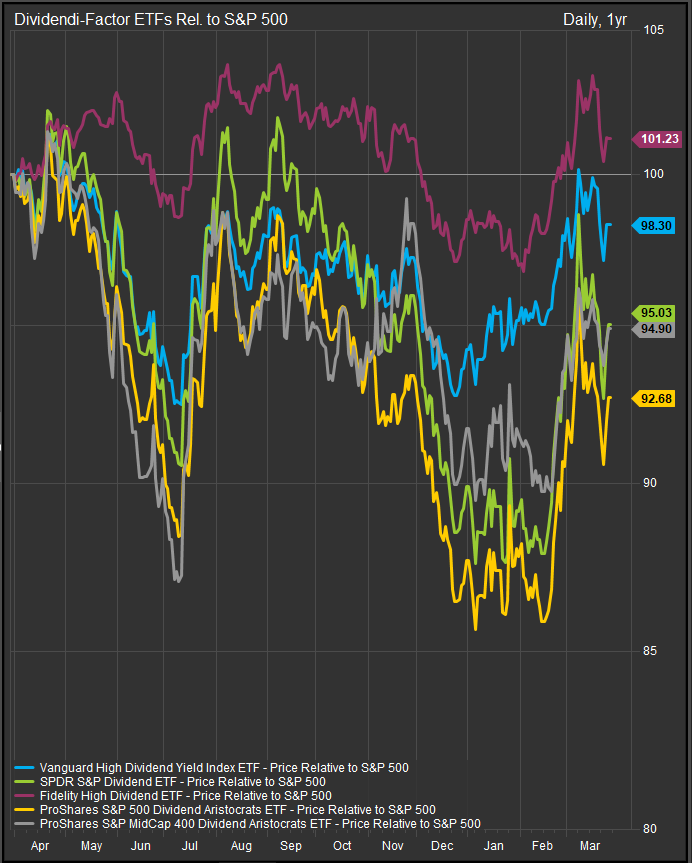

Low Vol. and Dividend Factor ETFs have seen a Pause in Outperformance

Coincident with the near-term equity rally, Low Vol. and Dividend Factor ETFs have seen a pause in recent out performance. We think that outperformance is setup to resume with the equity rally petering out. As seen on the chart below, a number of US and EAFE Low Vol. ETFs recently broke to 52-wk new highs relative to the S&P 500 (chart below). The near-term pull-back looks like a decent entry point in an ongoing bullish reversal for these exposures.

Dividend Factor Funds are showing a similar dynamic, and we are expecting another leg higher here as well as investors stay in a tariff induced crouch. If rates move lower with equities, these funds should get an additional tailwind.

Conclusion

Rates are likely to go lower in the near-term on rotation into the safety trade, but we also think lower rates have some potential to re-catalyze the bull market if borrowing costs can go down and provide relief before the US consumer taps out. We don’t love the current setup with tariff policy continuing to add inflation pressure at a time when the Fed would like to be in the business of helping out Main Street and lowering rates to get the housing market unfrozen. The upshot is we don’t think the Fed can act as a white knight here and the outlook for equities will likely have to get worse before it gets better. We think that’s a set up for rotation into safety.

Data sourced from FactSet Research Systems Inc.