ETF Insights | January 1, 2025 | Financial Sector

S&P 500 Financial Sector Price Action & Performance

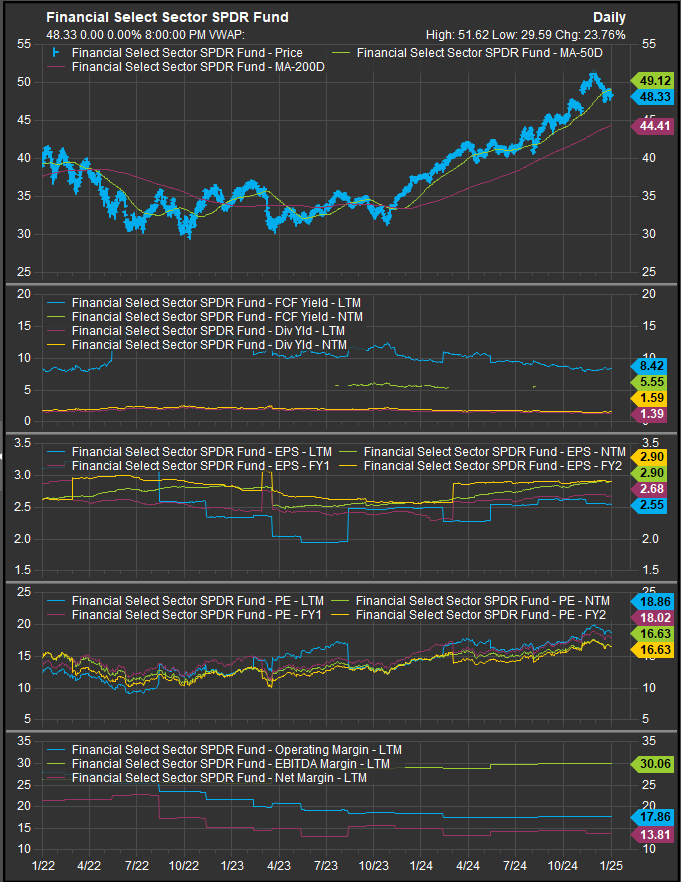

The Financial Sector enters 2025 6 months into a bullish reversal from lows in mid-2023. The sector historically benefits from rising rates and is a likely outperformer if the “soft landing” economic scenario flourishes into an expansion. Oscillator studies (chart below, panels 3 & 4) show oversold conditions in an intermediate term uptrend. At the broad market level, selling into year-end has led to broad oversold conditions while the uptrend remains intact. This setup has consistently been accumulated in this cycle.

S&P 500 Financial Sector: Industry Performance Trends

The Financial Sector had broad upside participation across industries in 2024. A durable recovery in Consumer Finance stocks led the strong finish to the year. Banks continued their steady rebound from a disastrous 2023, and Capital Markets stocks rebounded from a correction into mid-year.

S&P 500 Financial Sector Breadth

The Financial Sector trend dynamics show a massive near-term dislocation to the downside. Given the indiscriminate nature of the selling (Chart below, panel 2, yellow line) we are betting on accumulation. We would also note the technical saw that “all gaps are filled” when considering a likely max draw down scenario for the near-term move. That level is $46.72.

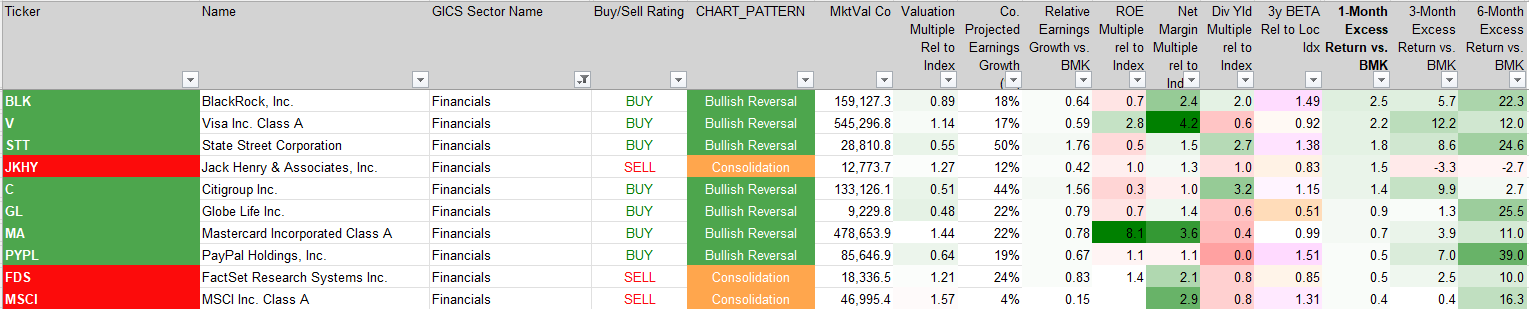

S&P 500 Financial Sector Top 10 Stock Performers

Payment stocks got a boost in December with V, MA and PYPL improving in our stock ratings.

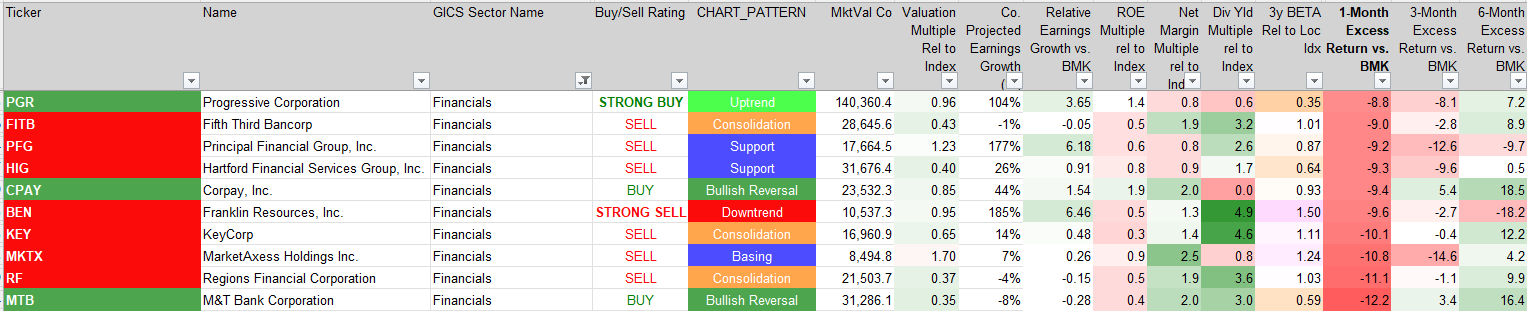

S&P 500 Financial Sector Bottom 10 Stock Performers

MTB, despite the correction, remains in a bullish reversal structure.

S&P 500 Financial Sector Fundamentals

The chart below shows S&P 500 Financial Sector FCF yield, and Dividend Yield as well as projected earnings over the next 3 years, valuation and trailing margins. Financials have seen steady reflation in their valuation multiple, while still steeply discounted to the broad market. Trailing Net Margin (chart below, bottom panel) has appeared to bottom out after steep declines in 2023.

Economic and Policy Developments

Several economic and policy developments during December 2024 directly influenced loan issuance and financing costs. Treasury yields hit seven-month highs late in the month before retreating slightly, reflecting the bond market’s reaction to the Federal Reserve’s easing cycle. Persistent inflationary pressures and deficit concerns have kept long-term rates elevated, impacting mortgage rates and corporate borrowing costs.

Mortgage market dynamics were a significant focus. November pending home sales rose 2.2% m/m, slightly beating expectations, while October’s Case-Shiller and FHFA house price indices both showed increases of 0.3% and 0.4% m/m, respectively, signaling robust demand. Rising housing inventory levels and resilient consumer spending contributed to a favorable environment for mortgage issuance despite elevated borrowing costs.

In the broader financial ecosystem, concerns over tariffs and trade war policies under a potential “Trump 2.0” administration could create uncertainties for cross-border financing and trade-related lending. The Treasury Department’s acknowledgment of a major cybersecurity incident tied to Chinese hackers added another layer of geopolitical risk that financial institutions must navigate in their risk assessments.

2025 Outlook

The S&P 500 Financial sector enters 2025 with key upside drivers include expectations of easing monetary policy, a potential rebound in housing market activity, and continued strength in consumer spending. The Federal Reserve’s stance on inflation and interest rates will be critical in shaping loan issuance and financing conditions. Lower rates could drive mortgage refinances and corporate lending, boosting profitability across financial institutions.

Risks to continued outperformance include persistent inflationary pressures, trade and tariff uncertainties, and geopolitical challenges such as cybersecurity threats.. Asset managers and investment banks may face headwinds if market volatility persists, while regional banks and mortgage-focused companies could benefit from a more stable rate environment.

In Conclusion

The Financial Sector presents to us as a bullish accumulation opportunity in 2025 provided interest rates stay contained. We start 2025 with the Financial Sector as an overweight position of +4.28% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.