ETF Insights | February 1, 2025 | Industrial Sector

S&P 500 Industrial Sector Price Action & Performance

The heady days of “onshoring” and inflation seem to be in the rearview mirror for the Industrial sector which has bided its time as a market performer in 2024 and now into 2025. The chart below shows an incomplete bullish reversal on price that needs to get above the $145 level to re-establish the sector’s uptrend. A break-down on price here would flip the sector to a bearish technical position.

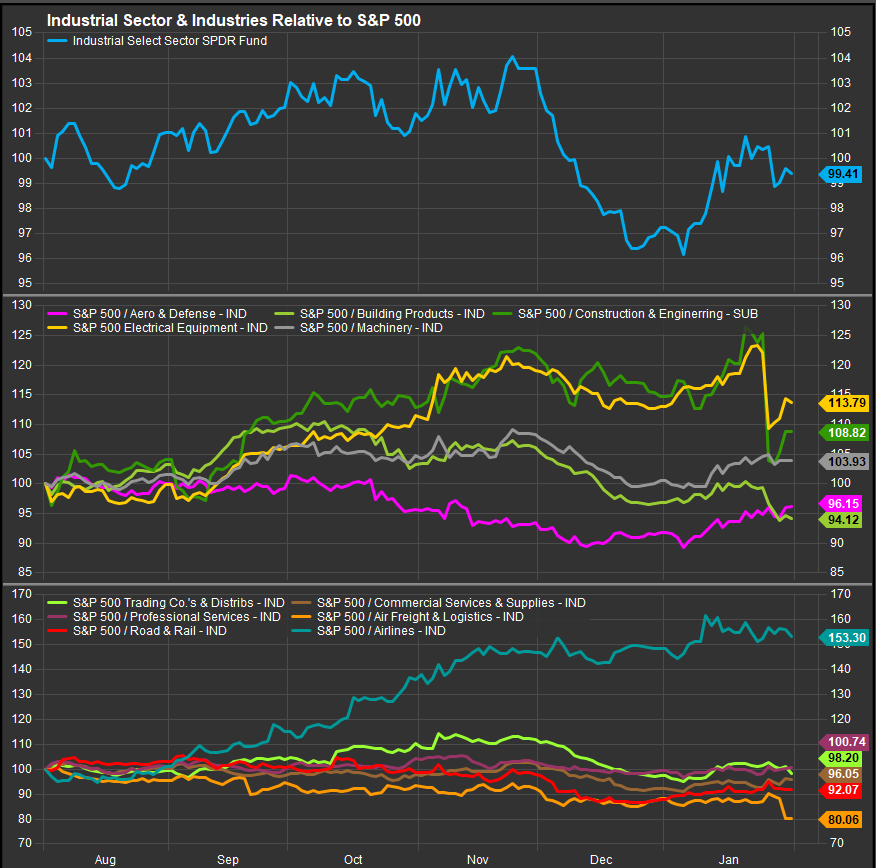

S&P 500 Industrial Sector: Industry & Sub-Industry Performance Trends

We saw several industries that had previously led the sector correct sharply in January, most notably the Construction and Engineering industry which is just one stock (PWR), but it has been a leader through most of the cycle. Transports ex-Airlines remain weaker, and we are seeing Airlines lose some upside momentum as well. Industrial Services and Aero/Defense industries are firming which typically happens when economic data starts to soften.

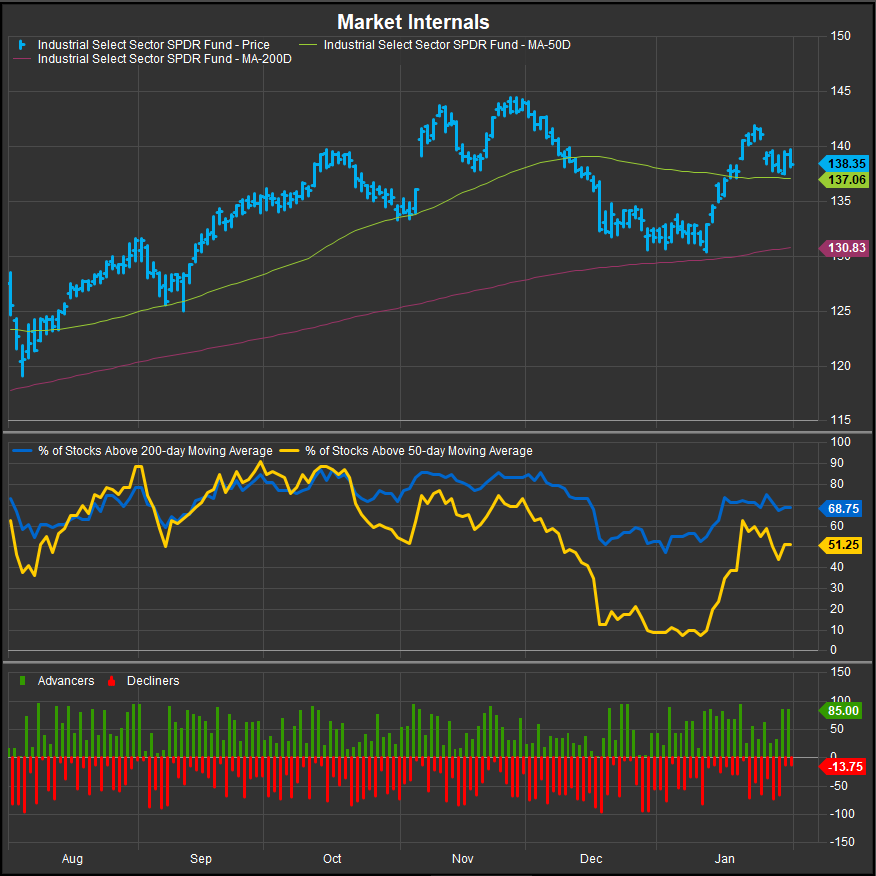

S&P 500 Industrial Sector Breadth

The Industrial Sector rebounded from oversold conditions in December, but internal strength is at a neutral level. We want to see the % of stocks above their 50-day m.a. reach the 90 level to confirm the bull trend. That’s typically where it needs to be for the sector, which isn’t anchored by Mega Cap. heavyweights.

S&P 500 Industrial Sector Top 10 Stock Performers

GE Aerospace continues to be a leader in the sector. HWM is in a similar category, and both are buy rated in our process. BLDR and UBER are both short of our bullish reversal thresholds despite gains in January.

S&P 500 Industrial Sector Bottom 10 Stock Performers

As mentioned earlier, PWR corrected on an earnings miss while LII is on our downgrade watchlist as well. CARR already tipped into sell territory and the Building Products Industry has been fading as rates stay steady despite Fed policy goals.

S&P 500 Industrial Sector Fundamentals

The chart below shows S&P 500 Industrial Sector with Margins, Debt/EBITDA, Valuation and Earnings. Current and forward earnings expectations have been tapering off over the 2nd half of 2024. Margins remain firm and debt is low relative to earnings, but valuation has been getting steadily richer with the sector now trading at a multiple comparable to the S&P 500 itself rather than its typical discount.

Economic and Policy Developments

The Federal Reserve held rates steady, with markets anticipating rate cuts by mid-year, supporting capital-intensive industries like building products and engineering services. However, tight financial conditions continued to weigh on construction and manufacturing demand, with leading indicators like ISM manufacturing PMI showing contraction.

Onshoring and infrastructure spending remained tailwinds, with government-backed investments driving industrial activity. Demand for engineering and construction services stayed firm, though some companies flagged near-term project delays due to financing constraints.

Freight and logistics remained volatile, as soft demand and ongoing overcapacity pressured transportation stocks. However, better-than-expected consumer spending and inventory restocking helped rail and trucking companies stabilize toward month-end. Meanwhile, parcel and logistics stocks underperformed, with UPS hit by Amazon’s decision to cut volumes and weaker demand outlooks from carriers.

Trump’s tariff threats on Mexico, Canada, and China created uncertainty for industrial supply chains, particularly for building materials, machinery, and transportation companies reliant on cross-border trade. Reports of potential delays or exemptions softened the immediate impact, but uncertainty remains a key overhang for the sector.

2025 Outlook

The outlook for February hinges on Fed policy clarity, trade developments, and the health of industrial demand.

Building products and engineering stocks may benefit from strong public-sector projects, though higher-for-longer interest rates could continue weighing on private construction.

Onshoring trends should remain a long-term positive, particularly for automation, infrastructure, and defense-related companies, though global supply chain risks and geopolitical factors could disrupt execution timelines.

Freight and logistics companies face a soft demand environment, but stabilizing consumer activity and potential tariff-driven supply chain shifts could drive incremental tailwinds.

In Conclusion

Industrials stocks have been in the middle for a while now, never taking off into a leadership position or falling all the way out of bed to the downside. We continue to give the long-term bull trend in equities the benefit of the doubt, and we start February with an overweight position of + 0.52% in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.