The Japan Carry Trade is a popular foreign exchange strategy that takes advantage of Japan’s low interest rates. This strategy has been extremely popular, with an estimated $4 trillion involved in yen carry trades.

Here’s how it works:

Borrowing in Yen: Investors borrow money in Japanese yen at very low interest rates. Japan has maintained extremely low interest rates for decades, with the Bank of Japan even implementing negative interest rates in 2016.

Investing in Higher-Yield Assets: The borrowed yen is then converted to another currency, typically the US dollar, and invested in higher-yielding assets such as stocks or bonds.

Profit Mechanism: The profit comes from the interest rate differential between Japan and the country where the money is invested. For example, if an investor borrows yen at 1% and invests in US bonds yielding 5%, they can potentially earn a 4% profit (minus transaction costs).

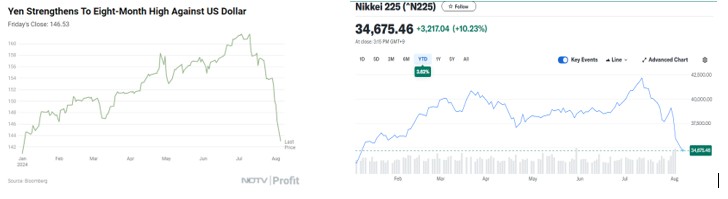

Recent events highlight risks for investors. In early August 2024, the Bank of Japan raised interest rates slightly (from 0.1% to 0.25%), causing the yen to strengthen against the dollar. This small change triggered a massive unwinding of carry trades, contributing to a sharp sell-off in global markets.

Here is the YTD performance of the Yen and Nikkei Index. the day after. the -12% equity market selloff.

Japan is thousands of miles away, I’m a US investor, why should I care?

Many 401k plans and other investment strategies have global exposure. For example, if a retiree owns an MSCI EAFE portfolio, Japan’s weight tends to be over 20%. Investors should know where their money is exposed. There are also wider impacts that may affect other asset classes in which retirees are invested.

Impact on Asset Prices: The liquidation of carry trades can lead to a rapid decline in asset prices. When traders exit their positions, they sell off the higher-yielding assets they had invested in, such as US stocks and Treasury bonds. This can lead to a sharp drop in the prices of these assets, contributing to broader market sell-offs. The recent market chaos saw significant declines in stock prices as traders sold off dollar-denominated assets to cover their yen-denominated loans.

Market Volatility: When conditions change and investors rush to unwind these trades (by selling their investments and buying back yen to repay loans), it can cause significant market volatility. If the yen strengthens significantly against the investment currency, it can wipe out the interest rate gains and lead to losses.

Broader Economic Impact: The unwinding of carry trades can have broader economic implications. For example, the recent market upheaval was partly driven by fears of a possible recession in the United States and concerns over the profitability of technology shares. These broader economic concerns, combined with the dynamics of carry trades, can lead to significant market disruptions and affect investor sentiment globally. In summary, carry trades can have a profound impact on global financial markets by amplifying volatility, causing significant currency fluctuations, affecting asset prices, creating self-perpetuating market cycles, and contributing to broader economic concerns.

While the Japanese carry trade can introduce certain risks and volatility to the portfolios of U.S. retail investors, it’s important to remember that awareness and strategic planning can mitigate these impacts. By leveraging financial education and seeking professional advice, U.S. retail investors can turn potential challenges into avenues for growth and resilience. In the end, the global financial landscape, with all its intricacies, provides a dynamic environment where informed investors can thrive. By embracing a well-rounded approach and maintaining a positive outlook, U.S. retail investors can continue to build and secure their financial futures, even in the face of challenges like the Japanese carry trade.