ETF Insights | January 1, 2025 | Industrial Sector

Industrial Sector January 2025 Outlook—A 10% December correction leaves the sector at a key pivot point. We remain constructive.

S&P 500 Industrial Sector Price Action & Performance

The S&P 500 Industrial Sector starts 2025 on an oversold condition after prices declined almost 10% in December. Oscillator work shows oversold conditions, but while there is nascent positive divergence observed in the RSI study (chart below, bottom panel), the MACD study is still on a sell signal. Prior to December, S&P 500 Industrials were enjoying a constructive year and our read at present is that prices are overdone to the downside and represent a likely accumulation opportunity.

S&P 500 Industrial Sector: Industry & Sub-Industry Performance Trends

Prior to December’s capitulation, there were clear leading and lagging industries within the sector. Airlines have held up despite the drawdown, outperforming the S&P 500 by 24% in 2024, while Electrical Equipment stocks and Construction & Engineering stocks were also strong. Road & Rail and Air Freight were the weakest industries, both lagging by >20%.

S&P 500 Industrial Sector Breadth

Internals for the Industrial Sector are at near-term “wash out” levels with < 20% of constituents above their 50-day moving average. Prior to December, Industrials had been a market performing sector in a bull market, so we still have 58% of stocks above their 200-day moving average. This setup is similar to the Energy Sector and more constructive than what we’ve seen out of the Materials Sector.

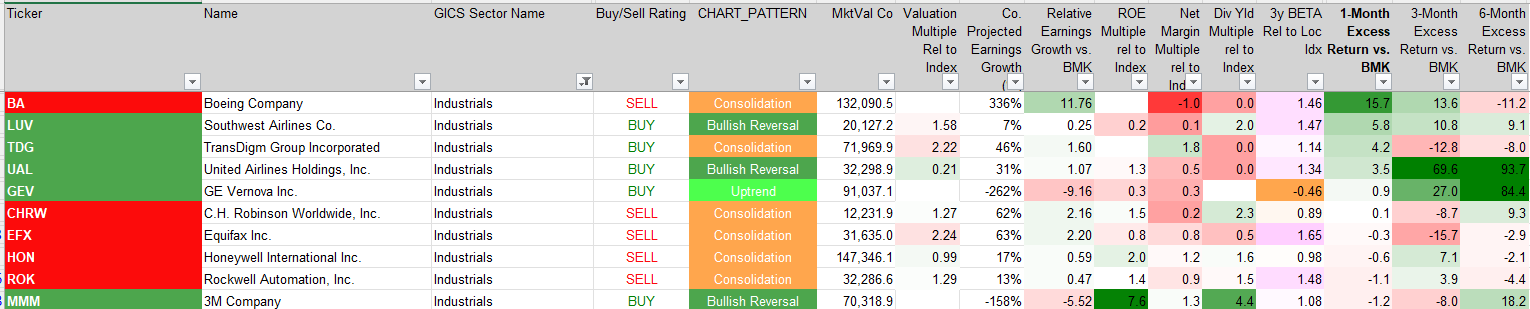

S&P 500 Industrial Sector Top 10 Stock Performers

Just 6 industrial stocks posted positive gains in December led by Boeing which is attempting to form a bullish reversal in the near-term. Airlines (LUV, UAL) make the list as well.

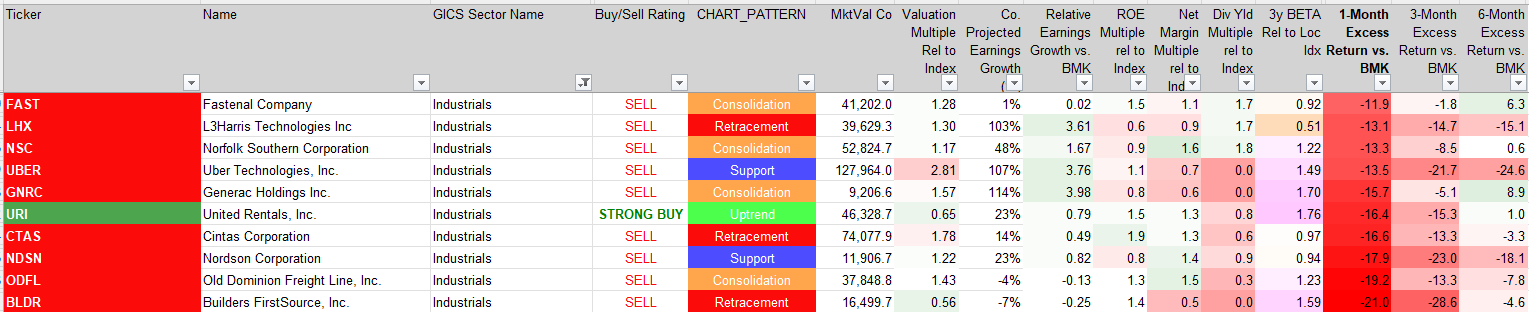

S&P 500 Industrial Sector Bottom 10 Stock Performers

Some big earners are on the bottom-10 list this month as LHX, UBER and GNRC are all projected to grow earnings 3x faster than the S&P 500 this year.

S&P 500 Industrial Sector Fundamentals

The chart below shows S&P 500 Industrial Sector FCF yield and Dividend Yield as well as projected earnings over the next 3 years, valuation and trailing margins. Forward EPS estimates for the sector on an NTM basis have been rising steadily. Valuation remains at a discount to the S&P 500 (23.5x vs. 27x). Net margins have been expanding despite investors dumping shares.

Economic and Policy Developments

Global manufacturing activity provided beearish signals for Industrials. The Chicago PMI for December came in at 36.9, well below the consensus of 43.0, signaling continued contraction in US manufacturing. Meanwhile, China’s industrial profits showed a steep decline in December, highlighting persistent demand challenges despite fiscal stimulus optimism. European markets also faced subdued manufacturing activity, amplifying concerns about industrial demand worldwide.

Supply chain issues remained a key theme. Reports highlighted improved logistics and shipping conditions compared to the peak disruptions of 2022-2023. However, industrial companies continued to grapple with elevated input costs due to lingering inflationary pressures, as evidenced by rising prices for metals and other key commodities.

Infrastructure spending continued to support the sector, with the US Inflation Reduction Act (IRA) driving demand for construction and clean energy-related projects. The IRA provided a tailwind for companies like United Rentals (URI) and Deere & Co. (DE), which stand to benefit from increased equipment and machinery demand tied to renewable energy and public infrastructure development.

Geopolitical uncertainties remained a headwind. Reports of potential new tariffs under “Trump 2.0” raised concerns about disruptions to global trade flows, particularly for industrial exporters. Defense spending showed resilience amid geopolitical tensions, benefiting aerospace and defense companies like Raytheon Technologies (RTX) and Lockheed Martin.

2025 Outlook

The S&P 500 Industrials sector is expected to face a mixed but generally optimistic environment in 2025. Infrastructure spending, bolstered by the IRA and similar initiatives, will continue to drive demand for heavy machinery, construction equipment, and materials. Defense spending should remain robust amid geopolitical uncertainties, supporting aerospace and defense stocks.

However, challenges persist. The potential reintroduction of tariffs could disrupt global supply chains and weigh on margins for exporters. Persistent inflationary pressures and high borrowing costs could dampen capital expenditure plans for industrial companies, though the Federal Reserve’s easing cycle may provide some relief.

Global demand, particularly from China, will be a critical variable. Optimism around China’s fiscal stimulus, including a proposed CNY3 trillion in special treasury bond issuance for 2025, could support industrial demand if executed effectively. Conversely, lingering demand weakness in Europe and other key markets could temper growth.

Overall, the Industrials sector is poised to benefit from structural tailwinds tied to infrastructure and clean energy transitions, but its cyclical nature and sensitivity to geopolitical risks require a cautiously optimistic outlook for 2025

In Conclusion

When we overlay near-term technical oversold conditions at the sector level, Industrial stocks look like a potential rebound candidate in the near-term. Structural transitions towards clean energy, disaggregation of the global supply chain and demand for housing and infrastructure are all still in place. That needs to be balanced against the potential for rising costs through policy and inflation. We give the long-term bull trend in equities the benefit of the doubt at present, and we start 2025 with an overweight position of + 0.34% in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.