January 9, 2026

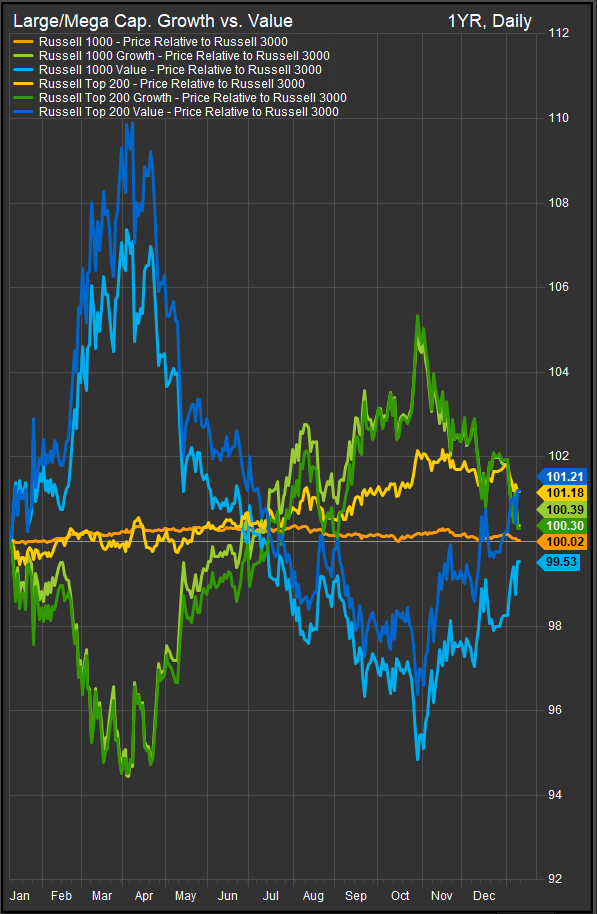

The opening weeks of 2026 have been marked by a noticeable change in market leadership, as Value-oriented equities have begun to outperform Growth (chart below) after an extended period of dominance by long-duration, technology-heavy exposures. This shift has been visible not only in relative index performance but also in investor flows toward large, liquid Value and income-oriented factor ETFs, which have outpaced the S&P 500 over the past three months. The move reflects a recalibration of investor priorities rather than a wholesale rejection of Growth—and understanding that distinction is critical for positioning going forward.

At the macro level, the catalyst for this rotation has been the direction and volatility of interest rates, not an outright tightening shock. After a period in which declining inflation and easing policy expectations consistently supported Growth valuations, yields have become more range-bound and less predictable. Even modest increases in real rates materially affect equity discounting, compressing multiples on stocks whose valuations depend heavily on cash flows far into the future. In contrast, Value sectors—particularly Financials, Industrials, and dividend-paying cyclicals—derive a greater share of their valuation from near-term earnings and cash returns, making them more resilient when discount rates stop falling.

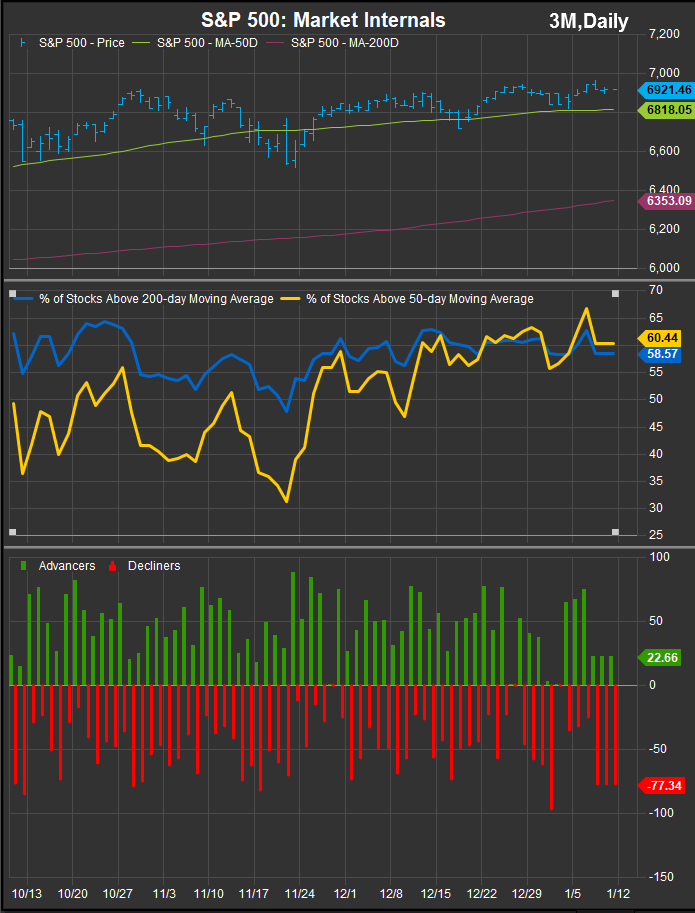

Fundamentally, the rotation has also been aided by improving earnings breadth. Consensus estimates compiled by FactSet indicate that while headline S&P 500 earnings growth remains robust, the S&P 493 has begun to close the gap, reducing the premium investors are willing to pay for a narrow cohort of Growth leaders. This shift has coincided with stabilizing—not accelerating—earnings revisions in Technology and Communication Services, while revisions in select Value-heavy sectors have turned modestly positive. The result is a market environment where valuation discipline matters more than it has over the past several years.

Mag7

S&P 500 Breadth Measures

Flows and positioning dynamics have reinforced this fundamental backdrop. Year-end rebalancing, profit-taking in crowded Growth exposures, and redeployment into dividend and Value strategies have all served as funding sources for the rotation. Large, liquid Value-tilted ETFs and dividend strategies have benefited from this repositioning, particularly as investors seek to reduce concentration risk without moving fully defensive. Importantly, this does not signal a broad risk-off shift; rather, it reflects a preference for earnings certainty and cash-flow visibility at a late stage in the cycle.

However, while the early-2026 outperformance of Value is grounded in real macro and earnings considerations, it does not yet meet the criteria for a durable regime change. Historically, sustained Value leadership requires either a persistent rise in real interest rates, accelerating nominal growth, or a meaningful deterioration in Growth earnings. None of these conditions are firmly in place. Inflation continues to moderate, growth remains steady rather than overheating, and Growth sectors still command superior absolute earnings growth—even if the pace of positive surprises has slowed.

As a result, much of the recent Value strength should be viewed as tactical rather than structural. Flow-driven rotations can persist for months, particularly when valuation spreads are wide, but they tend to fade unless reinforced by a clear macro inflection. If rates resume a downward trend or volatility subsides, investors are likely to re-engage with high-quality Growth franchises, especially those tied to secular drivers such as AI, cloud infrastructure, and digital services.

The most likely outcome for 2026, therefore, is not a clean handoff from Growth to Value, but a more rotational market in which leadership shifts back and forth as rates, earnings revisions, and risk appetite evolve. In that environment, binary style bets become less effective, while balanced portfolios that pair selective Value exposure with high-quality Growth franchises are better positioned to navigate changing regimes.

Bottom line

Value’s early-2026 outperformance is a rational adjustment to rates, valuations, and earnings breadth—not an over-reaction. Yet absent a sustained rise in real rates or a breakdown in Growth earnings, it remains a late-cycle rotation, not the start of a long-term Value renaissance. Investors should treat it as an opportunity to rebalance and diversify, rather than as a signal to abandon Growth altogether.

Sources

- FactSet – Earnings Insight and Sector Earnings Breadth Data

- Federal Reserve – FOMC Statements and Summary of Economic Projections

- Federal Reserve Bank of St. Louis (FRED) – Treasury yield and real-rate data

- FTSE Russell – U.S. Growth vs. Value style index performance

- MSCI – Growth and Value Index Methodology and Returns

- S&P Dow Jones Indices – Style and factor performance data

- BlackRock – Global Investment Outlook and factor research

- Vanguard – Market Perspectives on valuation and style cycles

Other Data sourced from FactSet Research Systems Inc.