ETF Insights| December 1, 2024

Price Action & Performance

The Industrials sector outperformed in November, gaining +777 basis points (bps) versus +573 bps for the S&P 500. This strong performance was driven by positive macroeconomic developments, robust earnings, and supportive policy announcements. The sector benefited from President Trump’s re-election, a 25bps rate cut by the Federal Reserve, and easing geopolitical tensions, particularly in the Middle East.

Oscillator inputs into our trend model show behavior consistent with sustained uptrend price action for Industrials with the MACD on a near-term buy signal and the RSI gage closer to overbought than oversold.

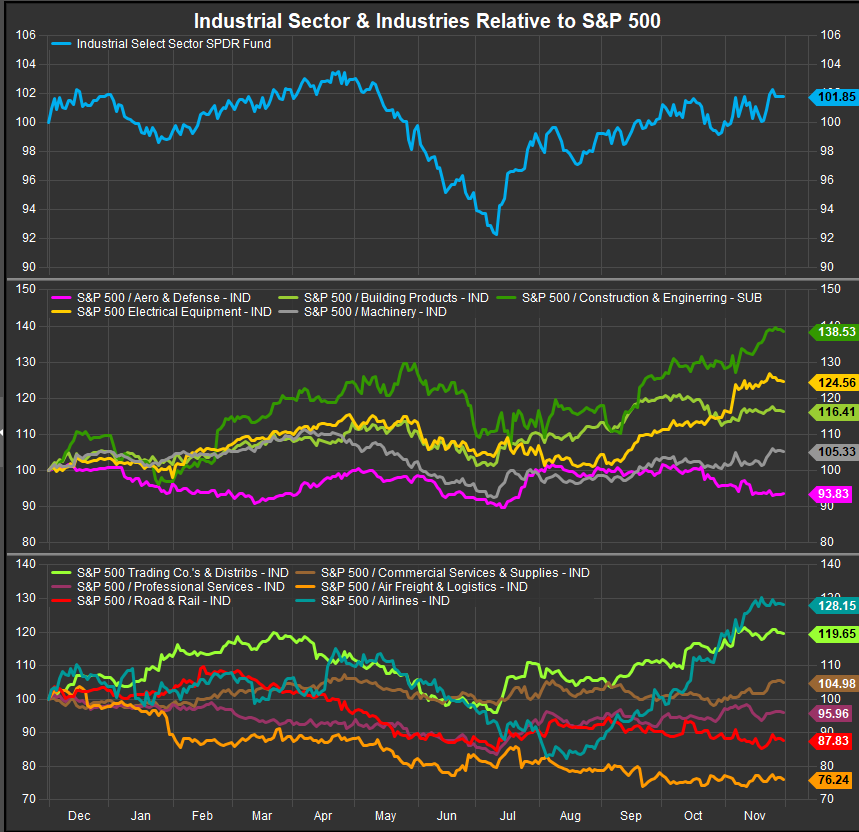

A majority of industries within the sector have outperformed within the past month and YTD led by Construction and Engineering, Airlines, Electrical Equipment and Trading Co’s.

At the stock level, larger names have been slightly better than smaller ones from a technical perspective, but we are starting to see improvement in the average stock. Our favorite stocks within the Sector are GE, TDG, HWM, AXON, TT, CARR, CTAS, PWR, ETN, GEV, CAT, PH, WAB, PNR, GWW and URI

Economic and Policy Drivers

Economic data in November showed mixed but improving trends. The ISM Manufacturing Index remained in contraction at 46.5, though the new orders inventory spread turned positive (+0.3). October jobs were soft, with just +12K new positions, while durable goods orders slipped (-0.2% m/m). Housing metrics showed a mixed picture: existing home sales rose 3% m/m, but housing permits fell 1% m/m, and new home sales dropped sharply (-17% m/m). The Auto SAAR increased to 16.2M, signaling strength in the automotive market, while the Architectural Billings Index (ABI) returned to expansion territory at 50.3, reflecting improving nonresidential construction demand.

Policy developments further supported the Industrials sector. Optimism surrounding President Trump’s re-election and his economic agenda—including deregulation, infrastructure spending, and energy policies—bolstered investor sentiment. However, concerns about potential tariffs on Canada, Mexico, and China weighed on some subsectors, such as Canadian railroads and domestic auto manufacturers. Meanwhile, the Federal Reserve’s 25bps rate cut underpinned expectations for sustained economic growth across cyclical industries.

Engineering & Construction stocks (+14.5% MTD) were supported by NuScale’s (+55%) nuclear optimism and robust guidance from MasTec, although Fluor lagged after missing expectations. Airlines (+13.7% MTD) benefited from improving geopolitical stability, highlighted by a ceasefire between Israel and Hezbollah, which lifted names like United Airlines, though Spirit Airlines filed for Chapter 11 bankruptcy.

In Aerospace & Defense, Boeing gained as it resolved a union strike, while Triumph Group raised FY25 guidance. However, defense contractors like Lockheed Martin and Northrop Grumman lagged due to F-35 program concerns. Machinery stocks also performed well, with Deere (+10%) surpassing FY25 guidance and Caterpillar (+9%) delivering a strong Q4. Electrical Equipment names, including Vertiv (+166% YTD), were boosted by Nvidia-related momentum, while Emerson Electric announced a spin-off of its Safety business.

Despite the strong overall performance, some pockets of the Industrials sector faced challenges. Wallbox (-25%) and Blink (-23%) lagged on weak EV charging infrastructure guidance, and Symbotic (-30%) declined after announcing accounting restatements and cutting Q1 guidance. Fluor also struggled due to disappointing earnings and reduced guidance, while Spirit Airlines (-73%) was impacted by bankruptcy proceedings.

Looking ahead, December has historically been favorable for Industrials, with the sector averaging a +0.5% return over the past 15-20 years. Continued economic resilience, dovish Fed policy, and positive seasonal trends are expected to support further gains. However, uncertainties around trade policy, geopolitical tensions, and elevated valuations pose risks. Overall, the Industrials sector remains well-positioned for continued strength as macroeconomic tailwinds and policy initiatives converge, providing opportunities for growth

In Conclusion

Industrials have improved in our model inputs as the macro environment has begun to favor Value and Cyclicality over Growth on the margins. Industrials can benefit as long as the economy grows as the breadth of business lines within the sector can benefit regardless of the direction interest rates resolve towards.

We remain long the Industrials Sector on improving conditions for Value stocks relative to Growth and a supportive Fed. We start September OVERWEIGHT XLI with a +3.49% allocation above the benchmark S&P 500.

Chart | XLI Technicals

- XLI 12-month, daily price (200-day m.a.| Relative to S&P 500)

- The recent break-out on price from intermediate-term consolidation has us viewing near-term overbought conditions more favorably for XLI

XLI Relative Performance | XLI Industry Level Relative Performance | 1YR

Data sourced from FactSet Research Systems Inc.