The Kansas City Chiefs, over the last ten years, have dominated the NFL: Four Super Bowl victories, seven consecutive AFC West division championships, and six consecutive AFC Championship Game appearances.

The Philadelphia Eagles have been strong and are getting stronger: Three Super Bowl appearances with two wins and four NFC East Championships.

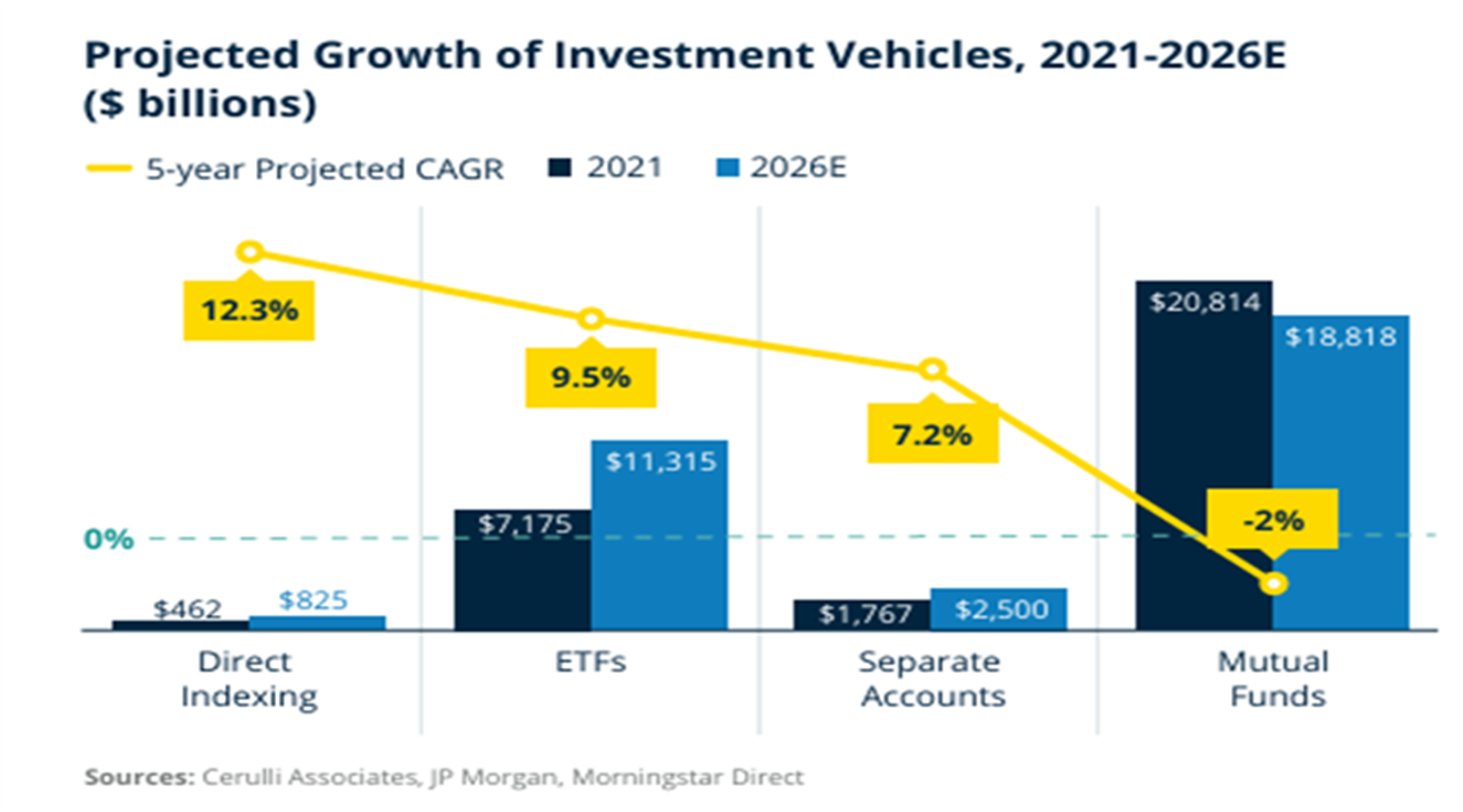

Investors are seeing a shift in investment vehicle options. The Mutual Fund market has dominated the attention of retail investors and plan sponsors for a long time.

The younger ETF market continues to grow as investment firms can add this wrapper to their line-ups and distribute unique benchmarks and active strategies, pulling assets from the Mutual Fund market.

This Cerulli/JPM/Morningstar projected growth study shows how ETFs are growing at the expense of Mutual Funds.

The Chiefs have relied on top offensive talent with a great quarterback and very effective running backs and receivers who have been the most proficient over the last decade.

The Eagles have built a team for long-term success. A huge and powerful offensive line that can push the competition around. Paired with a destructive defensive front four that can shut down even the best offenses.

Can we equate the Chiefs to Mutual Funds and the Eagles ETFs?

Mutual Funds and ETFs are both viable investments for any investor depending on your investment strategy. Mutual Funds are well established, can have longer track records, and are priced on the market close. Whereas ETFs can be more tax-efficient and can trade throughout the day.

While Mutual Funds still have the opportunity to dominate investor choices, ETFs are built for success. No matter which vehicle you route for, ETFs appear to be picking up some steam and could soon cross the 50-yard line.

Are the traditionally dominant Chiefs giving ground to the Eagles? Well, the 40 to 22 Super Bowl LIX may be an indication…