With ZION, WAL and FHN in the news for the wrong reasons today, we should revisit the relationship between banking stress and the AI trade which has grown to the point that it influences the primary trend for equity prices when it comes under pressure. Financial stress in the U.S. banking system tends to ripple well beyond the lenders at the center of it. When confidence in regional banks weakens, investors instinctively reassess risk across the market. Yet the relationship between bank stress and the technology sector—particularly the AI trade—is more nuanced than it might appear. While conventional wisdom suggests that credit tightening and liquidity shocks should hurt high-growth equities, history tells a more complicated story. During the 2023 regional-bank crisis, the Technology Sector actually outperformed, led by mega-cap names such as NVIDIA, Microsoft, and Apple, which investors viewed as safe, cash-rich alternatives to fragile financials. The question now is whether renewed bank stress in 2025 would trigger a similar defensive rotation into tech—or a broader de-risking across the AI trade.

In 2023, the AI Trade was a Haven

One reason technology outperformed during the 2023 banking turmoil was relative balance-sheet strength. While regional banks struggled with unrealized bond losses and deposit outflows, the largest technology companies were sitting on record cash reserves. At the time, Apple’s cash position exceeded $160 billion, Microsoft held more than $110 billion, and Alphabet had over $100 billion. Those reserves provided insulation from tightening credit conditions, allowing these companies to keep investing in cloud infrastructure and AI development even as banks curtailed lending. Investors seeking stability rotated into these firms as “new defensives”—businesses with global revenue bases, strong free-cash flow, and minimal refinancing risk.

Another factor was the interest-rate backdrop. The 2023 bank stress accelerated expectations for Federal Reserve rate cuts, pushing yields sharply lower. The 2-year Treasury yield fell from 5.07% to 3.76% in less than three weeks, the largest decline since 2008. That drop in rates boosted valuations for long-duration growth assets—particularly AI leaders such as NVIDIA, whose shares nearly doubled in the months that followed as investors bet that falling discount rates would magnify future earnings. In short, the 2023 bank run triggered a flight within equities, not out of them: from credit-sensitive cyclicals into cash-rich, secular-growth technology.

Structural tailwinds also supported the sector. AI spending was in its acceleration phase—cloud providers were ramping GPU purchases, corporate budgets were expanding, and sentiment toward generative AI was euphoric. That growth narrative helped investors overlook macro risk. For many, technology was the only sector offering both earnings visibility and balance-sheet resilience at a time when financials, real estate, and cyclicals were under pressure.

Why Things Might Be Different This Time

While those factors could still apply today, several conditions have shifted in ways that may make the current episode more challenging for the AI trade. The most important is valuation. By late 2025, the tech sector’s relative price-to-earnings ratio versus the S&P 500 has climbed to its highest level since 2000. The “AI trade” is no longer under-owned—it is the market’s most crowded position. In March 2023, positioning in large-cap tech was defensive; in 2025, it is speculative. That inversion means that any shock to liquidity or credit confidence could trigger profit-taking rather than rotation into tech.

Second, the macro environment is different. In 2023, bank stress coincided with a Fed pivot toward easier policy. Today, the Fed is already cutting rates and the market has priced in further easing, leaving less room for surprise dovishness. If regional-bank stress were to flare again now, it would likely signal economic deterioration rather than policy relief—a scenario that historically hurts growth stocks as earnings expectations adjust downward.

Third, the AI capital-spending cycle is maturing. After two years of extraordinary investment, hyperscalers are scrutinizing ROI and moderating data-center buildouts. If credit contraction among regional lenders were to spill into real-estate or equipment financing, smaller AI and chip-infrastructure firms could feel the pinch. The industry’s capital intensity means that tighter lending conditions could delay projects, particularly for second-tier suppliers or start-ups that lack access to public markets.

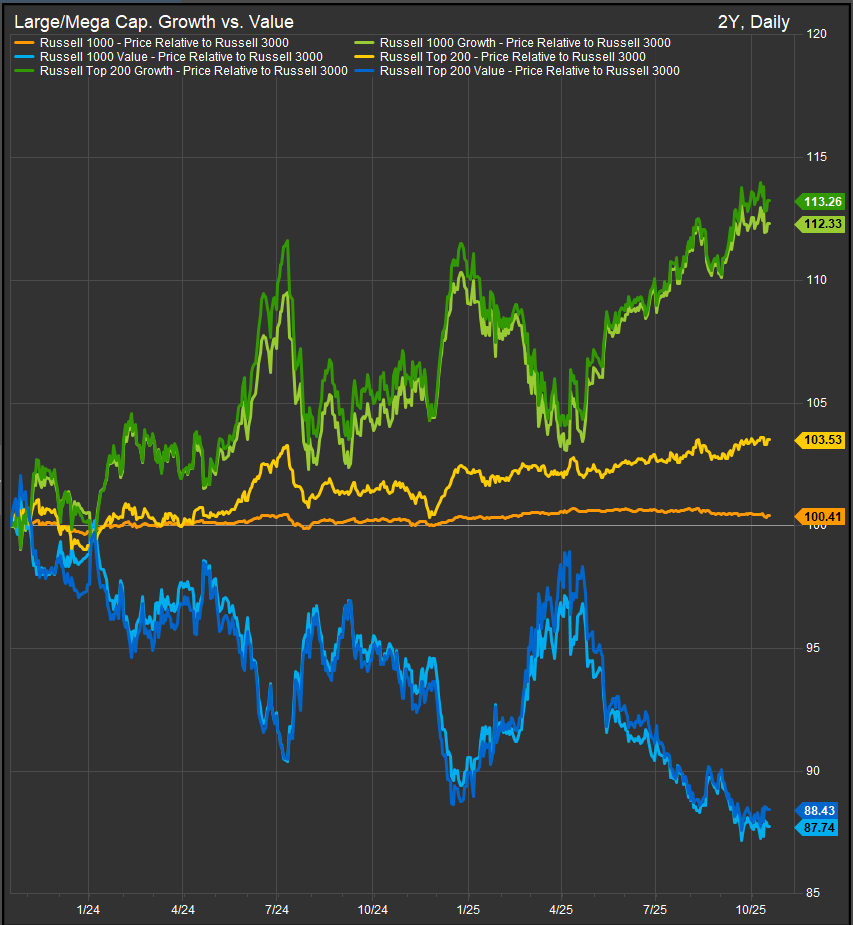

Finally, sentiment itself is a constraint. In 2023, AI optimism was fresh and underwritten by discovery—new capabilities, explosive growth narratives, and limited skepticism. In 2025, that enthusiasm has given way to valuation fatigue. Investors are more sensitive to policy, earnings, and liquidity risks than they were two years ago. If regional-bank headlines were to rekindle fears of systemic risk, there is less cushion of disbelief—and more capital sitting in crowded trades—to unwind. If that is the case, Growth stocks are in a position to see profit taking based on where Growth vs. Value performance stands since the bull market cycle began in early 2023 (chart below).

Why Things Might Still Be Similar

Even so, there are reasons to think the market’s response could echo 2023. The largest technology companies remain effectively credit-independent, generating cash far faster than they can deploy it. In a risk-off environment, they still look safer than leveraged sectors tied to bank credit or consumer demand. If stress stays contained to a few regional lenders, the same “flight to quality within equities” dynamic could re-emerge—favoring large-cap tech and AI platform firms over small-cap cyclicals.

Moreover, the AI theme continues to represent one of the few clear long-term growth stories in global markets. Institutional investors facing structural constraints—pension funds, endowments, sovereign wealth funds—often use such periods of stress to add exposure on weakness to secular themes. That tendency helped the sector recover quickly in 2023 and could again in 2025, provided the credit shock does not metastasize into a full-blown liquidity crisis.

Conclusion

The interplay between regional-bank stress and the AI trade underscores how market psychology evolves over the cycle. In 2023, financial instability strengthened the technology sector by accelerating a rotation into its most liquid, cash-rich leaders. In 2025, those same companies are larger, pricier, and more crowded—meaning they could both benefit from and amplify volatility. If credit stress remains limited and rate expectations ease modestly, tech could again serve as a relative haven. But if bank problems broaden or economic data deteriorate, the sector’s elevated valuations could make it a source of funds rather than a destination.

Ultimately, whether the AI trade repeats its 2023 resilience or suffers a sharper pullback this time will hinge on one question: does bank stress tighten liquidity enough to undermine confidence, or merely redirect it toward the safest corners of growth? We think investors should be paying close attention to the direction of interest rates (upwards pressure on Treasury Yields would put further pressure on credit), factor performance trends and sector performance trends. Tech outperformance in a correction would be a sign that investors don’t think bank stress will derail the Growth trade. In 2020 during the pandemic and in early 2023 enthusiasm for Tech shares insulated the sector from stress and added alpha to portfolios. We need to keep that in mind as the latest credit issues play out.

Bibliography / Sources

- Federal Reserve Board, Senior Loan Officer Opinion Survey on Bank Lending Practices, March 2023 & 2025.

- Federal Reserve Bank of St. Louis (FRED), 2-Year Treasury Yield and National Financial Conditions Index.

- S&P Dow Jones Indices, S&P 500 Sector Performance Data, March–May 2023.

- Bloomberg Intelligence, Tech Sector Flows and Relative Performance During the 2023 Bank Crisis, July 2023.

- KBW Nasdaq, Regional Bank Index (KRX), Historical Data 2023–2025.

- McKinsey Global Institute, AI Investment and Capital Allocation Trends, 2024–2025.

- FactSet, S&P 500 Valuation Metrics by Sector, September 2025.

- U.S. Federal Deposit Insurance Corporation (FDIC), Quarterly Banking Profile, 2025.

- Morningstar Direct, Investor Positioning and Crowding Indicators, 2025.

- BIS Quarterly Review, Liquidity Stress Transmission Across Asset Classes, December 2024.

Other Data sourced from FactSet Research Systems Inc.