ETF Insights | February 2, 2025 | Financial Sector

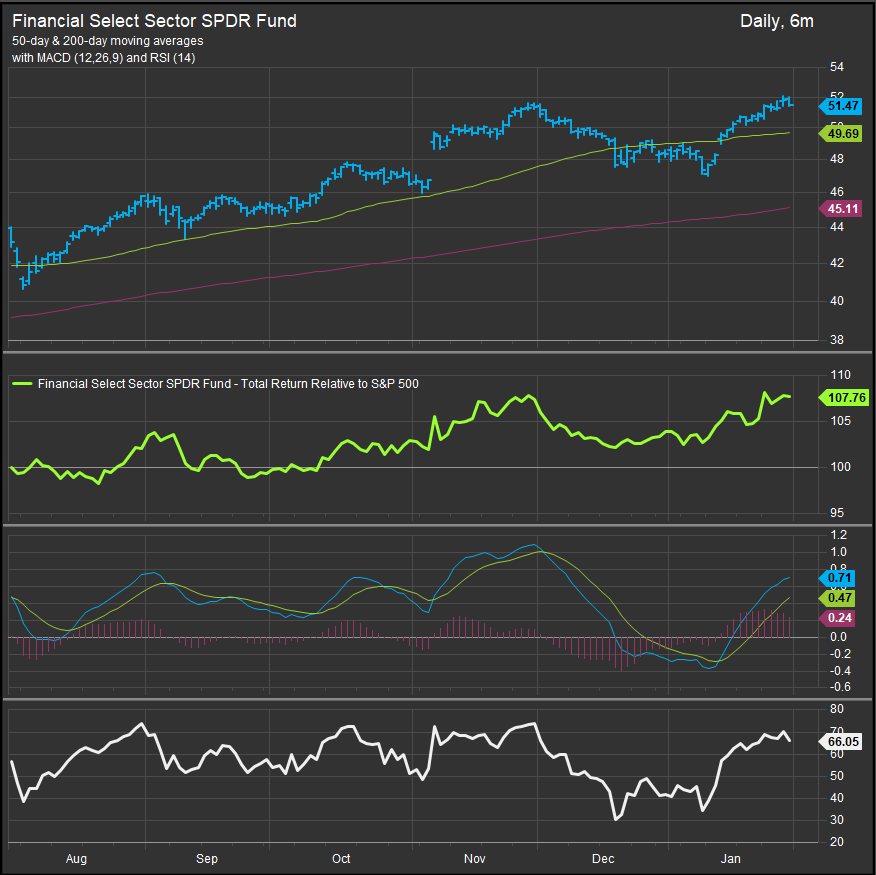

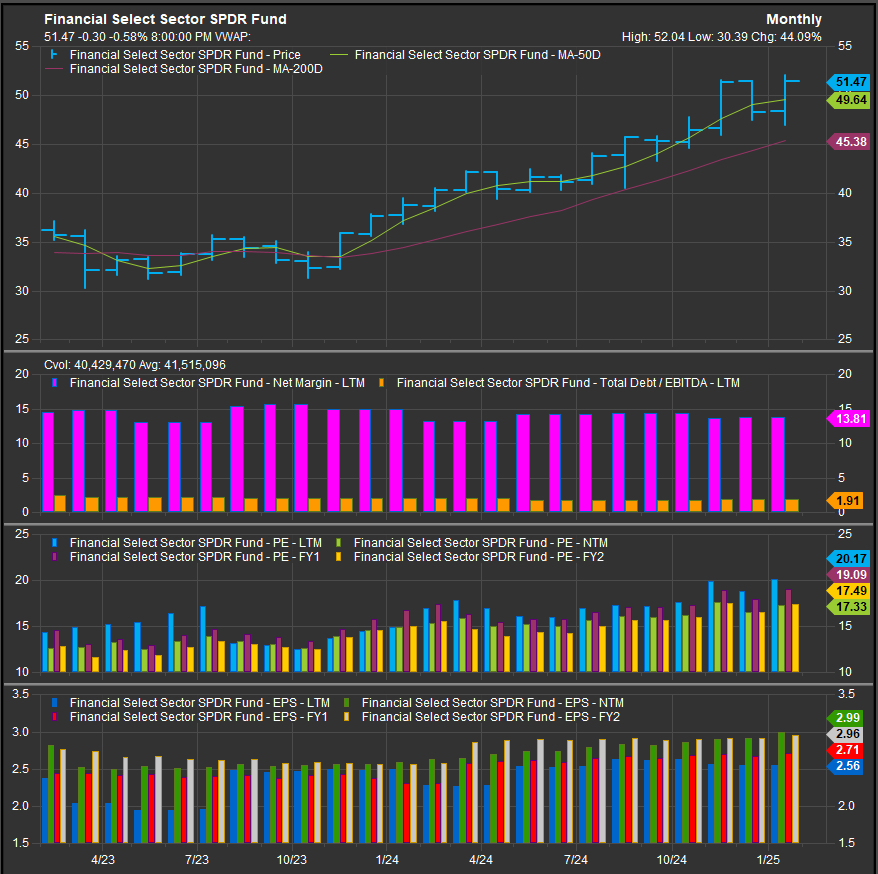

S&P 500 Financial Sector Price Action & Performance

The Financial Sector outperformed in January finishing the month near all-time highs. The Sector has seemingly been the beneficiary of the Tech. Sector fade that has been going on since November of 2024. Oscillator work has the MACD on a buy signal while the RSI study is in overbought territory. This is consistent with an uptrend, and we will see if we get some sustained bullish momentum here.

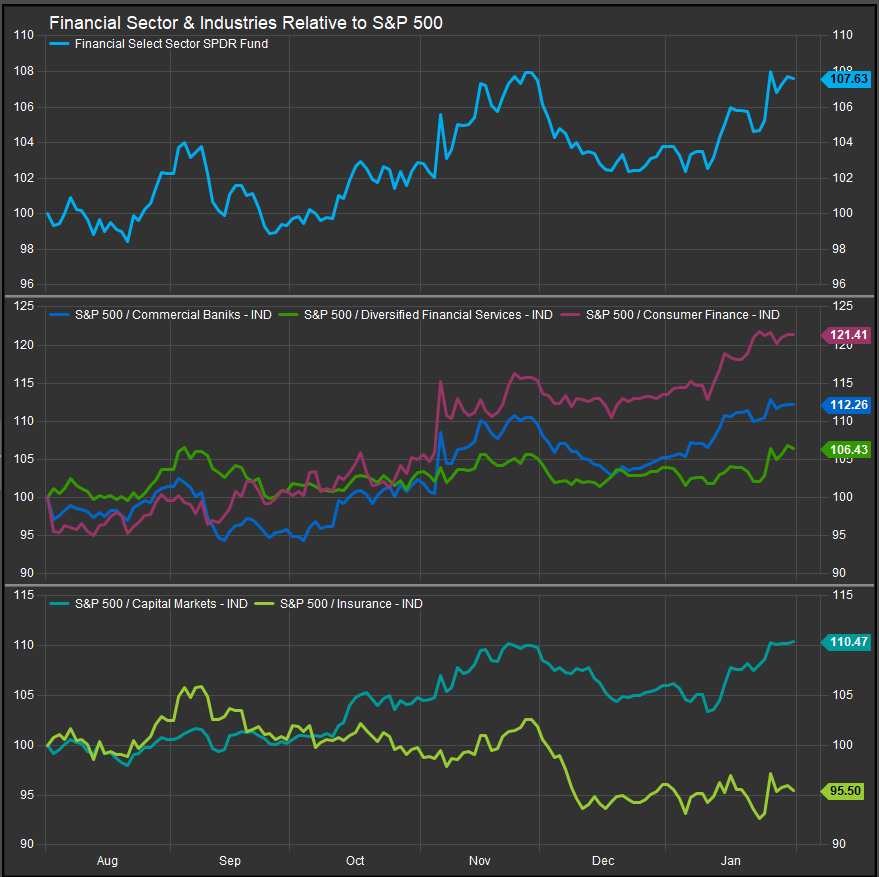

S&P 500 Financial Sector: Industry Performance Trends

The Financial Sector continues to see broad upside participation across industries. The Insurance industry is the loan laggard while Banks, Diversified Financials, Consumer Finance and Capital Markets are outperforming robustly.

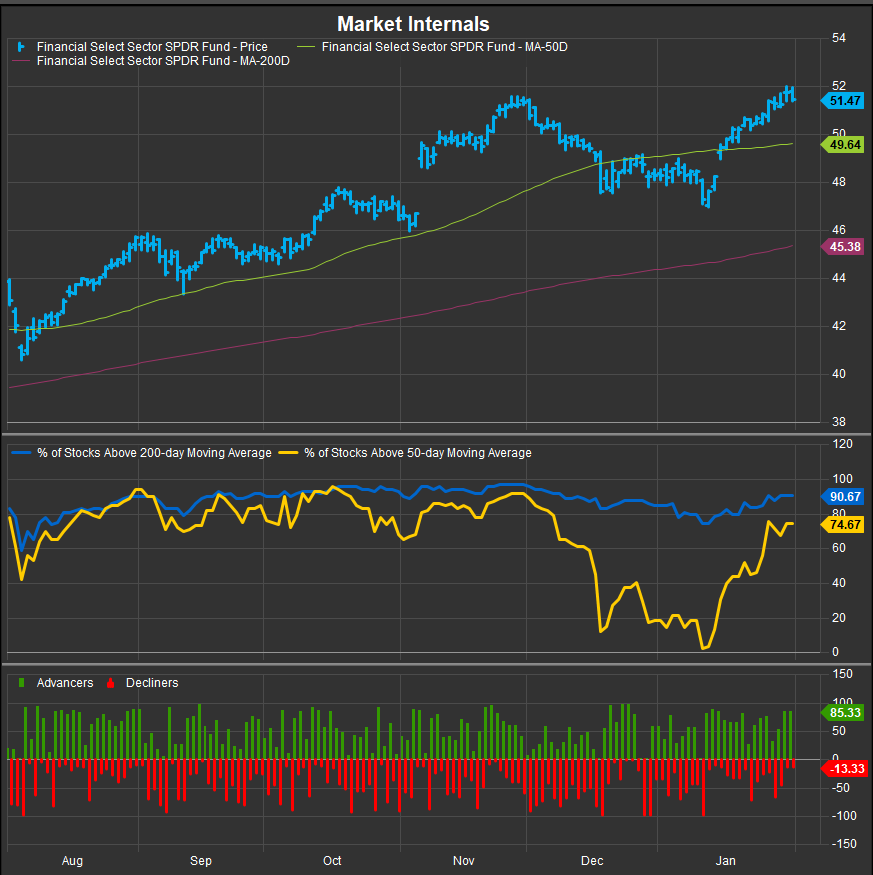

S&P 500 Financial Sector Breadth

The near-term rebound in the sector as proxied by the % of stocks above their 50-day moving average (chart below, yellow line) has come without significant deterioration in the longer-term internals. We interpret this as a sign of strength, and it backs up the broad outperformance at the industry level.

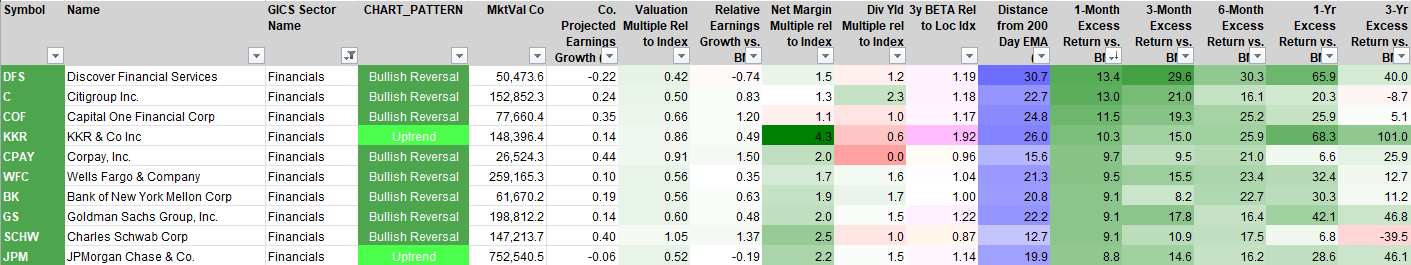

S&P 500 Financial Sector Top 10 Stock Performers

The strong stocks are getting stronger here.

S&P 500 Financial Sector Bottom 10 Stock Performers

Insurance stocks continue to deteriorate broadly.

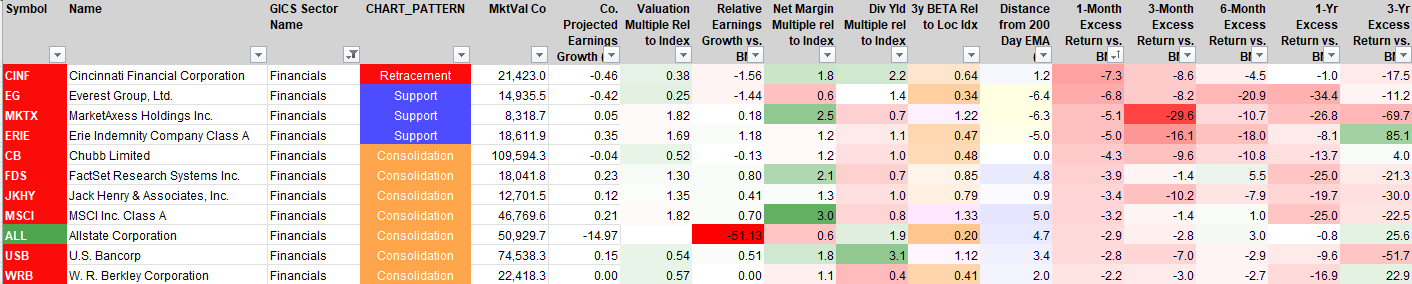

S&P 500 Financial Sector Fundamentals

The chart below shows S&P 500 Financial Sector Margin, Debt/EBITDA, Valuation and Earnings. Despite some compression, margins remain well into the double-digits. Valuation is becoming richer, but out year earnings projections have also risen in the 2nd half of 2024 and the sector P/E remains below that of the S&P 500.

Economic and Policy Developments

The Federal Reserve maintained its policy stance, leaving rates unchanged, and signaled that rate cuts may not come until mid-year. This supported net interest margins (NIMs) for large banks but created uncertainty about future loan demand and deposit pricing pressures. Additionally, Trump’s administration floated new tariffs and potential financial regulations, including a possible halt to federal aid disbursement (briefly reversed) and discussions of broad tax cuts, which could impact financial market liquidity.

Earnings & Loan Issuance Trends

Large banks posted strong results, driven by trading revenue and robust loan growth. JPMorgan (JPM) and Goldman Sachs (GS) exceeded expectations, benefiting from investment banking and wealth management growth. Bank of America (BAC) and Citigroup (C) delivered solid results, though they flagged concerns about rising credit card delinquencies and corporate loan demand softening.

Regional banks continued to face headwinds. Western Alliance (WAL) beat estimates due to strong fee income, but net interest margin pressure remained a challenge. Citizens Financial (CFG) and Regions Financial (RF) saw weaker loan growth and higher provisioning for loan losses, particularly in CRE and auto loans.

Credit standards tightened in response to macro uncertainty. The Fed’s Senior Loan Officer Opinion Survey (SLOOS) showed banks tightening lending standards across consumer, mortgage, and corporate loans, citing economic uncertainty and regulatory concerns. Mortgage lending remained subdued despite a slight increase in homebuyer demand, as higher-for-longer rates limited affordability.

In the payments space, Visa (V) posted a strong quarter, highlighting accelerated US volume growth in January, while Mastercard (MA) also beat expectations, citing resilient consumer spending. American Express (AXP) saw strong spending trends but gave conservative guidance due to potential headwinds in discretionary consumer spending.

The insurance sector was mixed. Cigna (CI) dropped after reporting higher-than-expected medical loss ratios, while The Hartford (HIG) beat estimates but faced charges related to asbestos and environmental liabilities. Progressive (PGR) and Travelers (TRV) reported stable underwriting results, benefiting from strong pricing power and lower catastrophe losses.

Key Policy & Economic Developments

The Fed’s January decision to hold rates steady reinforced expectations that cuts may not begin until mid-year. This benefitted banks’ NIMs and deposit stability but raised concerns about loan demand softening in the coming months. Additionally, Trump’s tariff threats on Canada, Mexico, and key industrial sectors (chips, energy, and materials) injected uncertainty into financial markets, particularly for companies with global trade exposure.

Consumer spending remained resilient, with Q4 personal consumption growing 4.2% annualized. However, higher credit card delinquencies and increased loan loss provisions signaled that consumer credit health may be deteriorating. Initial jobless claims fell to 207K, underscoring labor market strength, but wage growth pressures remain a key concern for inflation.

In regulatory news, the Department of Justice (DoJ) filed an antitrust lawsuit to block the Hewlett Packard (HPE) and Juniper Networks (JNPR) merger, signaling increased regulatory scrutiny over financial transactions and M&A. Additionally, financial regulators discussed potential new capital requirements for large banks, which could impact lending capacity.

February Outlook

Earnings reports from key financial names like Morgan Stanley (MS), Charles Schwab (SCHW), and Berkshire Hathaway (BRK.B) will provide further insight into market conditions, wealth management trends, and insurance sector performance. Meanwhile, Trump’s evolving tariff policy and potential tax cuts could add further volatility, impacting credit markets and financial sector sentiment.

Overall, the financial sector remains well-positioned due to resilient consumer spending and stable net interest margins. However, credit quality concerns, policy uncertainty, and the timing of Fed rate cuts will be key themes driving performance in February. We start 2025 with the Financial Sector as an overweight position of +5.30% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.