ETF Insights | January 1, 2025 | Healthcare Sector

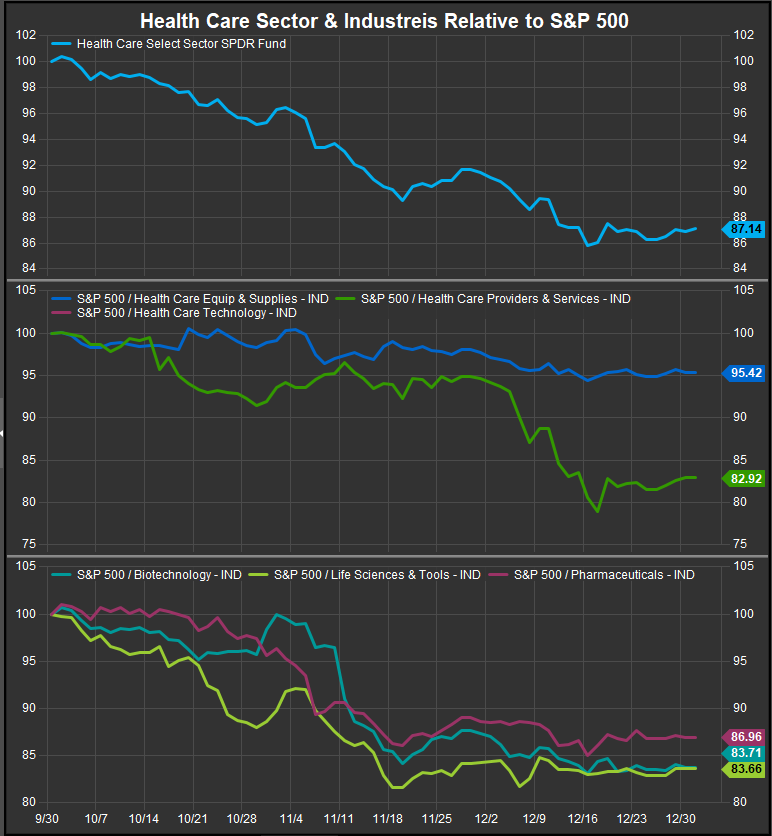

S&P 500 Healthcare Sector Price Action & Performance

Healthcare stocks finish up 2024 in a deeply oversold condition after a decline of almost 7% in December. The monthly decline has left the sector very close to where it started 2024 and caps an almost 15% decline since the sector’s high for the year on September 4th. A year to forget after the sector lagged the S&P 500 by almost 20% on a relative basis.

S&P 500 Healthcare Sector: Industry Performance Trends

At the industry level, HC Equipment stocks have been the best of a bad bunch, lagging the S&P 500 by 5% in 2024. Every other industry within the sector underperformed by >12% with Life Sciences stocks the weakest area of performance.

S&P 500 Healthcare Sector Breadth

The Healthcare Sector is yet another historically low vol. sector that has seen breadth get completely washed out. What gives us pause about this chart is typically when the % of stocks above their 50-day moving average gets to these extreme levels in a bull trend for equities, we usually see the series bounce back above the 70% level (at least). The fact that the series hasn’t gone above 50% since September is concerning.

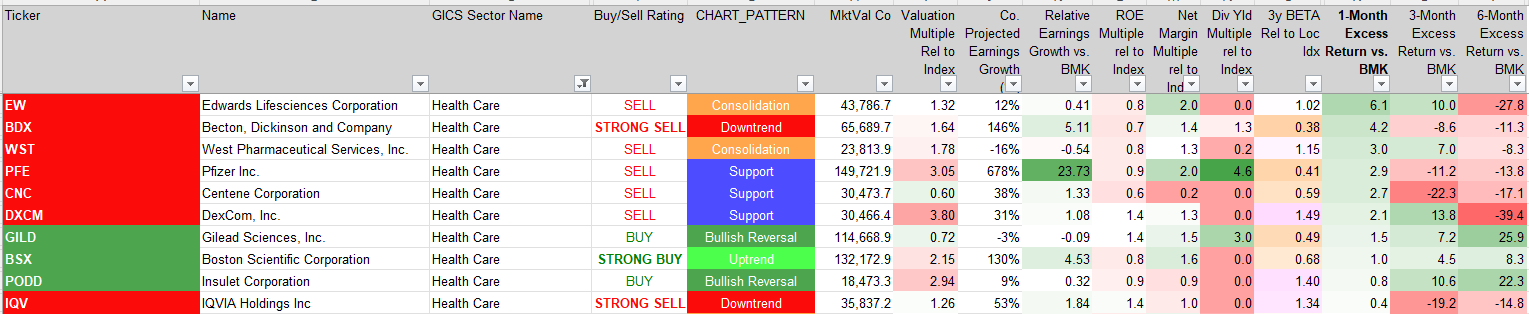

S&P 500 Healthcare Sector Top 10 Stock Performers

Not too many stocks in the sector have been able to sustain 6 months of outperformance. We like GILD, BSX and PODD. EW is improving but falls short of our bullish reversal criteria at present

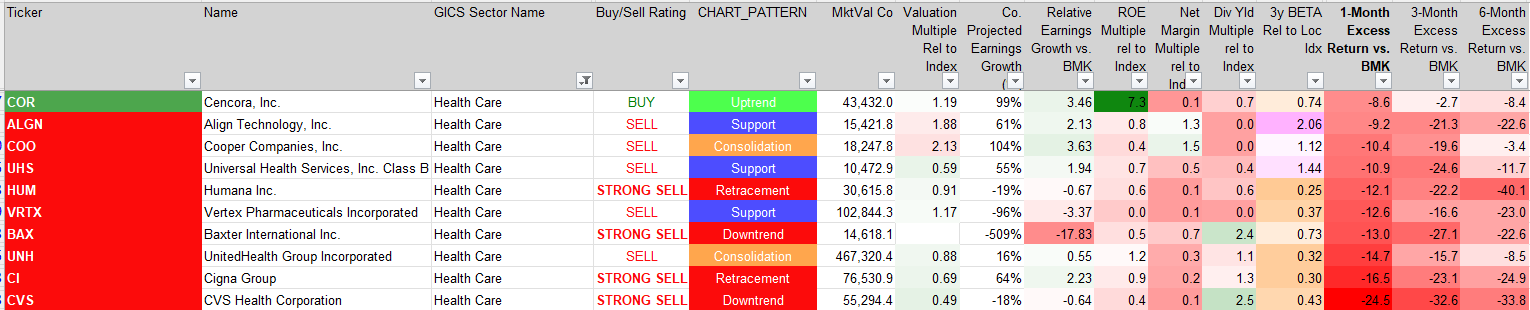

S&P 500 Healthcare Sector Bottom 10 Stock Performers

HC Providers have taken it on the chin this month.

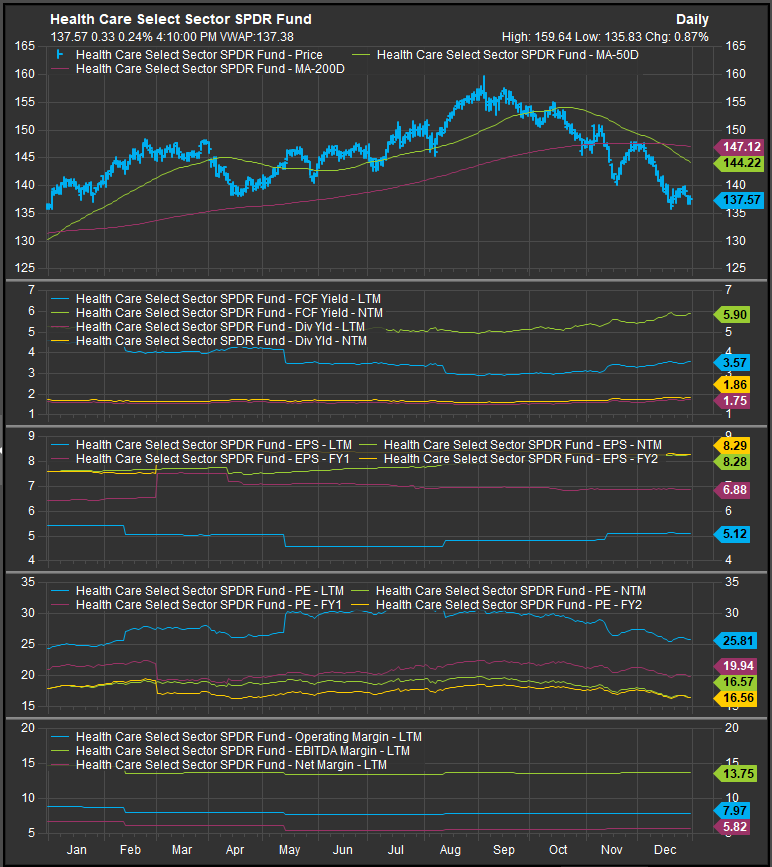

S&P 500 Healthcare Sector Fundamentals

The chart below shows S&P 500 Healthcare Sector FCF yield, and Dividend Yield as well as projected earnings over the next 3 years, valuation and trailing margins. The Healthcare sector stands out as having significant upside to consensus earnings over the next two years. However, valuation has been higher than the broad market multiple for most of the year despite lagging performance. For the time being, price is not following earnings.

Economic and Policy Developments

Health insurance costs remained a focal point, with industry trends reflecting persistent inflation in medical services and pharmaceuticals. Federal data indicated a 2.1% rise in healthcare costs year-over-year through November, highlighting affordability challenges for consumers. Managed care companies like Humana (HUM) and Cigna (CI) reported concerns about increased costs of providing coverage amid higher-than-expected utilization rates, particularly for specialty drugs and chronic disease management.

The healthcare sector faced ongoing uncertainty from regulatory changes. Debate over Medicare pricing reforms intensified, with discussions about extending drug price negotiation powers under the Inflation Reduction Act. This policy could impact pharmaceutical companies by capping prices for high-demand medications. Additionally, potential shifts in Medicaid expansion under the new administration created uncertainty for healthcare providers and insurers, with ripple effects on revenue streams.

The Affordable Care Act (ACA) remained a critical anchor for health insurance costs. Proposals to expand subsidies and address the “family glitch” (which limits access to premium tax credits for some households) could improve affordability for millions, but these changes could also increase compliance costs for insurers.

The pharmaceutical and biotech industries navigated heightened competition for key therapeutic areas like diabetes, obesity, and oncology. Novo Nordisk (NVO), a key competitor to Eli Lilly, faced setbacks with CagriSema, its weight-loss drug, which failed to meet market expectations for efficacy, providing a tailwind for Lilly. Meanwhile, broader concerns about patent cliffs for blockbuster drugs fueled M&A speculation as companies sought to replenish pipelines through strategic acquisitions.

2025 Outlook

The S&P 500 Healthcare sector is poised for moderate growth in 2025, supported by demographic trends, advances in medical technology, and the resilience of healthcare demand. Aging populations and increasing prevalence of chronic diseases are expected to sustain growth for insurers, pharmaceutical companies, and healthcare service providers. Companies like UnitedHealth and Amedisys, which are leveraging synergies from mergers and diversified service offerings, may outperform in the managed care space.

However, risks remain significant. Drug pricing reforms, combined with heightened scrutiny of M&A activity, could weigh on pharmaceutical and biotech valuations. Rising input costs, including wages for healthcare workers, could further pressure profit margins for providers. Meanwhile, increasing adoption of generics and biosimilars could erode revenue for branded pharmaceutical manufacturers.

In Conclusion

With an absence of buyer interest notable across the Healthcare sector we start 2025 with Healthcare as one of our three zero weight positions resulting in an underweight of -11.60% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.