ETF Insights | February 1, 2025 | Healthcare Sector

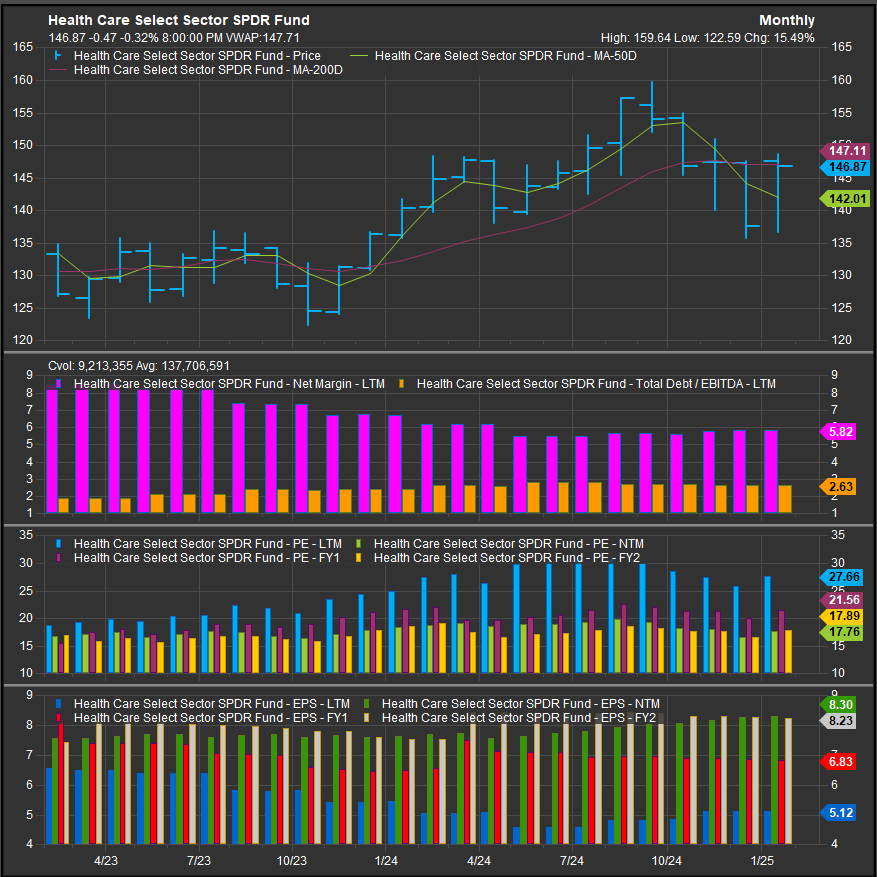

S&P 500 Healthcare Sector Price Action & Performance

The XLV (chart below) has traded up to its 200-day moving average and is on the cusp of a bullish technical reversal in the near term. The MACD oscillator has crossed into uptrend territory and while the RSI study is near overbought levels, that fits with potential trend change.

S&P 500 Healthcare Sector: Industry Performance Trends

There are signs of a turnaround in performance over the past 2 months. The sector pivoted in mid-December, but at the industry level there had been some positive divergence in performance a month prior. Biotech, Life Sciences and Pharma performance has stabilized since November. Medical Equipment stocks have catalyzed some follow-though in January and are near 6-month relative highs vs the S&P 500.

S&P 500 Healthcare Sector Breadth

Further evidence of a potential turnaround is reflected in the breadth readings for January. At the high, almost 90% of Healthcare Sector stocks traded above their 50-day moving average after less than 10% were to begin the month.

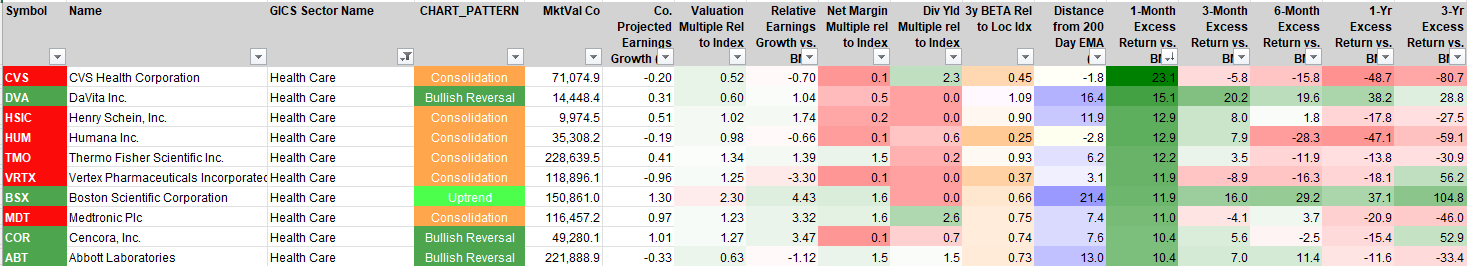

S&P 500 Healthcare Sector Top 10 Stock Performers

Healthcare Sector laggards have finally been discounted too far as CVS surges >20% this month. VRTX and TMO bounced as well. Those moves can still be described as counter-trend, but this is the first month in a while where we upgraded several stocks in the sector. BSX remains a top idea.

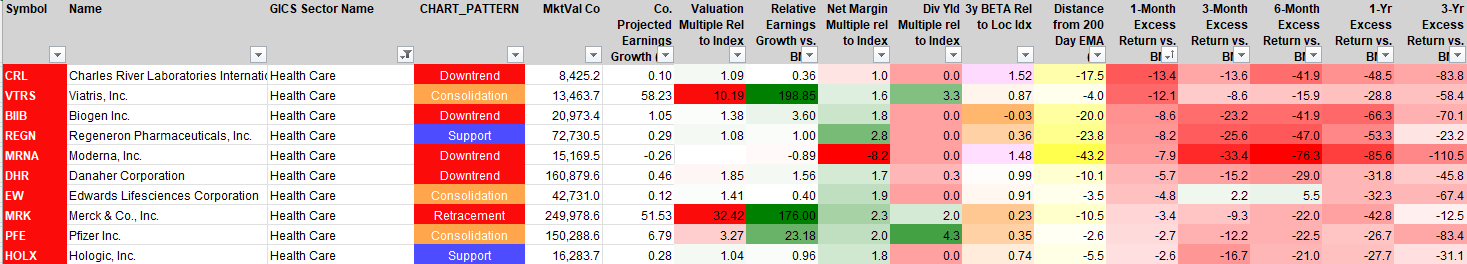

S&P 500 Healthcare Sector Bottom 10 Stock Performers

Still plenty of tape bombs in the sector. REGN has fallen on hard times.

S&P 500 Healthcare Sector Fundamentals

The chart below shows S&P 500 Healthcare Sector with Margin, Debt/EBITDA, Valuation and Earnings. Margin compression has been a concern. High valuations over the trailing 12-months are expected to normalize over the next 3 years on robust consensus earnings growth expectations.

Economic and Policy Developments

Trump’s administration reignited regulatory uncertainty, particularly around drug pricing and healthcare funding. Reports surfaced that the White House is considering tariffs on pharmaceutical imports, particularly from Canada and Mexico, which could affect generic drug costs and pharmaceutical supply chains. Additionally, the administration froze certain federal grants and Medicaid disbursements before reversing course, creating near-term uncertainty for hospital systems and managed care providers.

Earnings

Earnings season kicked off with strong results from key large-cap pharma names. AbbVie (ABBV) beat estimates, driven by strong immunology sales from Skyrizi and Rinvoq, and raised its long-term outlook for both drugs. Vertex Pharmaceuticals (VRTX) saw a regulatory win with FDA approval for suzetrigine (Journavx), a new acute pain treatment. In contrast, ResMed (RMD) dropped 8.3% on weaker-than-expected U.S. device growth, potentially due to increased awareness of GLP-1 weight loss drugs reducing sleep apnea cases.

Managed care and hospital stocks had mixed performances. Cigna (CI) declined over 6% after posting higher-than-expected medical loss ratios and guiding 2025 EPS below estimates, citing rising cost pressures in stop-loss coverage. Meanwhile, Cardinal Health (CAH) and Quest Diagnostics (DGX) posted stable results despite some margin pressures in medical-surgical and diagnostic testing segments.

Medical device and equipment companies saw positive momentum. Thermo Fisher (TMO) and Stryker (SYK) both beat earnings estimates, driven by strong instrument sales and orthopedic demand. However, Danaher (DHR) underperformed after forecasting a decline in Q1 core revenue, citing lower respiratory-related diagnostics and pricing headwinds in China.

Policy Changes & Industry Pricing Pressures

Policy headlines remained a key source of volatility in the sector. The Biden administration’s Medicare drug price negotiation program, set to expand in 2025, continues to weigh on pharma and biotech valuations as investors gauge its potential impact on drug pricing power. Meanwhile, Trump’s floated tariff threats on pharmaceutical imports raised concerns about rising input costs and potential supply chain disruptions.

Additionally, FDA activity remained strong, with accelerated reviews for key drugs in oncology, immunology, and rare diseases. Companies with strong drug pipelines saw renewed investor interest, while those reliant on older, high-margin therapies faced pricing pressure risks.

February Outlook

February will see continued earnings reports from healthcare giants like UnitedHealth (UNH), Merck (MRK), and Eli Lilly (LLY), which will provide insight into consumer healthcare spending, drug pricing strategies, and payer cost trends. Investors will watch closely for guidance on GLP-1 drug adoption, which has already shown ripple effects across multiple healthcare sub-sectors.

The policy environment remains fluid. Trump’s proposed tariffs on pharma imports, potential further cuts to Medicaid, and expanded Medicare drug pricing controls will continue to create uncertainty. Any signals from the Fed on interest rate expectations could impact growth-oriented biotech stocks, while macroeconomic indicators like nonfarm payrolls and CPI (Feb. 12) may influence broader sector positioning.

Overall, healthcare is well-positioned as a defensive play relative to our other choices. Some renewed interest in certain parts of the sector is a welcome change. Policy shifts in favor of reduced regulatory burdens could unlock upside, but the path remains unclear.

In Conclusion

Overall, healthcare is well-positioned as a defensive play relative to our other choices. Some renewed interest in certain parts of the sector is a welcome change. Policy shifts in favor of reduced regulatory burdens could unlock upside, but the path remains unclear. We start February overweight the Healthcare sector with and exposure of +2.43 % vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.