May 30, 2025

The S&P 500 continues to develop a bullish reversal price structure (chart below). The rally off the early April lows is above March highs and only has congestion between 5963-6100. We remain sanguine on the recovery as US shares have established leadership vs. ex-US equities off the low (chart, bottom panel). Our near-term support level is 5786, just above the 200-day moving average while structural support for the bullish reversal pattern is at 5504. A violation of the latter level would be a sell signal.

Give the improving prospects for equities, the next phase of the game is to identify leadership themes in the bull trend. The prior bull market as driven by Mag7, Semiconductors, Homebuilders, Asset Managers and Brokerage and Staples Retailing and Distribution. Currently things are different in that homebuilding stocks remain underpressure to the downside. Semiconductors have retraced gains with the exception of AVGO and NVDA which we think is a natural evolution in the AI trend. Investors bid on everything, now there is some discernment and the average semiconductor stock is not getting a halo from the AI theme.

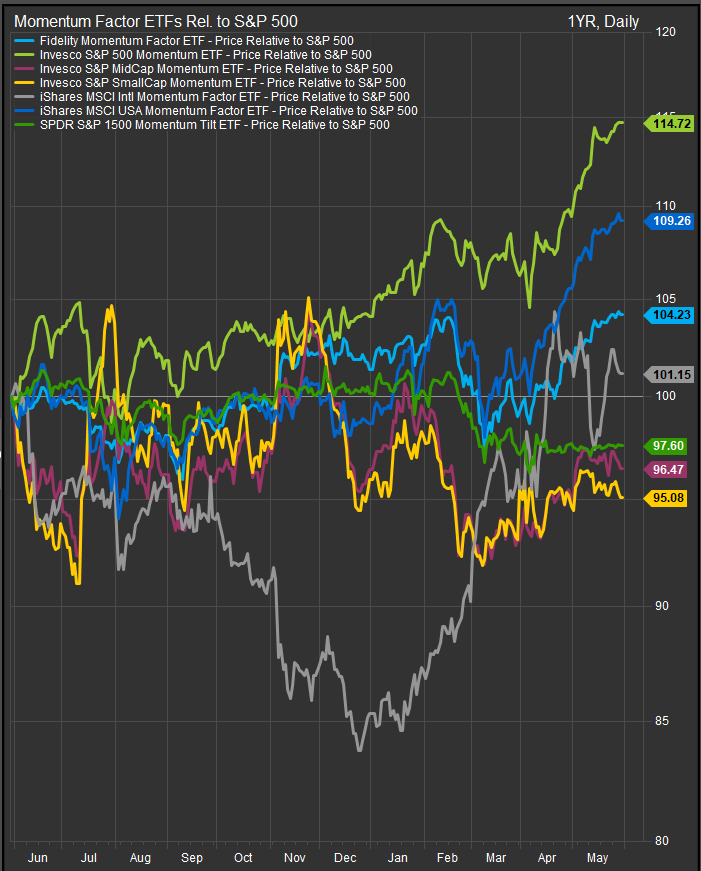

That’s all fine and good, but what is the new leadership? We like to look at the best performing momentum funds to get clues on emerging trends. The chart below is a basket of momentum ETFs covering domestic and international momentum stocks. Over the past 12-months there has been a wide dispersion in the performance of these Mo factor ETFs. We can see the iShares International Momentum Fund (IMTM) was a standout performer from December through the S&P 500 low in early April, but with the bottom in place for equities, that dynamic is now retracing. The longer-term leader among this cohort remains the Invesco S&P 500 Momentum ETF (SPMO). It saw performance consolidate vs. the S&P 500 during the Feb-April correction but held onto some gains and pivoted adroitly higher with the broad market.

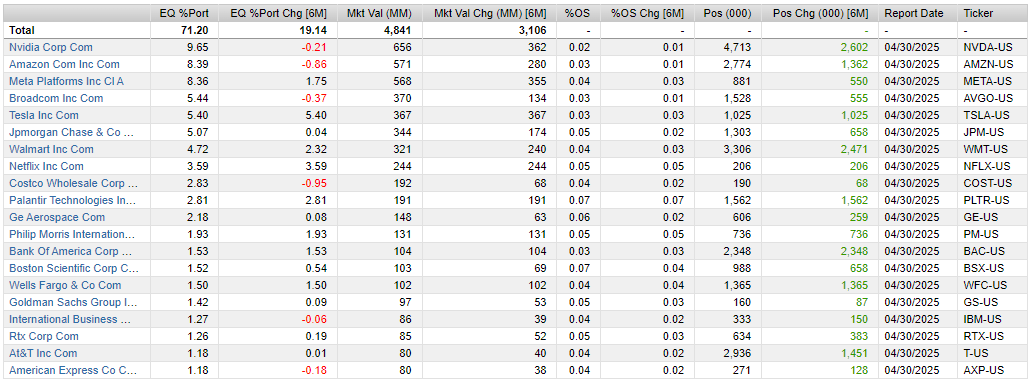

A look at top holdings in the SPMO ETF (below) shows a broad mix of themes in the fund’s top 20. What strikes us is that the Mo factor is starting to discriminate at the stock level rather than the thematic level. For example, among Mag7, NVDA, AMZN, TSLA and META are top holdings, but MSFT, AAPL and GOOG are not. Among semiconductor stocks, the fund has NVDA and AVGO, but no other Semiconductor stocks in the top holdings group. Staples and Telecom names are in there, but not Utilities.

Conclusion

The bottom line is, we’re moving into a different phase of the bull market. Big themes around AI, big data, cyber security, internet, etc. are starting filter out pretender companies that are proving to be inferior to the best of breed in each space. We think it will be appropriate for investors to start picking winners and losers within themes rather than simply adding broad exposure. This is likely the stock-pickers phase of the bull market.